- Canada is launching a tax credit for zero-emission vehicles on May 1.

- To qualify, the base model of a new car must sell for less than $45,000 CAD.

- Tesla vehicles will not qualify for the credit because the company’s cheapest Model 3 option starts at $53,700 CAD.

Tesla vehicles will be ineligible for the Canadian government’s new $5,000 electric vehicle tax credit when it takes effect on May 1.

In guidelines published Wednesday by Transport Canada, base-model vehicles with six or fewer seats must have sticker price below $45,000 CAD with allowances up to $55,000 CAD MSRP for higher-priced trims.

Tesla’s cheapest car, the Model 3, starts at $53,700 in Canada, according to the company’s website. The Model S and X start at $114,000 CAD and $117,000 CAD, respectively.

Other vehicles that meet the threshold for the tax credit include the Chevrolet Bolt and Volt, Chrysler’s Pacifica Hybrid, Audi A3 e-tron, Ford Fusion Energi, and others. You can find the full list here.

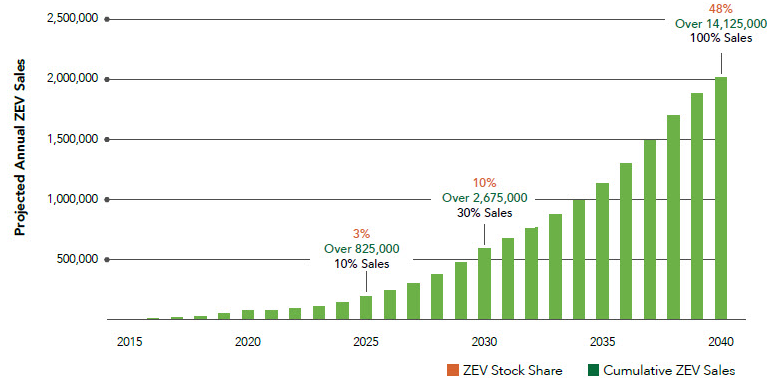

"Canada is committed to decarbonizing the country's transportation sector and becoming a global leader in zero-emissions vehicle," Transport Canada said on its website. "Analysis has shown that without any further action, Canada could achieve zero-emissions vehicle sales of 4% to 6% of all new light-duty vehicles purchased by 2025 and 5% to 10% by 2030."

By 2040, the government says, all vehicles on Canadian roads can be zero-emission.

In 2018, Tesla surpassed the limit of vehicles sold for the US' governments similar tax credit. Once the automaker passed 200,000 cars sold, the incentive was halved to $3,750 in January.