Stocks are on a tear, and the US dollar is rising – all since Donald Trump was elected the 45th president of the United States.

A month after the election, we’ve taken a closer look at how markets have moved since then, as well as some idea of why those moves have happened.

We put together a collection of charts illustrating some of the biggest moves in the weeks since Election Day.

For the charts showing corporate stocks, a red line on the chart indicates closing time on Election Day.

For yields, currencies, and gold, which see extensive overnight trading, the line shows midnight of Nov. 9, around which time it became clear that Donald Trump would win the election.

Stocks have climbed to a record, but...

On Election Night, as the shocking results started coming in and showing an increasing likelihood of a Trump victory, markets went haywire. Near midnight, futures for the benchmark S&P 500 and Dow Jones Industrial Average indices fell over 4%.

Stocks often tumble during unexpected and surprising moments, like Trump's late night victory and, earlier in 2016, the Brexit referendum.

The chart, however, only illustrates moves during the regular trading day (as do the following charts of stock prices), and so it doesn't include the wild ride from the night of November 8.

Instead it shows how quickly stock markets recovered, as investors focused assumptions that are good for the market, instead of uncertainty which is bad for stocks.

All the major indices have set all-time-high records. As the next charts will show, certain sectors have been big winners since the election while others have not fared as well.

Check out more about the S&P 500 at Markets Insider.

...to understand why, it is important to look at specific sectors. Bank stocks, for example, have staged a huge rally that seems directly related to assumptions about Trump's policy.

The financial sector has taken off in the wake of the election, on the assumption that a Republican administration will foster a much more lenient regulatory environment than has been in place since the financial crisis. As we will see later, interest rates have also gone up since the election, and higher rates could benefit banks.

Check out more about Wells Fargo at Markets Insider.

In particular, Goldman Sachs — a previous employer of several key Trump advisors — has been on a tear.

The investment bank has outperformed the other 29 companies that make up the Dow Jones Industrial Average since the election. Indeed, according to legendary trader Art Cashin, about one-third of the post election increase in the Dow Jones Industrial Average came directly from Goldman Sachs' performance.

It's worth noting that Trump's chief strategist Steve Bannon and his nominee for Treasury Secretary Steve Mnuchin are both Goldman Sachs alumni, and on Friday it was widely reported that Trump intended to name Goldman chief operating officer and president Gary Cohn the head of the National Economic Council.

Check out more about Goldman Sachs at Markets Insider.

Drugmakers are another group that did well right after the election, though this is more about what Trump hadn't said than what he had.

Biotech stocks swung up sharply the day after the election and continued to climb for around a week after.

During the campaign, Hillary Clinton was often critical of pharmaceutical companies and their pricing policies. Her defeat suggests that the regulatory environment for drugmakers could be more lenient than many expected pre-election.

At least that was the assumption driving gains at first. But then one prominent drug company CEO recently noted that drug prices are a populist issue, which means investors may be getting ahead of themselves if they think Trump is going to leave the companies alone.

Days later, Time magazine published an interview with Trump in which he said he is "going to bring down drug prices."

The sharp dropoff you see near the right side of the chart is what happened next.

There's also some much narrower themes at play. For example, for-profit higher education companies like Apollo Education have rallied on news of a new administration.

The Obama Administration cracked down on for-profit higher education, including Department of Education sanctions against for-profit college ITT eventually leading that company to cease operations and file for bankruptcy. Markets appear to be betting that President-elect Trump will be more lenient towards for-profit colleges.

Betsy DeVos, Trump's pick for education secretary, is a long-time supporter of school vouchers, or government subsidies for families to send their children to private and charter schools rather than traditional public schools. It will be interesting to see how her Education Department deals with for-profit colleges.

Check out more about Apollo Education Group at Markets Insider.

So have private-prison stocks.

CoreCivic, formerly the Corrections Corporation of America, is the largest private prison company in the US. The company's stock soared the day after the election.

Private prisons have come under fire from Democrats and the outgoing administration. Markets could be pricing in the likelihood of President-elect Trump undoing the Obama Administration decision to phase out private prisons for federal inmates.

Other likely Trump policies could also be potential boons for the prison industry. Trump ran as a "law and order" candidate throughout the campaign, suggesting the possibility of a crackdown on crime in his administration, adding demand for prison beds.

Similarly, Trump's campaign promises to dramatically ramp up detention and deportation of undocumented immigrants would likely boost demand for private prisons, should they be implemented.

Check out more about CoreCivic at Markets Insider.

Trump isn't seen as good news for everyone, though. His plan to unravel Obamacare has hit some healthcare stocks, like Hospital Corporation of America, hard.

With Obamacare unlikely to survive in its present form under a Trump administration, the future health insurance of some 20 million Americans is uncertain. If Congress and the incoming president roll back the Affordable Care Act's subsidized individual insurance exchanges and Medicaid expansion, many of those 20 million Americans insured under those provisions could lose coverage.

Millions of potential patients for doctors would no longer be able to afford health care, and markets appear to think that could mean lost business for hospitals.

Check out more about Hospital Corporation of America at Markets Insider.

All this buying has left stocks historically expensive relative to their underlying values.

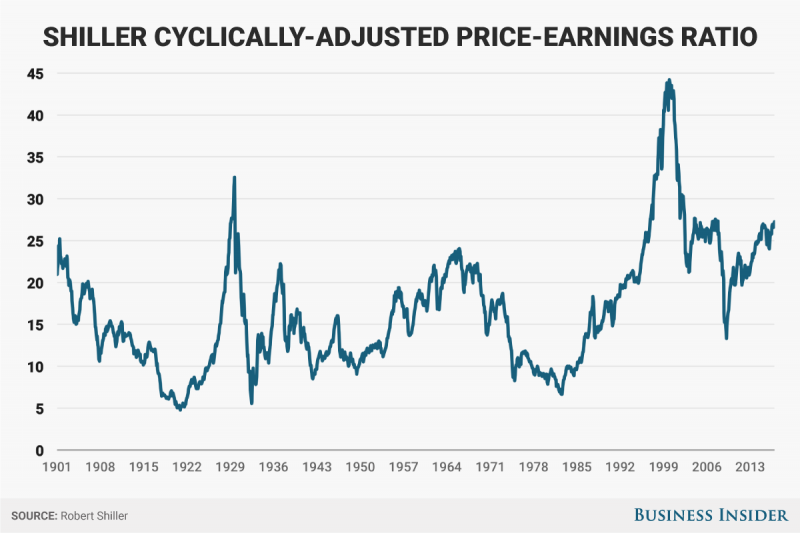

The Shiller price-to-earnings ratio is a commonly used measure of how expensive stocks are relative to their underlying values. It shows the ratio of S&P 500 companies' stock prices to their earnings, after adjusting for macroeconomic factors.

As of Friday, the ratio hit 27.86, and the only times it's been higher were right before the 1929 crash, the dot-com bubble of the late 1990s, and the runup to the 2008 financial crisis.

Of course, high valuations don't necessarily mean a crash is imminent, but stocks have certainly gotten very pricey lately.

Moving to the bond market, treasury yields tumbled briefly election night before ratcheting up over the following weeks.

Treasurys and other bonds have been selling off fairly consistently since the election (prices and yields for bonds move in opposite directions: as prices go down, yields go up.)

President-elect Trump's proposed economic policies, including a massive infrastructure plan, lower corporate taxes, and less regulation, could lead to higher growth and inflation. Those two consequences tend to make bonds less attractive to investors, leading to the sell-off in Treasurys and other fixed income assets.

Check out more about the bond market at Markets Insider.

Here's another way of looking at investors expectations on inflation.

The 10-year breakeven inflation rate, which is based on comparing yields from regular 10-year Treasurys and inflation-protected Treasurys, gives a sense of what the market thinks inflation will look like over the coming years, and it's been mostly on the rise in the month after the election.

As mentioned on the last chart, Trump's proposed fiscal stimulus could lead to more inflation. Meanwhile, restrictive trade policies that make imported goods more expensive for American consumers and a crackdown on immigration leading to a possible labor shortage would likely also lead to higher inflation, while not doing much for economic growth.

Foreign exchange markets have had their share of drama too. One of the big stories has been the Mexican peso.

On Election night, the peso crashed to a record low as the results came in. The Mexican currency has since remained much lower than before the election.

Throughout the campaign, the peso acted as a sort of barometer of Trump's chances: Events that made Trump more likely to win caused the peso to fall; situations that favored Clinton strengthened the currency. Investors seem to be betting that Trump's plans to restrict trade and immigration could damage Mexico's economy.

Check out more about the Mexican peso at Markets Insider.

More broadly, the US dollar tumbled during election night, but quickly recovered.

HSBC laid out four factors that could affect the dollar going forward.

Trump's fiscal policy could push the dollar higher owing to the potential economic growth and inflation that could result from a big stimulus push.

The bank's analysts also noted that proposals to encourage companies holding money overseas to bring those profits back home could also be a boon if the overseas money is in a foreign currency that would need to be converted back into dollars.

More restrictive trade policy would have an "ambiguous" effect on the dollar against other developed market currencies, but could strengthen the currency against emerging markets that would have a harder time exporting to the US.

Finally, HSBC noted that a more restrictive immigration policy could threaten US economic growth, weakening the dollar.

Gold spiked on election night, but has steadily tumbled since.

Gold is often considered a safe haven, and its price tends to spike in the event of unforeseen events like Trump's election night victory.

In the weeks after the election, however, the metal has slumped. As noted in earlier charts, investors are optimistic that the president-elect's proposed fiscal policies could jump start growth, making other investments much more attractive.

Gold is also often used as a hedge against inflation, and so it's possible, should inflation emerge, or geopolitical uncertainty increase under the 45th president, that gold could turn around and dramatically rally.