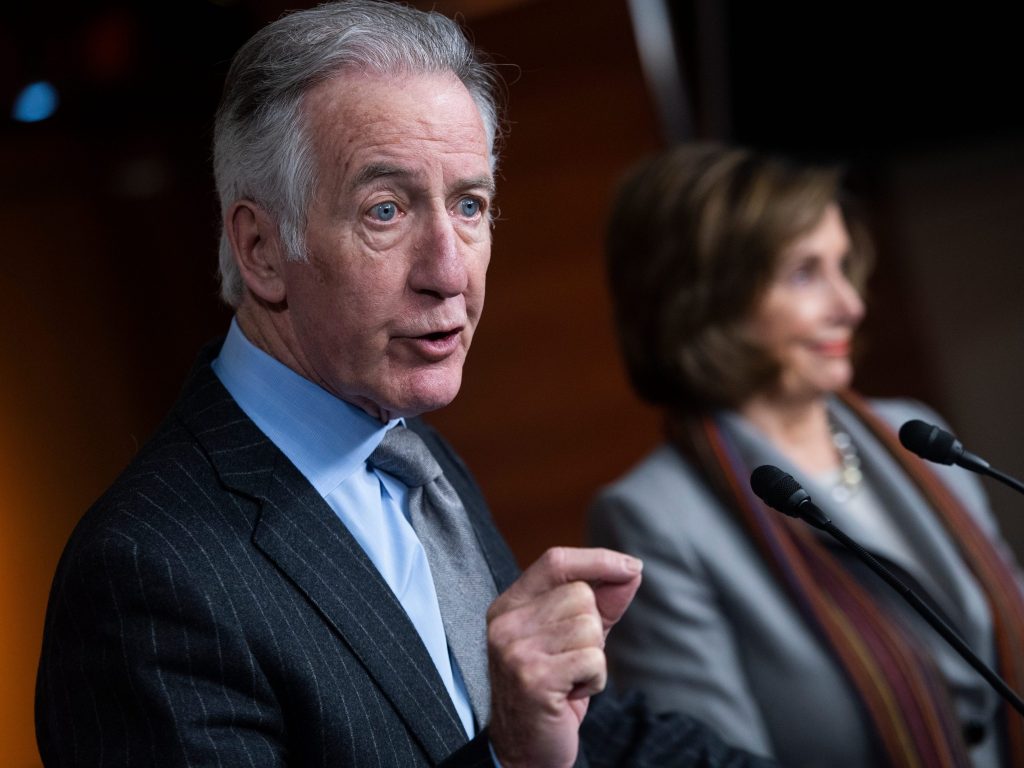

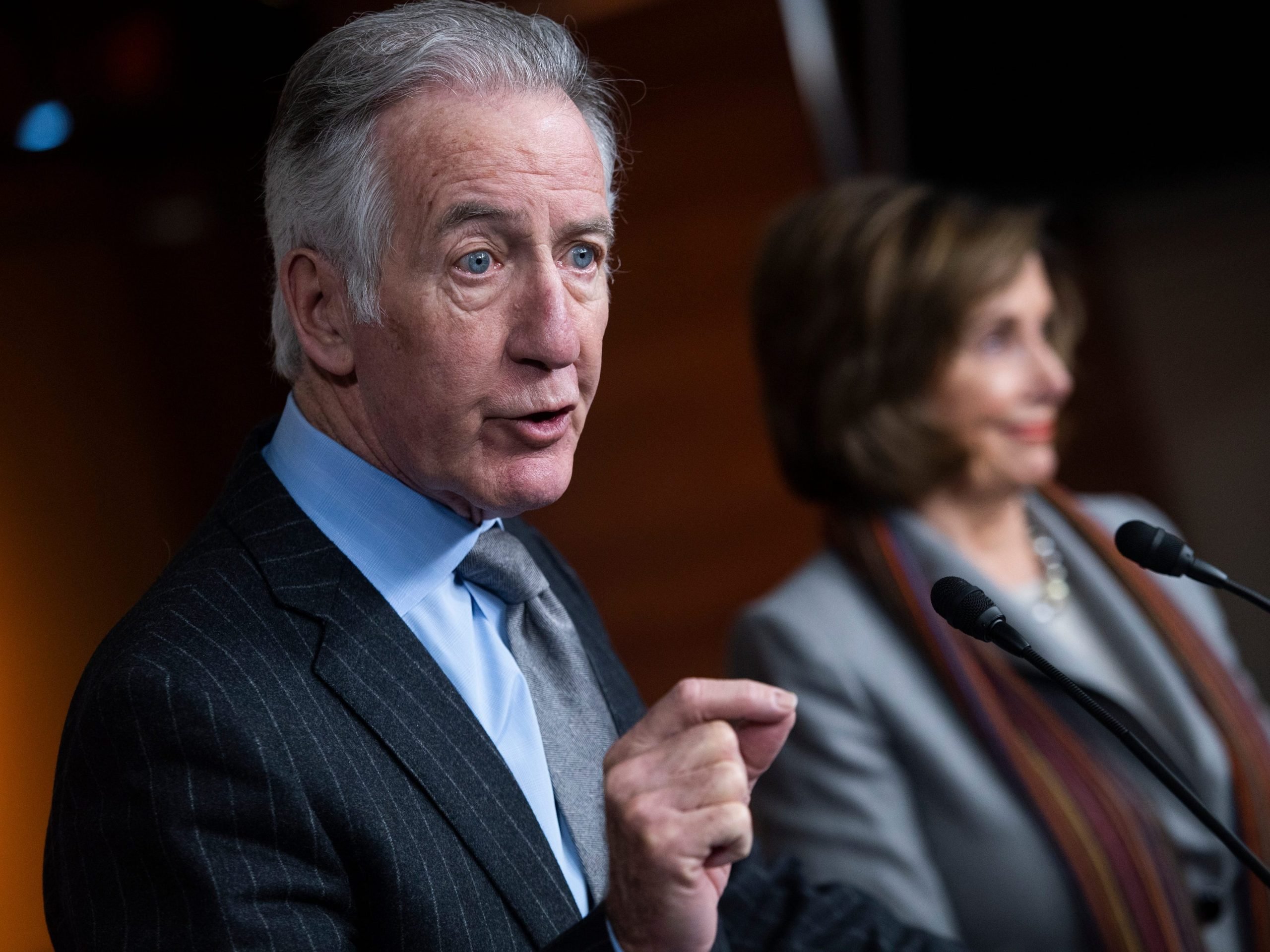

Tom Williams/CQ-Roll Call Inc. via Getty Images

- Democrats are still hashing out the final form of President Joe Biden's social spending plan.

- Currently, it doesn't include repeal of a Trump-era policy that cut tax breaks for people in wealthy states.

- But some Democrats want to bring it back; it also has an outsized impact on their constituents.

If you're confused about what is or isn't going to be in Democrats' proposed social spending plan, you're not alone.

A proposal for a billionaires' tax lasted less than a day. An increase on the top rate for high earners is also gone. A new surtax on multimillionaires and billionaires appeared in their place. But Democrats are still fixated on rolling back a Trump-era rule that actually hindered tax cuts for residents of wealthier areas.

It's called the SALT deduction, and it's a tax break you can claim for state and local taxes. Trump's 2017 tax plan capped the deduction at $10,000; it was previously unlimited. A group of House Democrats – in states with the highest local taxes – want to remove that cap, which would give a lot of money back to their wealthy constituents.

It's not currently in the framework released by the White House, but "SALT will be in the endgame, yes," according to House Ways and Means Chairman Richard Neal.

A report from the right-leaning Tax Foundation found that areas in New York, New Jersey, and California were among the top 10 counties with the highest state and local taxes. Representatives from all of those states have formed a bipartisan SALT Caucus that calls for restoring the deduction.

"This issue is so critical to our state and our constituents that we will reserve the right to oppose any tax legislation that does not include a full repeal of the SALT limitation," some of the group said in an April letter.

Paradoxically, as Democrats look to equalize the tax burden and make wealthier Americans pay more, the combination of removing the deduction and an increase on people earning over $400,000 could pay off for "high-income coastal professionals," The Wall Street Journal's Richard Rubin reports.

Indeed, tax expert Howard Gleckman at the nonpartisan Tax Policy Center wrote in a blog post earlier this year that households earning above $1 million annually would receive half the benefit. Around 93% of those households would get a tax cut averaging $48,000.

In stark contrast, 96% of middle-income households - those earning between $52,000 and $96,000 - would experience zero change in their tax bills.

The issue is dividing Democrats on ideological lines. Speaker of the House Nancy Pelosi has said that the cap is "mean-spirited" and "politically targeted," because it targets high earners in blue states. But key progressive Alexandria Ocasio-Cortez doesn't quite agree.

"I think it's just a giveaway to the rich," the New York representative said in the spring. "And I think it's a gift to billionaires."

The following September, the New York representative wrote on Twitter that Congress "should not endorse a full 100% repeal of SALT caps." She added that wealthy lobbyists have influence with Democrats as well as Republicans, and that a full repeal would benefit the richest of America's rich.

Democrats can only afford to lose three votes in the House and none in the Senate for the spending bill to pass using a maneuver known as reconciliation. The narrow margin of error may push Democrats to at least partially roll back the measure.

"I cannot imagine that this can get all the votes necessary without some SALT relief," Sen. Bob Menendez of New Jersey told reporters on Thursday.

As Democrats continue to hash out the details of the final social spending plan - something already causing tumult among more moderate and progressive members - the future of SALT will remain up in the air. And the months-long talks may not resolve anytime soon, with Democrats potentially squabbling through Thanksgiving.