- Tesla posted an impressive third-quarter profit on Wednesday, but the company’s topline revenue was even more stunning.

- The ocean of money flowing toward Tesla is far more important than whether it makes or loses money on a quarterly basis.

- As Tesla grows, questions could arise over its monopoly status and use of pricing power.

On Wednesday, Tesla posted a big quarterly profit, its first since 2016 and a fulfillment of CEO Elon Musk’s prophecy that the carmaker would enter the black in 2018.

The company made $312 million. But far more importantly, it raked in almost $7 billion in revenue, a massive increase to the top line, which had been moving very predictably by about $200 million a quarter. The $3 billion jump for the third quarter was, frankly, stunning.

More than the bottom-line number, it was a huge beat on analysts’ expectations. (Wall Street had figured in a breakeven quarter or a slight beat.) If you take out the sales of zero-emissions credits – about $50 million – Tesla made roughly $260 million.

For a sense of scale, Ford also reported Q3 earnings on Wednesday, making a profit of almost $2 billion on a non-GAAP basis on revenue of nearly $38 billion. It lost close to $200 million on its new mobility unit. (It’s in early growth stages.) So on a single division, Ford is losing something in the ballpark of what Tesla is making on its entire business.

Don't come away from that with the wrong impression - but don't get hung up on Tesla's profitability either. With just $3 billion in cash and $10 billion in debt, as well as some large debt payments coming due in 2019, Tesla needs a firehose of cash flow more than it needs profits.

Profits come and go, but revenue is forever

On a conference call after earnings were announced, Musk indicated that profits might not be so impressive going forward. For example, Tesla has to deal with a convertible-debt payout in Q1, adding up to more than $900 million. It also has billions in as-yet-gestational investment to contend with, including building a new factory in China and launching a crossover SUV.

The good news is that with surging revenue, Tesla ought to be able to manage profit expectations more consistently, thereby keeping the stock price up and maintaining an equity fundraising channel (despite Musk's declarations that the company won't need to sell more stock).

The better news is that an ocean of money coming in the front door will help Tesla scale out of its current constraints. The car business is extremely expensive. Tens of billions of dollars are really nothing to a major automaker - that's simply how much it costs to keep the lights on and the show running.

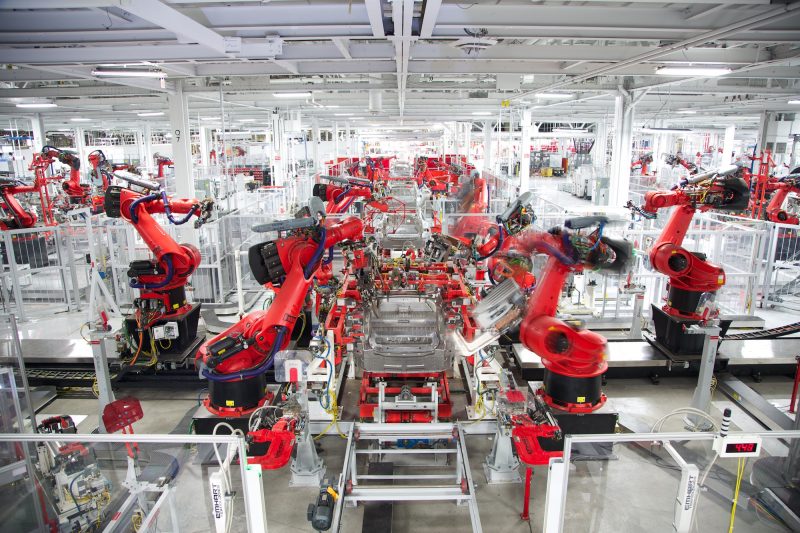

It was actually pretty easy to see the revenue spike coming. For most of its history, Tesla was a company that built fewer than 50,000 vehicles a year. Last year, it hit 100,000, and now 200,000 to 300,000 is within reach. If demand doesn't collapse, 500,000 should arrive in the next year or two.

Tesla ought to have a positive net margin on that volume of production - who knows if it will be 1% or 20%? - but more importantly, the amount of money sloshing through the company should be vastly higher than it has ever been, especially because forthcoming products will all be priced high, at least to begin.

Tesla is a micro-monopoly

The only potentially awkward issue raised by this development is that Tesla is clearly acting like a micro-monopoly.

The electric-vehicle market is tiny - only about 1% of global sales - and Tesla makes up most of it. The company has been using its pricing power to satisfy its capital needs, and, lacking any meaningful competition, there isn't much that consumers can do about it. (Besides, Tesla buyers thus far appear uniquely price insensitive. Whatever you say, Elon! Where do I sign?)

This might be OK in the short term - Tesla needs monopoly power to stay alive, and instructively, it hasn't been able to use that power to mint steady profits - but over the longer haul, Tesla can't be permitted to control a gigantic swath of a market that could grow significantly in coming years. The auto industry is the most competitive on the planet, and in the US consumers have benefitted enormously from a wide range of choices.

(For what it's worth, Musk doesn't want Tesla to be a monopoly - he understands that Tesla alone can't replace the globe's 1 billion gas-burning vehicles with electric ones.)

So while it certainly no longer seems as if Tesla will go down in flames, in the future it can't be Tesla or nothing. But for the moment, Musk and company are more than entitled to relax on a mountain of cash and survey their good work.