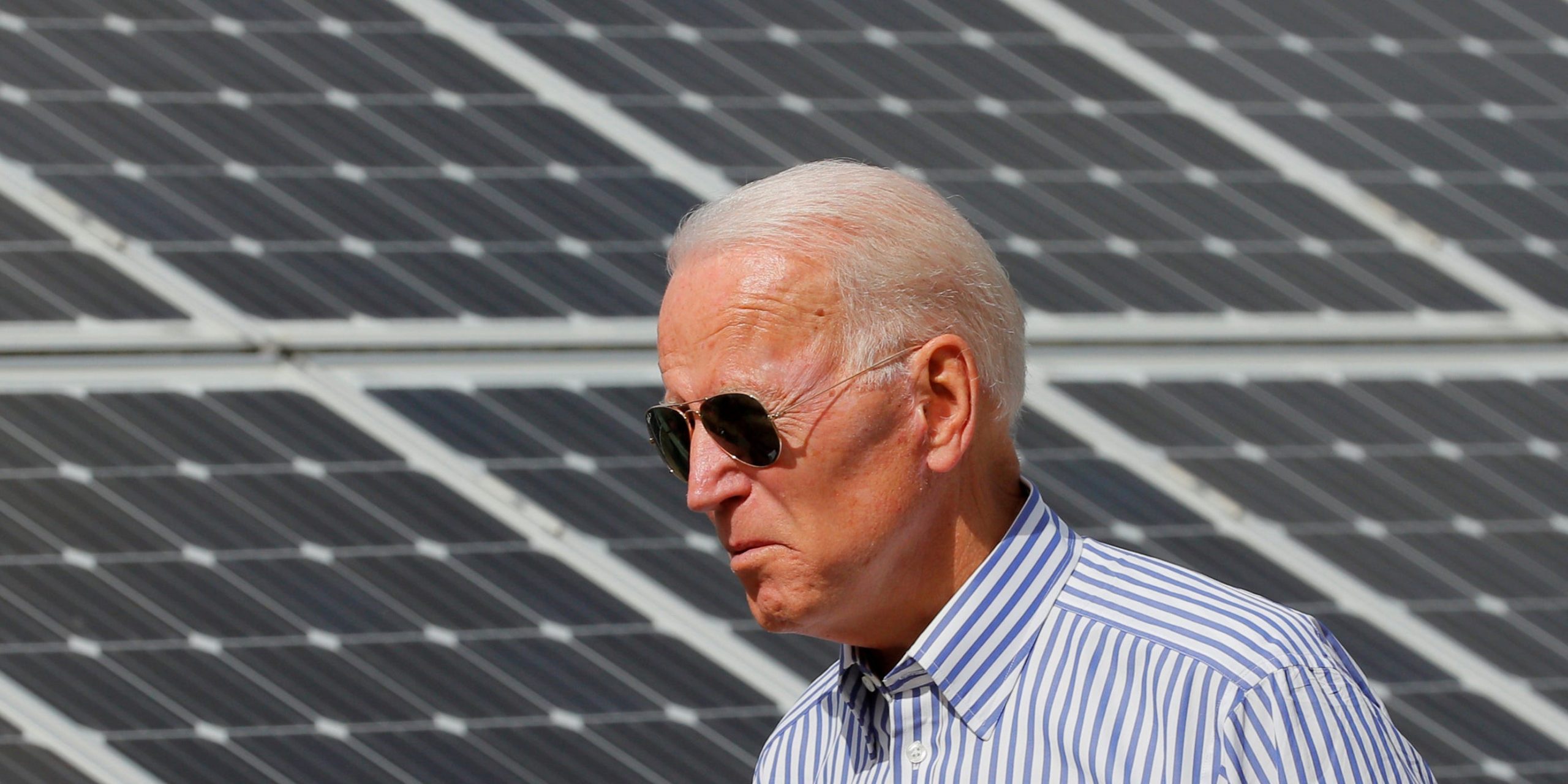

Brian Snyder/Reuters

- Solar stocks surged on Thursday after President Biden unveiled plans to cut US carbon emissions in half by 2030.

- Investors view solar energy as an essential tool that will be used to reach those carbon targets.

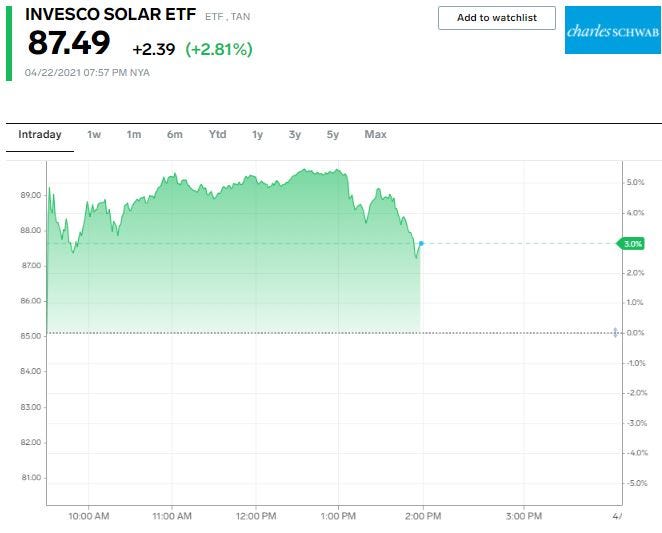

- The Invesco Solar ETF surged 5%, with Enphase Energy up as much as 8% in Thursday trades.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

President Joe Biden's plan to cut US carbon emissions in half by 2030 sent solar stocks soaring in Thursday trades, with the Invesco Solar ETF up as much as 5%.

The goal more than doubles what the US agreed to when Biden re-joined the Paris Climate Accord, and is based off of US' 2005 carbon emissions.

Biden's carbon emission reduction proposals came as he opened a climate summit among world leaders. Investors believe solar power will likely be a key technology that helps the administration meet its ambitious goals.

Shares of Enphase Energy, SunPower Corp., and SolarEdge Technologies jumped as much as 8%, 6%, and 10% respectively.

This isn't the first time an ambitious green-energy agenda helped boost a subset of clean energy stocks. Biden's $2.2 trillion infrastructure plan helped spur a rally in electric vehicle stocks last month, as the plan called for investing $174 billion in the sector to better compete with China.

The Biden administration said its new carbon reduction goals would "create millions of good-paying, middle class, union jobs."