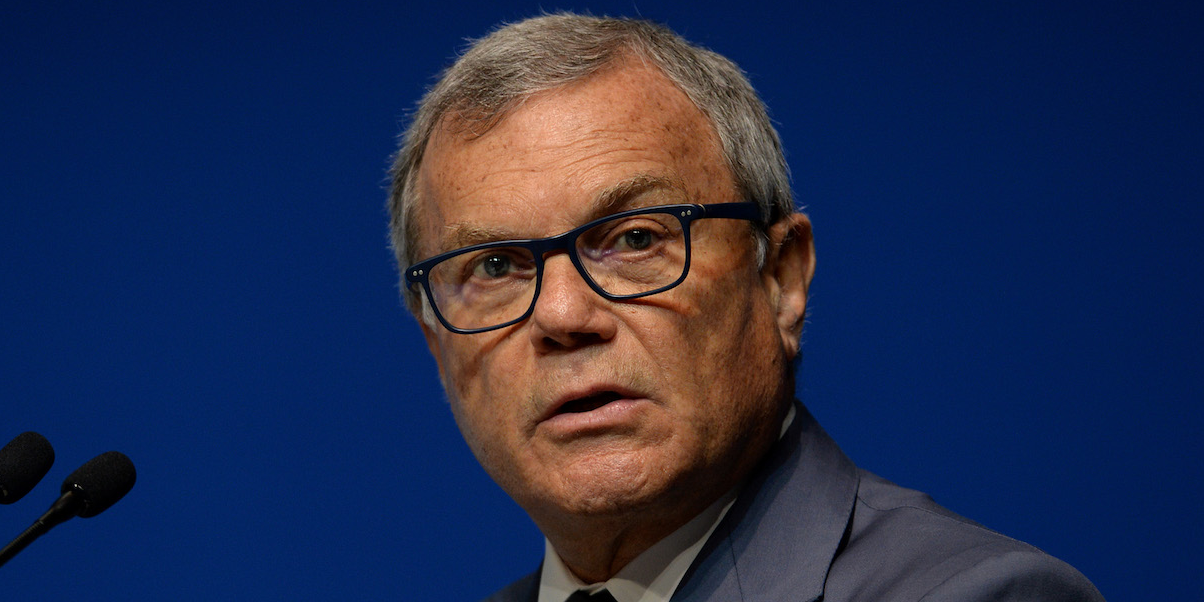

- Sir Martin Sorrell has formed a new investment vehicle, S4 Capital, which is coming to the stock market through a reverse merger.

- It comes just six weeks after Sorrell was forced out of WPP amid an investigation into allegations of improper behavior and misuse of assets. He denied the allegations but resigned.

- S4 Capital has raised £51 million and plans to build a “multi-national communication services business” through acquisitions.

LONDON – Sir Martin Sorrell has returned to the advertising industry just weeks after being forced out of WPP, the advertising holding company he founded over 30 years ago.

Stock market filings in the UK show Sorrell has set up a new investment vehicle called S4 Capital that has raised £51 million for acquisitions. £40 million has come from Sorrell himself and the new vehicle has non-binding letters of support from other institutions committing up to £150 million in additional capital, according to a statement.

S4 Capital is now undertaking a “reverse merger” of London-listed Derriston Capital to take itself public. Derriston is a small and little-known investment shell company that went public two years ago. Derriston will change its name to S4 Capital after the reverse merger and Sorrell will become its executive chairman.

Sorrell said in a statement: “S4 Capital is a company that aims to build a multi-national communication services business focused on growth. There are significant opportunities for development in technology, data and content. I look forward to making this happen.”

Derriston said in a statement that Sorrell is already in "preliminary discussions regarding a select number of potential acquisitions."

French financial newspaper Les Echos reported earlier this month that Sorrell was reportedly interested in a bid for Kantar, the market research agency owned by WPP.

Liberum's media analyst Iain Whittaker said in a note earlier this month that Kantar could be worth £3.5 billion and said: "The obvious route is for Sir Martin to team up with a private equity partner for a bid and it is worth noting that KKR was involved in the buyout of the listed shares of market research firm GfK."

Sorrell will own 75% of Derriston/S4 Capital after the reverse merger completes. He will have rights to veto executives and shareholder motions.

Paul Roy, a veteran financier who chaired the British Horseracing Association from 2007 to 2013, and Rupert Faure Walker, a former HSBC investment banking MD, are working alongside Sorrell in his new venture. Eton-educated Faure Walker first worked with Sorrell in 1987 on a hostile bid for ad agency J Walter Thompson.

Sorrell's dramatic comeback follows his departure from WPP in the middle of April after 33 years running the business. Sorrell resigned amid an internal investigation into allegations of improper behavior and misuse of assets. Sorrell denied the accusations at the time but said the "current disruption" was "putting too much unnecessary pressure on the business."

Sorrell founded WPP, the world's biggest advertising agency, in 1988 through a reverse takeover of a packaging group then known as Wire and Plastic Products. Sorrell helped grow the company to a market value of £16 billion. The holding company owns leading advertising agencies such as JWT and Ogilvy & Mather, as well as public relations firms and market research agencies.