- Tesla CEO Elon Musk announced last week that a new factory is planned for Germany, in the Berlin area.

- This is a bad idea. The European auto industry already has too many factories for the region’s level of demand.

- The European auto market also isn’t growing.

- A shift to electric vehicles could happen, but it would be far more sensible for Tesla to take over an existing plant or hire a manufacturer to build its cars.

- Musk’s addiction to storytelling is driving this decision.

- Sign up for Business Insider’s transportation newsletter, Shifting Gears, to get more stories like this in your inbox.

- Visit Business Insider’s homepage for more stories.

Last week, Tesla announced that it would build a new Gigafactory – Tesla’s term for a rather grandiose term for a car plant – near Berlin.

That would bring the Tesla Gigafactory count to four, with facilities in Nevada, New York state, China, and now Germany. Not all of these plants are explicitly for vehicle assembly, but they could be if needed. By reckoning, this means Tesla has committed to building more factories than any other established automaker in the world.

Tesla could offer some industrial logic for a plant in Shanghai, given that China is likely to be the world’s best growth market for all-electric vehicles and that Western car companies prefer to build vehicles where they sell them.

But Europe is a far different story.

Capacity utilization in the auto-manufacturing sector is in the low-80% range, an embedded structural problem that business leaders in the industry have been worrying about for a decade (the late Fiat Chrysler Automobiles CEO Sergio Marchionne made a big deal out of the issue in a widely debated 2015 presentation unsubtly titled "Confessions of a Capital Junkie").

A mature market with limited future growth and too many underutilized factories

The European auto market is large and mature, and it probably doesn't have much growth to look forward to. A wildcard is a switchover to electrification, driven by rising government emissions and fuel-economy standards and problems with diesel engines in the aftermath of Volkswagen's cheating scandal.

Electric cars won't really solve the overcapacity problem, however. Europe could abandon internal-combustion completely and still have ... 20% of its car factories operating below full levels.

Enter Tesla. CEO Elon Musk was in Germany last week to attend the annual Golden Steering Wheel awards handed out by Business Insider's fellow Axel Springer publication, Auto Bild. Never one to miss an opportunity to keep Tesla enthusiasm high, Musk gave the German audience what it wanted and announced the Berlin Gigafactory.

Auto manufacturing is somewhat variable; there are operational factories in the world that have been around since the early 20th century. Tesla's main assembly plant, in Northern California, was opened in the 1960s (Tesla bought it after the financial crisis). But for the most part, automaking in the 21st century outside bespoke operations for expensive exotic cars is a commodified process.

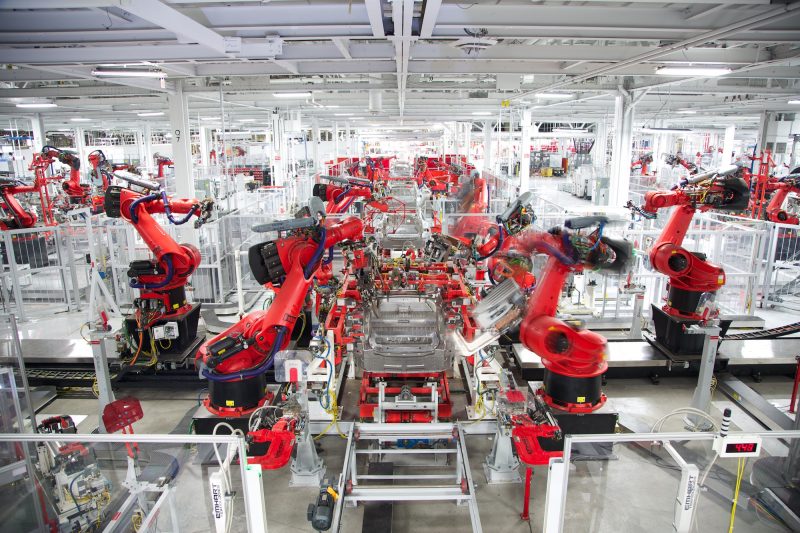

Musk has proposed, repeatedly, to reinvent this situation by creating highly automated factories, but Tesla had wound up with exactly the opposite: improvised outdoor assembly lines in California and a higher headcount indoors than Fremont had when it was a joint General Motors-Toyota plant in the 1980s.

Maybe Giga Berlin could rectify this, but that really wouldn't address the general overcapacity problem. The bottom line is that Europe doesn't need more car plants.

What's Musk's motive? It's mysterious ...

In this context, it's mysterious, if not to say mystifying, that Musk would want to build a new factory. There are plenty of plants that European automakers would be happy to sell him, for a song, and there are also contract manufacturers - such as Austria's Magna - who could start assembling Tesla vehicles faster than Tesla could construct and all-new facility.

It's worth noting that while Tesla's ambitions sound great, these new Gigafactories are all billion-dollar propositions - and Tesla is undertaking them with borrowed 2019 money. If they're in operation for 30 years, inflation should take care of the debt burden. But much of the competition built its plants with money gathered decades ago. And some of those factories are either slated to close or are running well below full capacity. Ford is reducing its European footprint to 18 from 23 plants and reducing shifts.

This ought to represent a happy hunting ground for Tesla, and Musk might still buy rather than build. But obviously, constructing something shiny and new sounds sexier.

Beyond the European overcapacity issue, any new Tesla factory is likely to replicate, depressingly, Tesla bungling approach to auto assembly. At a time when every other major automaker has adopted an industry standard "lean" manufacturing model, pioneered and refined by Toyota in the 1970s and 1980s, Tesla continues to operate more like the GM of the 1950s (or, with its improvised assembly line, the Ford of the 1910s).

Musk's cult of "production hell"

The output is pretty compelling; Tesla makes a nice car. But Musk has also created a cult of "production hell" that's simply baffling to industry professionals who are used to vehicles moving uneventfully from launch to production in a year or two. Germany, an industrial powerhouse, is especially good at this, so Musk parachuting in with his zany ideas might not go over all that well.

But honestly, he shouldn't bother. Or maybe he should, if his overarching goal is to keep the Tesla story fresh (it is). Tesla already has a sort-of factory in Europe, located in the Netherlands, but it's a final-assembly hub, completing vehicles shipped from the US. A soup-to-nuts factory in Europe's industrial heartland is a much more compelling plot point.

In many ways, Musk deserves his reputation for genius. He is by far the greatest living car salesman, a throwback to the giants of the business: Henry Ford, Enzo Ferrari, William Durant. But when it comes to the blocking-and-tackling stuff, his genius is useless. He constantly overcomplicates and reliably choosing the hard way when the easy way is staring him in the face.

The upshot is useful drama. But as Tesla gets bigger, the routine gets old. And if he really wants to sell more cars in Europe, there are much easier ways to do it than building a factory the continent doesn't need.