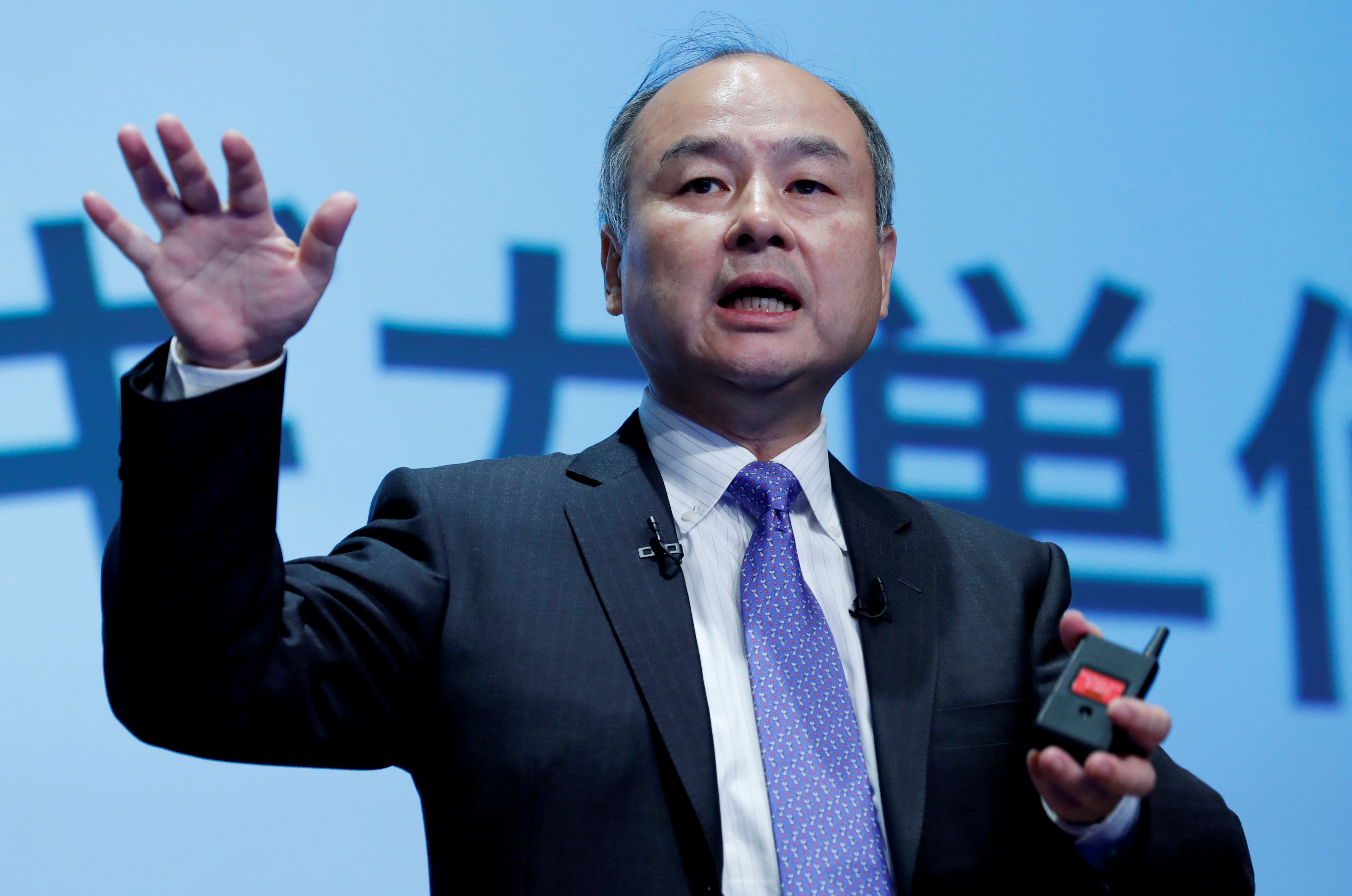

- SoftBank founder Masayoshi Son told Nikkei Business that he is embarrassed of his investment record.

- Two of SoftBank’s investments, Uber and WeWork, have seen their valuations drop recently, and WeWork cancelled its planned IPO.

- Son says he now has been telling founders to “know your limit,” to prevent issues like this in the future.

- Visit Business Insider’s homepage for more stories.

Masayoshi Son, founder of SoftBank Group, told Nikkei Business in an interview that he embarrassed and impatient with where some of the company’s investments are at in 2019.

Two of SoftBank’s flagship investments, Uber and WeWork, have both been disappointing recently. Shares of Uber have dropped over 30% since the company went public in May, Fortune reported. WeWork fared even worse, cancelling its planned IPO earlier this month. Softbank invested nearly $11 billion into the co-working company, which was once privately valued at $47 billion. On September 26, Son led the move to oust WeWork CEO Adam Neumann, and the IPO was pulled soon after the company was considering a valuation as low as $10 billion.

Son says he’s now warning founders that they can’t do everything.

"Recently, I've been telling founders to 'know your limit," he told Nikkei Business, seemingly referencing WeWork founder Adam Neumann and Uber co-founder Travis Kalanick, both of whom were pushed out. "Knowing your limitations will help unleash limitless possibilities." Neumann, the charismatic yet controversial former CEO, helped WeWork score massive investment's like SoftBank's, but has also been a source of scandal for WeWork, and was partially blamed for the cancelled IPO.

WeWork's botched IPO and questions about the company's business model and leadership under Neumann have damaged Son's reputation. Now, he's struggling to raise money for his second giant technology investment fund, Vision Fund 2. But Son is still optimistic about his investments and SoftBank's future.

"It only just began and I feel there is tremendous potential there," he told Nikkei Business. He claims that he has a 30-year plan, but also has ideas looking as far ahead as 300 years in the future. His strategy is to invest in companies that see a world shaped by artificial intelligence.