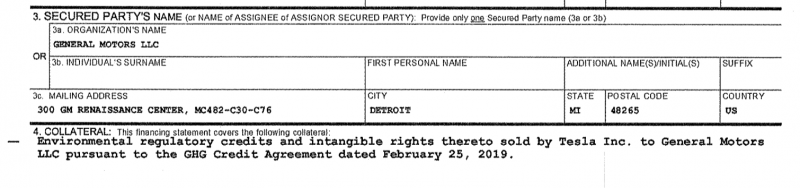

- New documents published by Bloomberg on Monday show that General Motors and Fiat Chrysler Automobiles (FCA) have been among the purchasers of Tesla’s zero-emissions regulatory credits.

- Previously, the buyers of Tesla’s emissions credits have been secret.

- FCA said consumer demand for zero-emissions vehicles isn’t keeping pace with regulatory requirements, hence the purchases.

- GM, meanwhile, said the purchases were to help hedge against future regulatory changes.

Since 2012, Tesla has made more than $1.7 billion selling regulatory credits to other automakers.

The buyers of those credits, which purchase them to make up for shortfalls in their own zero-emissions vehicle sales, have previously been shrouded in secrecy. However, Bloomberg News reported on Monday that both General Motors and Fiat Chrysler Automobiles (FCA) are two of the buyers, citing state filings in Delaware.

News of FCA’s credit buying in the US follows reports that the company said it would also pay hundreds of millions of euros in order to count Tesla’s electric vehicles among its own fleet, thus avoiding hefty fines from European Union regulators.

An FCA spokesperson told Bloomberg that government rules for emissions are being made stricter more quickly than consumer demand is turning in favor of electric vehicles.

GM spokesperson said its investment in the credits was a hedge against "future regulatory uncertainties."

For context, GM sold 5,226 Chevrolet Bolts, it's best-selling electric vehicle, in the first four months of 2019. In the same time, Tesla sold 32,475 Model 3s, according to sales data from InsideEV's.