LONDON – 2017 was the year the initial coin offering (ICO) went mainstream.

The fundraising method, first pioneered by Ethereum in 2014, was little used up to the start of this year but it has been widely taken up in 2017, eclipsing venture capital as a means of raising money for blockchain startups. Over $3.5 billion was raised through ICOs last year.

ICOs are where startups issue their own digital currencies, structured like bitcoin. These tokens, which can be traded online despite the company being private, are sold for real money that startups then use to fund their projects.

Off3r, a website that lets people compare and contrast investment opportunity, rounded up data on the 11 largest ICOs of 2017.

Here are the ones that made the list:

11. SALT — $48 million

Total raised: $48 million.

ICO date: August.

Company location: United States.

What it does: Lets you use cryptocurrencies as security for fiat currency loans.

10. WAX — $68 million

Total raised: $68 million.

ICO date: November.

Company location: United States.

What it does: Offers technology that lets people set up online marketplaces at no cost.

9. TenX — $80 million

Total raised: $80 million.

ICO date: June.

Company location: Singapore.

What it does: Cryptocurrency debit card.

8. Kin — $98 million

Total raised: $98 million.

ICO date: September.

Company location: Canada.

What it does: Cryptocurrency for video messaging app Kik.

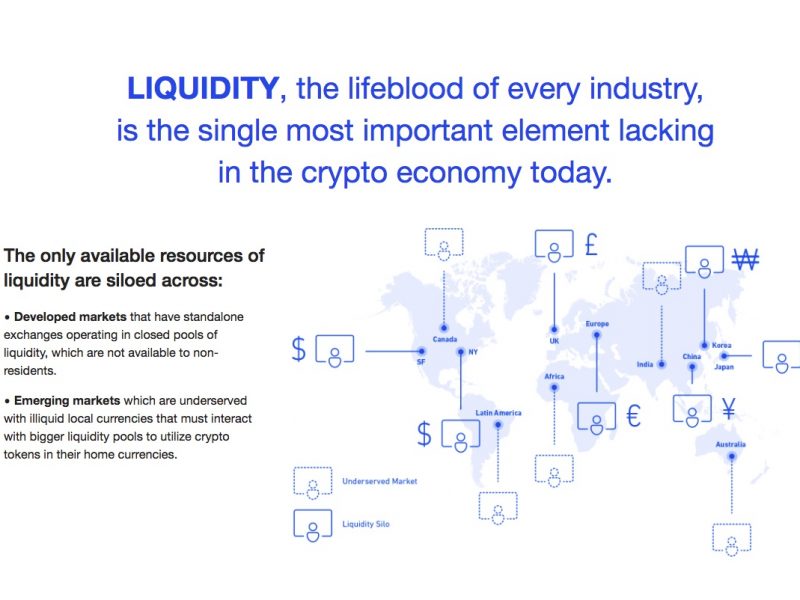

7. Qash — $106 million

Total raised: $106 million.

ICO date: November.

Company location: Tokyo.

What it does: Aiming to be a payment token for financial services.

6. Status — $107 million

Total raised: $107 million.

ICO date: June.

Company location: Switzerland.

What it does: An interface that makes it easier for people to use ethereum.

5. Polkadot — $145 million

Total raised: $145 million.

ICO date: October.

Company location: Switzerland.

What it does: Technology allowing people to use multiple blockchains at the same time.

4. The Bancor Protocol — $153 million

Total raised: $153 million.

ICO date: June.

Company location: Israel.

What it does: Decentralized liquidity technology for ethereum.

3. Sirin Labs — $157 million

Total raised: $157 million.

ICO date: December.

Company location: Switzerland.

What it does: Plans to build a blockchain-based smartphone.

2. Tezos — $232 million

Total raised: $232 million.

ICO date: July.

Company location: United States.

What it does: A new blockchain aiming to be more reliable than bitcoin or ethereum.

1. Filecoin — $257 million

Total raised: $257 million.

ICO date: September.

Company location: United States.

What it does: Blockchain-based data storage.