- Goldman Sachs is heralding the arrival of the new ‘Green Energy Majors’.

- The bank is estimating a €10 trillion investment into the sector by 2050.

- Here are the new energy titans, and the upside to investing in them, according to Goldman Sachs.

The green revolution has ushered a new generation of energy majors that will dominate the sector and overtake the traditional oil and gas giants in terms of size and prominence.

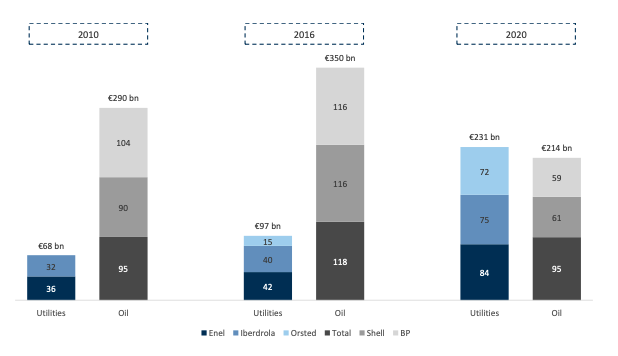

Already, investors are pushing cash into the green story. In 2020, the combined market value of the three green supermajors – Italian utility Enel, Danish wind power firm Orsted and Spanish power company Iberdrola – overtook the combined market capitalization of Total, BP and Shell, standing at €231 bln ($280.12 bln) and €214 bln ($259.50 bln) respectively.

These European players are already dominating their domestic markets, accounting for 60% of the region’s utility sector’s market cap. But with commitments to achieve net-zero emissions from nations around the world, these early entrants stand to make significant returns globally, according to research by Goldman Sachs.

With Europe continuing to set the tone for the industry, this is what the state of the sector looks like and a deeper dive into the names set to become the Green Energy Majors.

Datastream/Goldman Sachs Global Investment Research

The EU Green Deal: leading from the front

With several updates to the European strategy, Goldman Sachs is getting increasingly bullish on the sector, upgrading its forecasts. The bank now expects €10 trillion ($12.13 trillion) worth of investment from the EU Green Deal by 2050, up around 50% on original calculations.

Another new factor is the improvement in hydrogen-based technology, which the EU has included in its strategy. Goldman Sachs estimating investment in this space will reach €2 trillion ($2.43 trillion) by 2050.

Additionally, with the 2030 target of a 55% reduction in emissions fast approaching for EU leaders, there is an increasing demand for decarbonisation technology, or Carbon Capture Systems which could see a big boost to investment.

This combined with the roll out of 'net zero' policies around the world point to a near-220% acceleration in clean infrastructure capex for the Green Energy Majors, the note said.

The Paris Agreement, an international climate commitment to keep the global temperature increases below 2%, is also a pressure point. Current renewables and power grid investments currently amounting to €14 trillion by 2050, according to data from the International Energy Agency (IEA). But, Goldman Sachs estimate that - in order to meet the target, 2021-2050 cumulative investments into clean infrastructure could more than double to €40 trillion ($48.52 trillion), beating the International Energy Agency's estimate of €30 trillion.

Overall, this accounts for a quadrupling in annual wind and solar additions and a more than double the investment into green infrastructure, the note said.

What does this mean for market players?

In short: unprecedented growth, creating higher capex and translating to higher profits."We estimate the capex step-up for renewable activities alone could increase +325% under our global green deal scenario," the Goldman Sachs research team wrote. This is alongside a more than 200% acceleration in clean infrastructure spending, it added.

From this, the Green Majors are set to deliver a high-single-digit earnings per share (EPS) compound annual growth rate (CAGR) to 2030 (+9%), according to the research.

"We would expect these companies to outperform the rest of the sector, their share of the total sector's capitalization is likely to continue rising," it said, adding that the industry - originally considered a bond proxy - could evolve into a secular growth proposition.

Goldman Sachs are expecting big things for the GEMs' fundamentals, anticipating an 8% increase for their 10-year EBITDA CAGR between 2020-30E, smashing the +2x estimate for the rest of the sector in the same timeframe.

"Given the largely regulated/contracted nature of these investments, higher capex should translate into higher earnings growth," the note said.

Meet the eight Green Energy Majors:

The GEMs fall into two main categories: pure renewables and integrated.

The 3 pure renewables are:

Solaria:

- Ticker: SLR.BME

- Neutral

- Solar power

- % Upside: -18%

Market cap: €3.28 bln ($3.98 bln)

EDPR:

- Ticker: EDPR.ELI

- Buy

- % Upside: 5%

- Market cap: €20.11 bln ($24.39 bln)

Orsted:

- Ticker: ORSTED.CPH

- Buy

- Offshore wind power

- % Upside: 11%

- Market cap: $79.9 bln

These are the 5 integrated companies:

EDP

- Ticker: EDP.ELI

- Buy, on CL

- % Upside: 19%

- Market cap: €21.09 bln ($25.58 bln)

Enel

- Ticker: ENEL.BIT

- Buy, on CL

- % Upside: 42%

- Market cap: €87.33 bln ($105.91 bln)

Iberdrola

- Ticker: IBE.BME

- Buy

- % Upside: 18%

- Market cap: €76.65 bln ($92.96 bln)

SSE

- Ticker: IBE.BME

- Buy

- % Upside: 10%

- Market cap: €15.93 bln ($19.32 bln)

RWE

- Ticker: RWE.DE

- Buy, on CL

- % Upside: 30%

- Market cap: €25.05 bln ($30.38 bln)