Andia/Getty Images

- Stronghold Digital Mining soared as much as 68% in its IPO debut on Wednesday.

- The surge for the crypto miner came amid bitcoin's historic rally to new all-time highs.

- The company priced its IPO above its expected range at $19 per share and is valued at about $2 billion.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

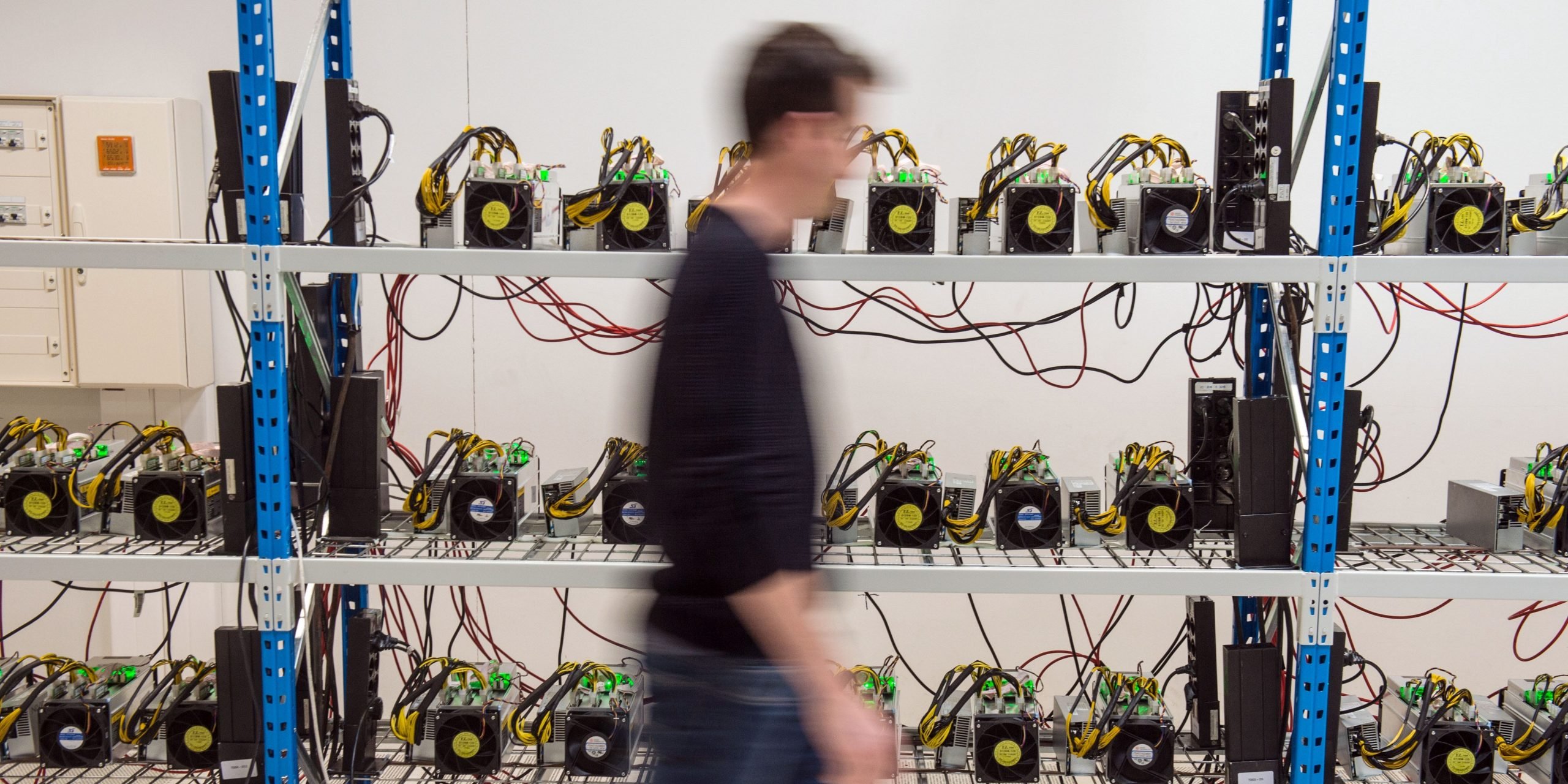

Stronghold Digital Mining soared as much as 68% in its IPO debut on Wednesday as bitcoin also surged to a record all-time high of about $67,000.

The bitcoin miner was founded in 2021 following a reorganization, is vertically integrated, and currently operates around 2,000 mining rigs powered by alternative energy. The company said in its S-1 filing that it generated about $8 million in revenue if the first half of the year.

According to its website, Stronghold Digital Mining derives much of its crypto mining power generation from coal refuse sites in Pennsylvania. The company burns piles of coal refuse leftover from Pennsylvania's legacy coal-mining industry in an emissions-controlled manner, which helps restore land, waterways, and air polluted by the coal piles.

The demand for the 6.7 million shares of Stronghold were strong, as it was able to upsize its offering and price its IPO at $19 per share, above its prior expected range of $16 to $18. The stock hit a high of $31.90, lending it a valuation of more than $1 billion.

The offering from Stronghold comes amid an ongoing frenzy by investors for cryptocurrency exposure. On Tuesday, ProShares launched its bitcoin futures ETF, which was the second largest debut for an ETF as measured by trading volume.

Stronghold said it raised about $130 million in proceeds from the IPO. The company trades on the Nasdaq under the symbol "SDIG."