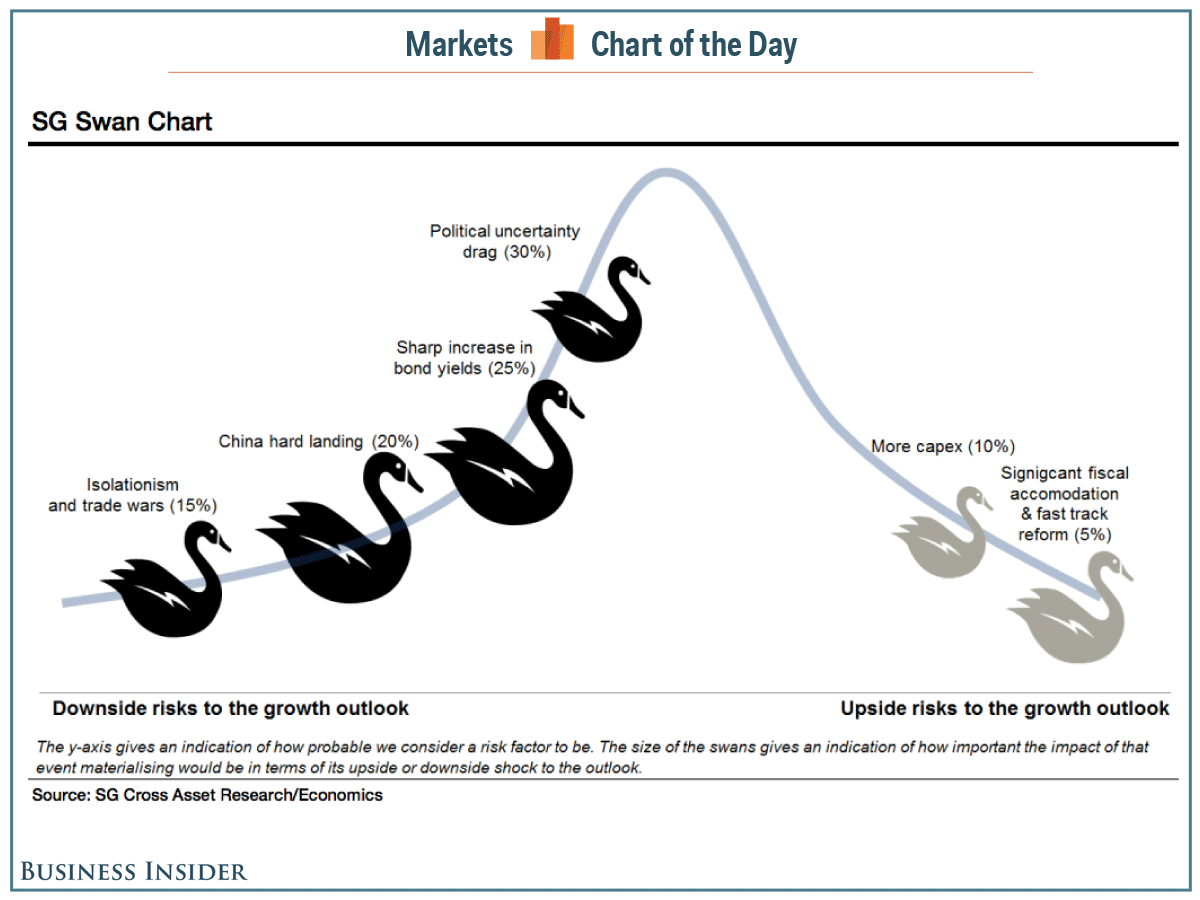

Societe Generale is out with its latest quarterly chart of swan risks that threaten to rock the global financial markets.

This time around, China is the big “‘pure’ economics” risk in the G5. SocGen argues that it’s the major economy with the “most significant risks with pockets of significant excess in housing, high debt levels and a burgeoning NPL problem,” and thus they see the risk of a hard landing at 20%. Taking it one step further, they added that “insufficient” structural reform “leaves the economy at very significant risk of a lost decade, which we set at a 40% probability.”

In their chart, SocGen lumped together broader political risk, pointing to the numerous upcoming European elections, potential spillover from policy uncertainty in the EU, and “significant uncertainty” regarding future US policy. But overall, they note, Europe’s the big space to watch politics-wise.

Separately, they also argued that bond yields are the “Achilles’ heel of global markets,” arguing that “market pricing on Fed rate hikes, however, remains modest and there is to our minds significant risk of a more disorderly repricing of global bond yields. Such a scenario could have very negative spillover, not least to emerging markets.”

We should note that it’s a bit of a faux pas to call these forecasts “black swan” events, given that black swan risks are, by definition, nearly impossible to see coming. But when they materialize, it’s bad – and that’s the point SocGen’s team seems to be making.

On the positive end, the team also points to two upside risks: significant fiscal accommodations and fast track reform in the US, as well as more capex.