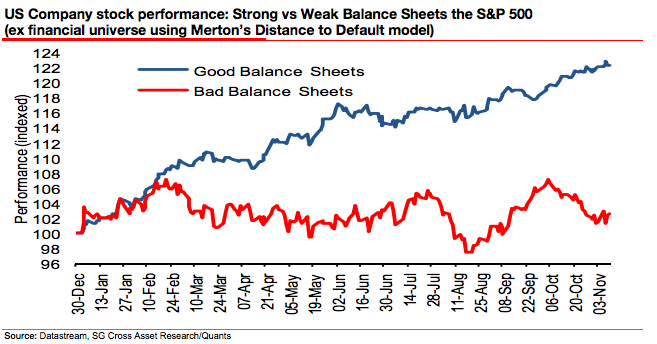

- Stocks of companies with a strong balance sheet are outperforming those of companies with a weak one as monetary accommodation slows.

- This signals that the 8-1/2-year bull market may be entering its final innings as investors flock to high-quality stocks.

In the stock market, when the best-financed companies are dominating returns, it’s time to get worried.

It’s a counterintuitive dynamic. You’d think that when investors are favoring companies with the strongest balance sheets – the ones with hefty cash balances and slim debt burdens – that implies that the market is healthy. In reality, the opposite is true.

What it actually signals is that a market rally is stretching into its late innings. It represents the period when investors are getting more discriminating with stock selection and chasing high-quality stocks.

This shift has been brought about by the imminent end of massive monetary accommodation from the Federal Reserve. The heyday of cheap debt financing is fleeting, and the companies so reliant on those easy conditions are falling out of favor with traders.

To the Societe Generale strategist and outspoken market bear Albert Edwards, the divergence in performance for companies with strong and weak balance sheets is a sign of something more ominous: the end of the 8-1/2-year bull market.

"Is this a straw in the wind that a bear market is arriving far sooner than most investors had anticipated?" he wrote in a client note. "It might be."

While it's an unquestionably cynical take to say outperformance for the best-capitalized companies in the market is a bad thing, it's a dynamic that has been highlighted in the past by Goldman Sachs. While the firm doesn't see strong-balance-sheet dominance in quite as negative a light as Edwards, it has repeatedly pointed out that it happens when monetary conditions are tightening.

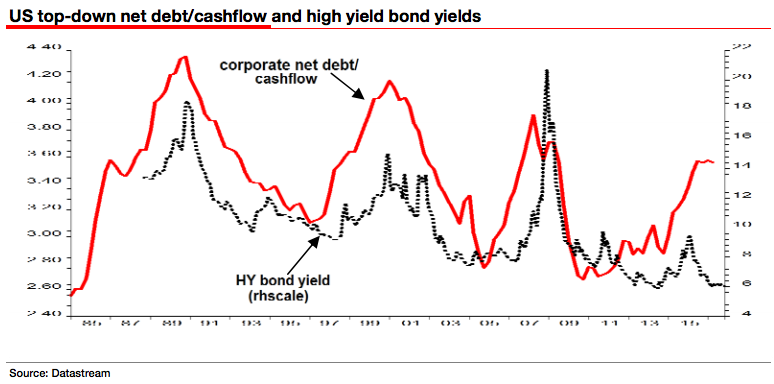

In addition to balance sheets, Edwards has his sights on another divergence: The ratio of corporate debt to cash flow is climbing while junk-bond yields fall. He points out that this measure normally peaks as profits fall, something that often accompanies a recession.

This must all be taken with a grain of salt, however, considering that Edwards has routinely called for the end of the bull market over the past few years. But what his arguments do succeed in is injecting some skepticism into a market that seems incredibly confident, with stock valuations hovering near record highs.

After all, it's this "irrational exuberance" that could eventually trigger a reckoning in the market, and it's best to be cautious.