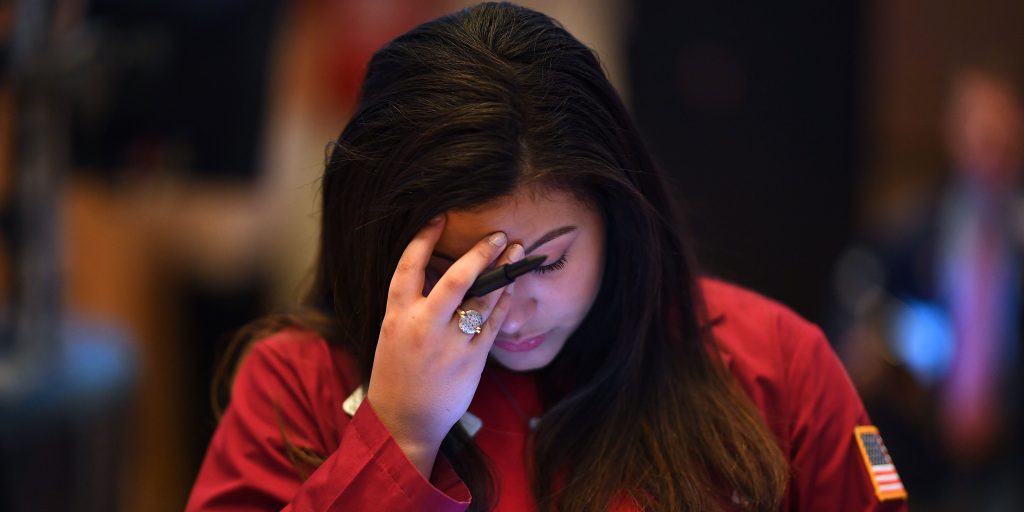

JOHANNES EISELE/AFP via Getty Images

- Technical indicators suggest US stocks are heading into a more challenging environment, CFRA says.

- Fewer stocks have been trading above their intermediate-term moving averages.

- Yet, it is unlikely that stocks are preparing to enter into a bear market.

- See more stories on Insider's business page.

The US stock market has been steadily hitting record highs this year but some technical indicators suggest it's set to run into a more challenging and volatile period with fewer stocks sustaining an upward pace, according to research firm CFRA.

Equities early Thursday were under pressure on a mix of concerns including worries about global economic growth with many countries battling the spread of the Delta variant of coronavirus. Meanwhile, rapid recovery in the US economy has prompted investors to question whether the Federal Reserve will withdraw monetary support sooner than anticipated. The Cboe Volatility Index, the stock market's so-called fear gauge, jumped 18% during the session.

But a "hint at near-term turmoil" had been forming before Thursday's session. On the S&P 1500 index, just 36% of its 47 sub-industries were trading above their 10-week, or 50-day, moving average compared with 90% on May 7, said Sam Stovall, managing director of US equity strategy at CFRA, in a note Wednesday.

"Fewer stocks trading above their intermediate-term moving averages means that a reduced number of stocks are in uptrends. The longer this condition persists, the more likely it is to cause the breadth indicators to roll over and diverge from price," said Stovall.

For the S&P 500 index, Stovall noted that 45% of Operating Companies Only issues traded above 30-day moving averages on July 2, when the S&P 500 hit another all-time high. That's considerably lower than 82.77% of such issues on May 7. OCO indicators are tracked by CFRA's Lowry Research business.

"Indeed, the cumulative OCO advance-decline line failed to confirm the S&P 500's latest all-time highs. This is potentially serious since it means that strength in select large-caps is masking growing internal weakness," he said.

However, it's unlikely that stocks will soon push into a new bear market, the strategist said. He pointed out that percentage of sub-industries on the S&P 1500 index trading above their 40-week, or 200-day, moving average remains above 90%, a run that's been in place for the past 35 weeks. It's the second-longest run since a 48-week streak ended in April 2004.

The "2003-04 run saw the market stumble into its first 5%+ decline nearly nine months after its start, but kept the next bear at bay for almost four more years," Stovall said.