- Bitcoin was trading in the green, above $7,000 a coin, during Sunday’s trade.

- This comes after it was reported that two traditional Wall Street firms are entering the market for cryptocurrencies.

Major cryptocurrencies were trading in the green Sunday morning following reports that two traditional Wall Street firms are eyeing the market for digital currencies.

Bitcoin, the largest cryptocurrency by market capitalization, was trading up 2.1% at $7,047 a coin, according to Markets Insider data.

It’s been a rough start to the year for bitcoin, which saw its price soar by more than 1,300% in 2017, but has not fared as well in 2018.

Reports of a crackdown on cryptocurrency advertisements by tech giants such as Google and Facebook as well as regulatory uncertainty in Asia and the US have weighed on the coin for much of March and April. The coin is down 50% since the beginning of the year.

But investors appeared to be more bullish during Sunday's trade following reports that two Wall Street icons were looking to get into the market for cryptos.

More notably, the investment fund founded by billionaire George Soros is preparing to dive into cryptocurrency trading, even though Soros himself previously described them as a "bubble."

Adam Fisher, who oversees global macroeconomic investing for Soros Fund Management, has gained internal approval to invest in and trade cryptocurrencies, according to a Bloomberg News report.

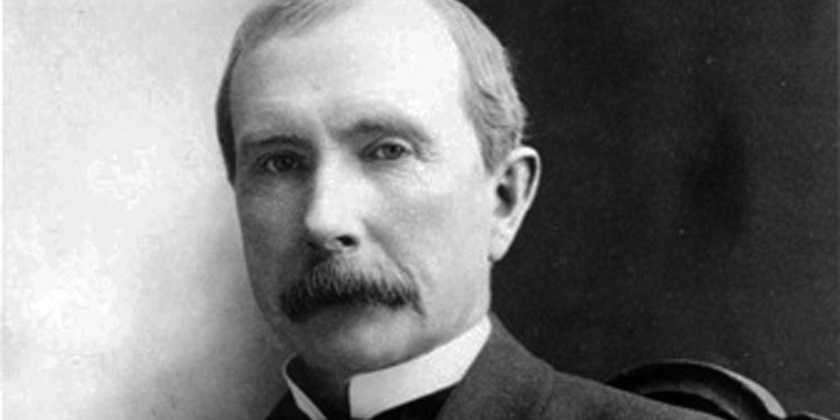

Also, Venrock - a venture capital firm founded by descendants of famed capitalist John D. Rockefeller - announced it was partnering with a cryptocurrency investment firm based in Brooklyn. Fortune first reported on the partnership.

Anthony Pompliano, whose crypto-focused VC firm Full Tilt was recently acquired by a traditional hedge fund Morgan Creek, told Business Insider these reports are "encouraging" for the nascent bitcoin market.

"It is encouraging to see institutions with the historical track record of Soros and Rockefeller beginning to gain exposure to blockchain and cryptocurrencies," he said.

"I anticipate more and more institutional capital will begin to pour in, hopefully leading to a more mature and sophisticated market."