Xinhua/Ding Ting via Getty Images

- The rise of Chinese EV brands represents a growing threat to Tesla, according to UBS.

- The bank reduced its Tesla price target by 10% to $660 from $730 in a Tuesday note.

- "Tesla's lead in EV powertrain will likely shrink while the AV opportunity is already fully priced," UBS said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The rise in popularity of Chinese electric vehicle brands like BYD, Nio, and XPeng represent a growing threat to Tesla's dominance, UBS said in a note on Tuesday.

The bank reduced its Tesla price target by 10% to $660 from $730, representing a potential decline of 4% from Monday's close.

Tesla is still seen as the top brand in China's electric vehicle market, according to a consumer survey conducted by UBS. But the company's lead is slowly starting to dwindle, "with a slight negative trend year-over-year while local EV brands have climbed in the rankings," UBS said.

And while Tesla still has a commanding lead in EV powertrain technology relative to legacy automakers like Ford and Mercedes-Benz, that lead will likely decline over time, making their vehicles less attractive when compared to competitor offerings.

"Tesla's lead in EV powertrain will likely shrink while the AV [autonomous vehicle] opportunity is already fully priced," UBS explained.

Going forward, the most upside potential in EV stocks will come from legacy automakers who are making the transition away from gas-powered. UBS thinks the legacy automakers with the greatest re-rating opportunity are Volkswagen, General Motors, and Hyundai, according to the note.

While investors may re-rate the stocks of legacy automakers higher, consumers seem to be sticking with Tesla for now. UBS found that 43% of respondents who intend to purchase an electric vehicle are considering Tesla products, far outpacing other EV automakers like Volkswagen, BMW, and Audi.

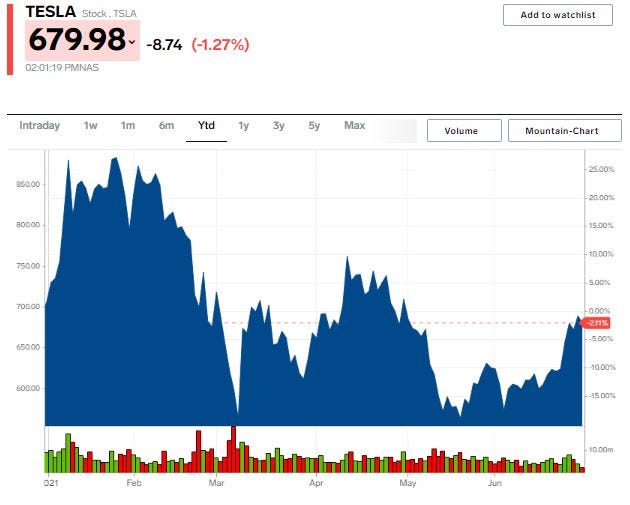

Shares of Tesla fell as much as 2% in Tuesday trades, and are down 3% year-to-date, as of Monday's close.