- Inflation is top-of-mind for investors after the CPI rose more than expected in April.

- But according to Marko Papic, investors are misreading how the Fed will react.

- He said the S&P 500 faces weak returns in the near-term partly because of this..

Members of the Federal Reserve’s Federal Open Market Committee have been drilling their message into investors for several months now: They won’t respond to a spike in inflation this year.

And yet, investors still don’t believe them, according to Marko Papic, the chief strategist at Clocktower Group, which manages $1.5 billion in assets.

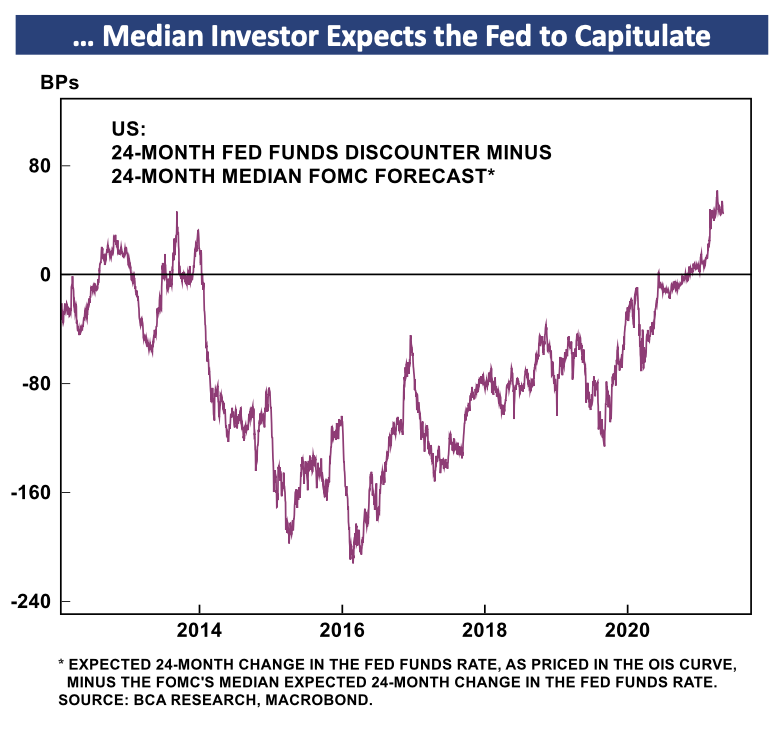

In an interview with Insider on Friday, Papic said investors are anticipating Fed intervention if inflation gets too hot this year. He pointed to the fact that the median investor expects the central bank to take a more hawkish stance on interest rates over the next two years, shown in the chart below.

But investors need to adapt to a new paradigm from the Fed, he said, where they are less focused on inflation and more focused on reducing income inequality.

"Investors are pricing in a Fed reaction function that's stuck in the last era, in the last cycle," Papic said.

A greater-than-expected rise in the Consumer Price Index (CPI), a main measure of inflation, this week spooked investors, another sign that they may fear a less-accommodating Fed in the coming months.

Until investors change this mindset and trust the Fed's hands-off messaging, the bull market's advance will be held back, Papic said.

Other reasons stocks could face dismal returns in the near future

But Papic said the misguided expectation on monetary policy is only one reason stocks are set for a period of weak returns in the immediate future.

He also argued that the economic recovery is fully priced into stocks at the moment, while bond yields still don't reflect this outcome. Yields of 10-year Treasury notes could "easily" rise to 2% by the end of 2021 from their current levels of 1.65%, he said.

This would cause a "vicious" rotation out the top growth stocks in the market into more cyclical names, he wrote in a recent report. Since the names at the top of the S&P 500 make up such a large percentage of the index, the broader market would be dragged down, he said, to the tune of a 10% drop over the next few months. This week's sell-off dragged the S&P 500 4% below its most recent record high.

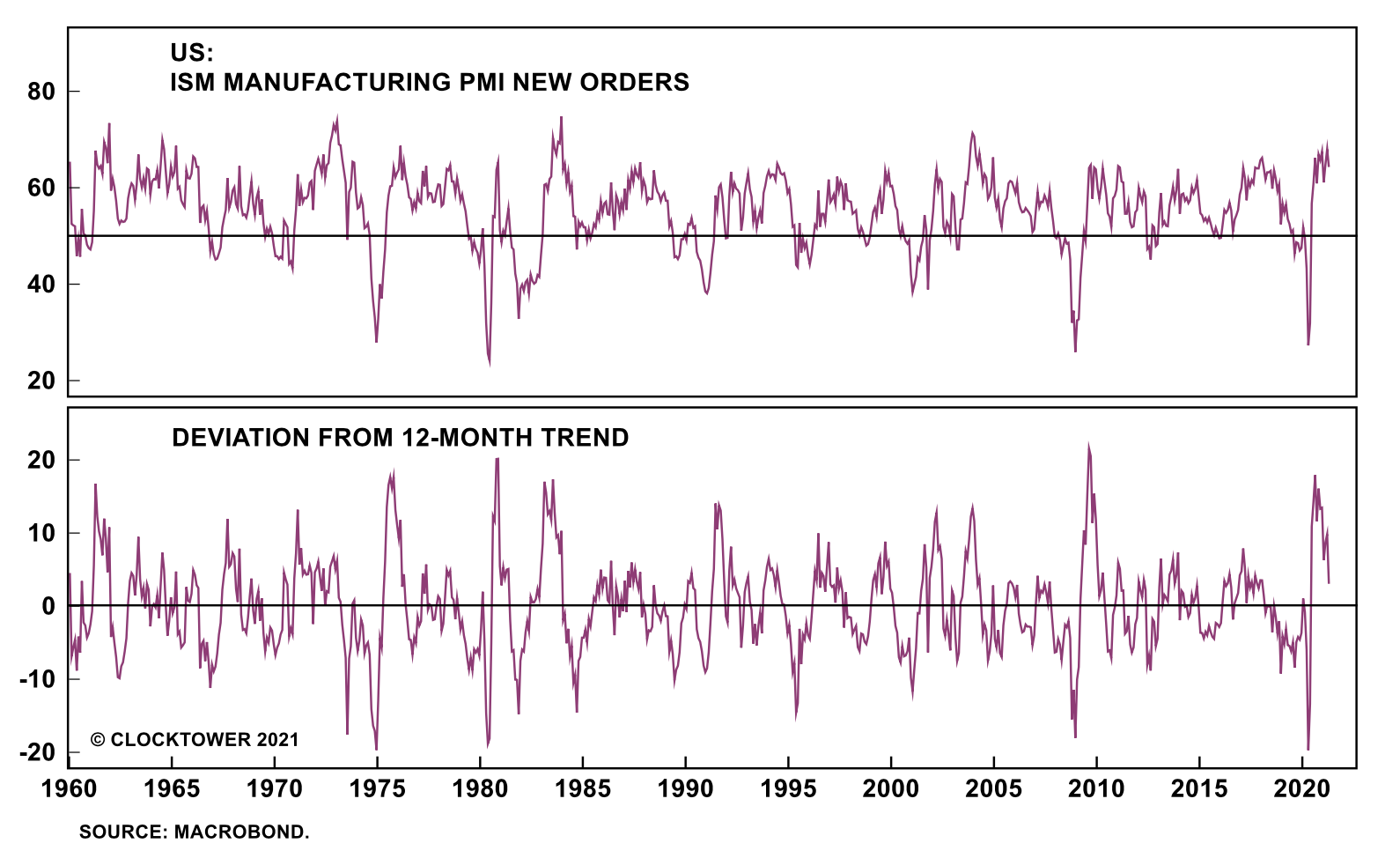

Another indicator that stocks are due for a greater pullback and heightened volatility is the fact that the ISM manufacturing index - a measure of economic activity - is registering at levels above 60, where it has historically struggled to continue climbing (see below).

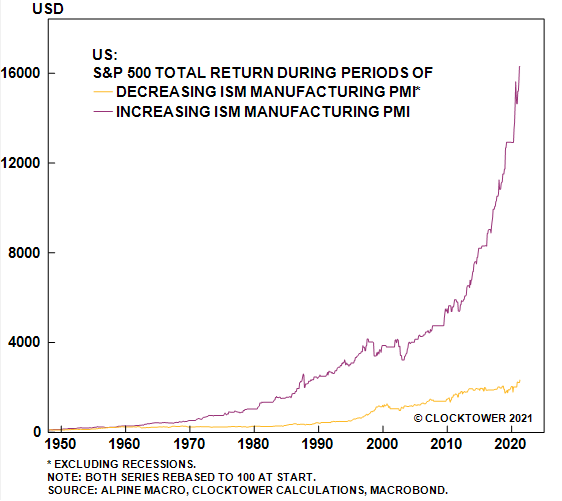

The higher likelihood that the index is set to decline bodes poorly for stocks' performance ahead - shown in the below chart.

"We're over 60 in the ISM manufacturing index. Normally at that point most of the growth surprises have been priced in," Papic said.

Although he doesn't like stocks' return prospects in the near future, Papic still thinks the bull market is intact and stocks have room to run in the mid-to-long term.

He also said investors should expect a shorter market cycle. The first phase of the bull market is over, he said, while the mid-phase volatility and sideways price action is beginning.

Papic's views in context

Some of Wall Street's top experts seem to agree with Papic's assessment of S&P 500 returns in the near-term.

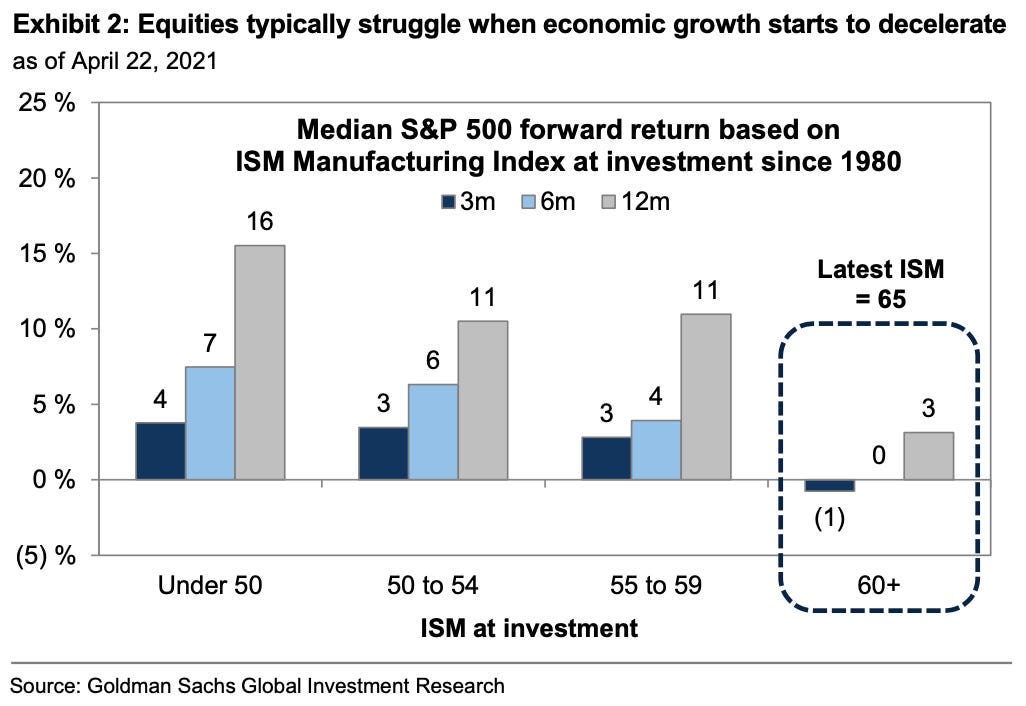

Goldman Sachs' Chief US Equity Strategist David Kostin also highlighted in a note at the end of April the ISM manufacturing index's bearing on stock performance.

"During the last 40 years, investors buying the S&P 500 when the ISM Manufacturing index registered above 60 - typically coinciding with peak growth - have experienced a median return of -1% during the subsequent month and a paltry +3% return during the subsequent year," Kostin wrote.

Still, Kostin sees the S&P 500 ending the year at 4,300, up 3% from its Friday close near 4,174.

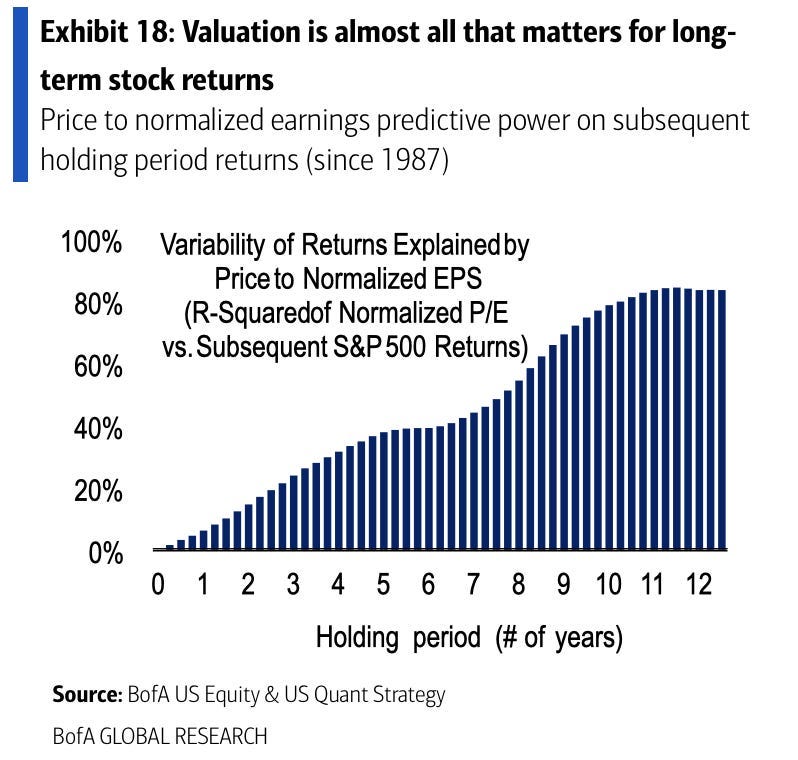

Meanwhile, Savita Subramanian, Bank of America's top US equity strategist, pointed to the fact that the height of current valuations makes it difficult to see strong returns over the next decade-plus. Valuations right now indicate - with a high degree of explanatory power - that investors can expect 2% annual returns from the S&P 500 over the next 12 years.

Subramanian expects the S&P 500 to close the year at 3,800, tied with Stifel's Barry Bannister for the lowest estimate among leading Wall Street chief equity strategists.

While Papic and others many may be questioning the returns that indexes will generate in the months or years ahead, they recommend individual stock picking and a cyclical preference.

Papic said he likes emerging market and European equities, as well as commodities.