Sterling is struggling to keep its head above water.

The pound has had another poor day on Thursday, falling against the euro and barely gaining against the dollar as investors keep on pricing in the likelihood that Britain’s government will opt for “Hard Brexit” – withdrawing from the EU without access to the Single Market.

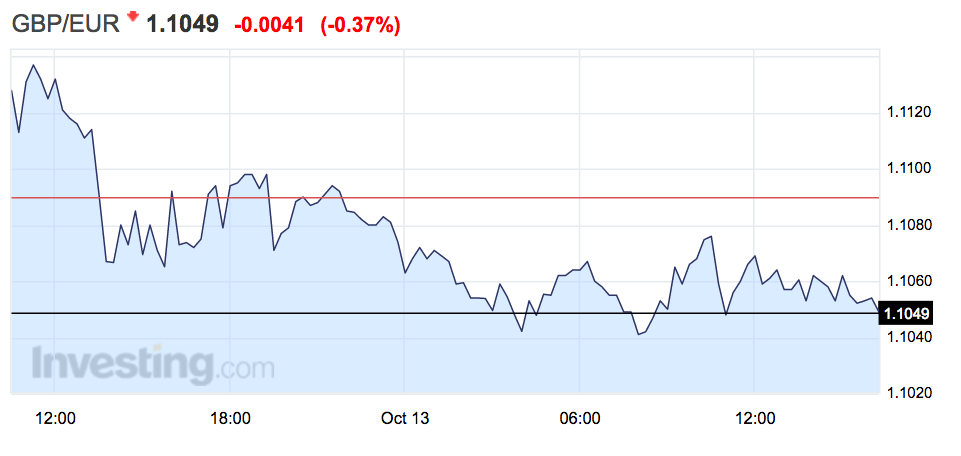

Around 4.30 p.m. BST (11.30 a.m. ET) the pound is lower by just less than 0.4% against the euro at €1.1049, slipping ever closer to parity with the single currency. Here’s how it looks on the day:

Sterling is a little up against the dollar, but only just, and spent much of the day in negative territory. Here’s the chart (remember the black line is the current price, the red line is the open earlier on Thursday):

Just over 24 hours ago, sterling had its worst run against the dollar since the referendum result on June 23. There was a short recovery before the pound started tanking again. Today is no better.

Investors seem certain now that May is unwilling to bend to the will of financial services in negotiations. On top of those fears, the UK Treasury this week leaked a document to say that a "Hard Brexit" would cost the UK £66 billion in lost taxes.

To make it worse, the pound collapsed as David Davis, the Secretary of State for Exiting Europe, answered questions on the government's Brexit strategy in Parliament.

Sterling initially rallied after prime minister Theresa May agreed to debate the triggering of Article 50, which begins the official Brexit process, in parliament. Traders hoped that signalled a more conciliatory stance. But Davis initially took a hard stance on the questioning and reiterated that control over immigration is the top priority in negotiations.

And it looks today that traders still have a hangover from those comments.