- Stocks are more likely to rise than fall, BCA Research’s Doug Peta said in a recent webinar.

- Generous government stimulus and shockingly strong earnings have driven an impressive market rally.

- Four sectors are safe to invest in, but Peta said tech stocks are risky with rates set to rise.

The S&P 500 is more likely to climb 10% and hit 5,000 than suffer a correction.

That’s according to Doug Peta, BCA Research’s chief US investment strategist, who said in an August 16 webinar that stocks are currently in a “Goldilocks” scenario – but not all sectors are equally safe.

Stocks have soared as the US economy emerged from a pandemic-induced downturn, fueled in large part by emergency fiscal and monetary stimulus programs that have managed to outlast the worst of the health crisis and economic nosedive.

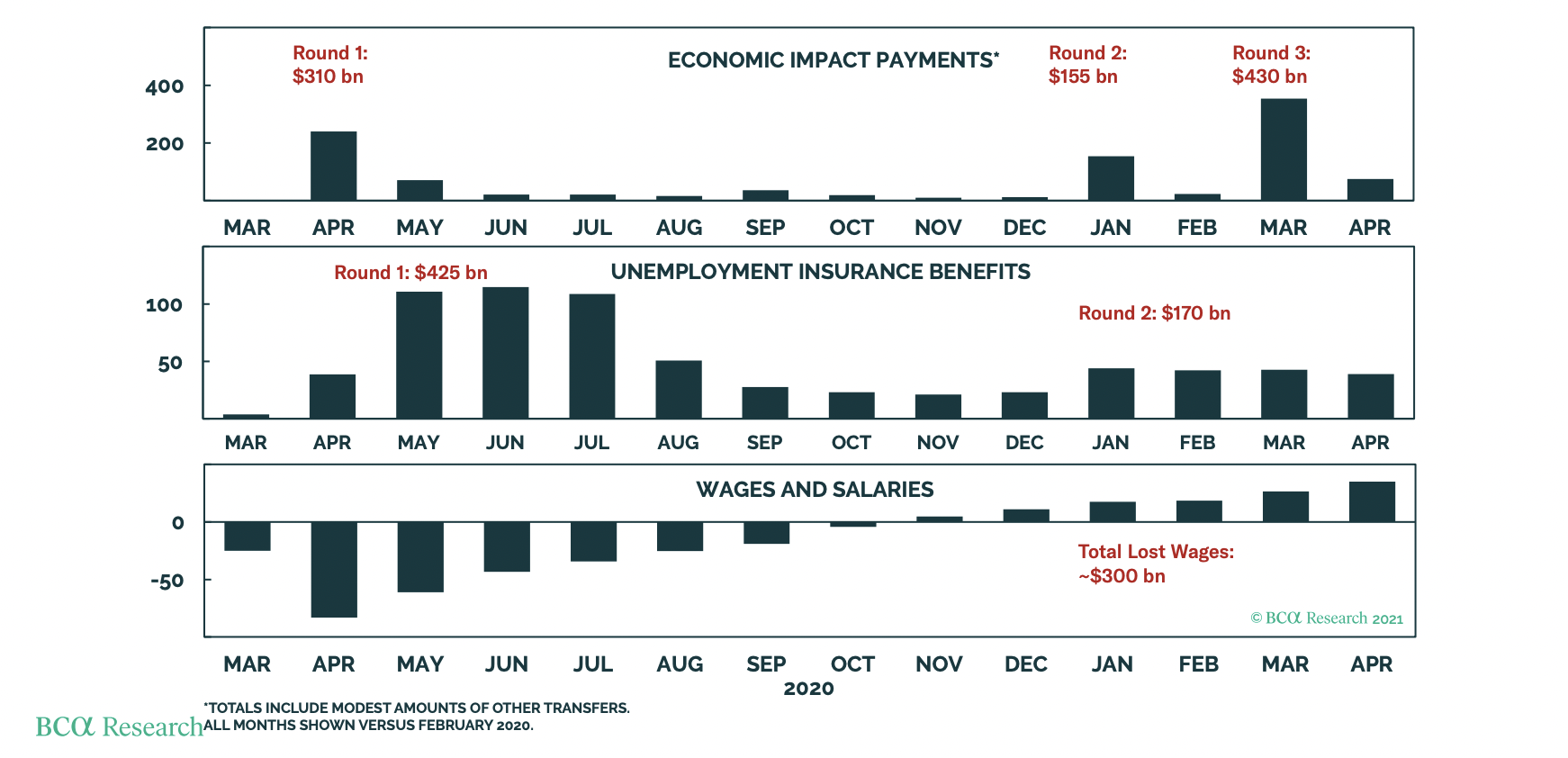

Policymakers in Congress and at the Federal Reserve have “done more than enough” to provide aid, Peta said. Nearly $1.5 trillion was injected into the US money supply by the government via direct stimulus checks to households and unemployment benefits, Peta said, adding that only $300 billion was lost in wages.

That $1.2 trillion stimulus surplus unleashed by the government has led to a spending boom and a savings surge of nearly $2.3 trillion, Peta said. The household savings rate far exceeded what it would've been had the pandemic not occurred, according to BCA Research projections, and delinquency rates are low and falling while household net-worth rates dramatically rise.

Some of that money has found its way into the stock market, stretching valuations to historically high levels and making investors uneasy despite the favorable economic backdrop.

But Peta said that fears of stocks melting down like in the 2000 tech bubble are overblown because of what he called five straight quarters of fantastic earnings. Earnings have crushed analysts' increasingly optimistic expectations in recent quarters by roughly 20% and two to three standard deviations, Peta said. Earnings were within a tight 1%-6% range in the 32 quarters before 2020.

Analysts expected Q2 earnings to fall 8% quarter-over-quarter, but they instead rose 6.4%. Wall Street is forecasting "next-to-no growth" in the next year, Peta said, and he thinks they'll be wrong again.

"Expectations will have to be revised higher over the next four quarters unless we have some really nasty pandemic surprise," Peta said.

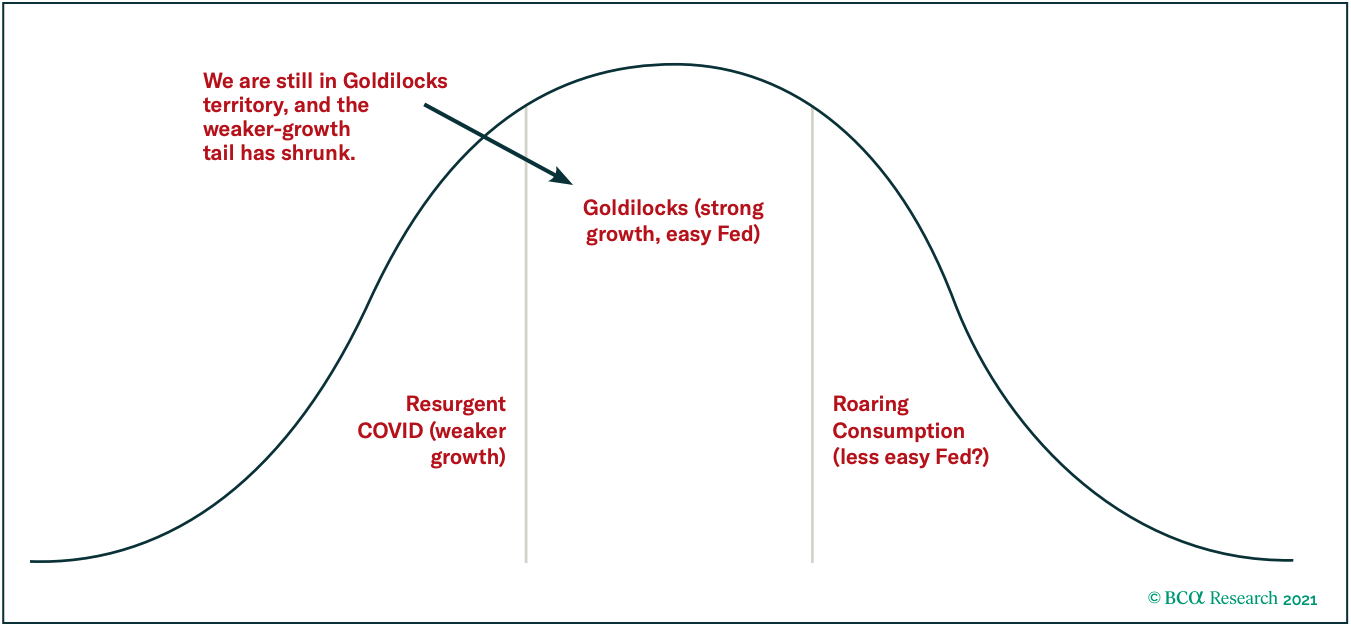

'Goldilocks' environment supports stocks

Stocks are enjoying a just-right "Goldilocks" backdrop, Peta said. Strong earnings reflect a healthy economy that's not at risk of entering a recession anytime soon, and while growth will inevitably decelerate, Peta said he's not worried because it's been at an abnormally high rate.

This "best-of-both-worlds" outcome has two key risks that investors are well-acquainted with: COVID-19 and inflation.

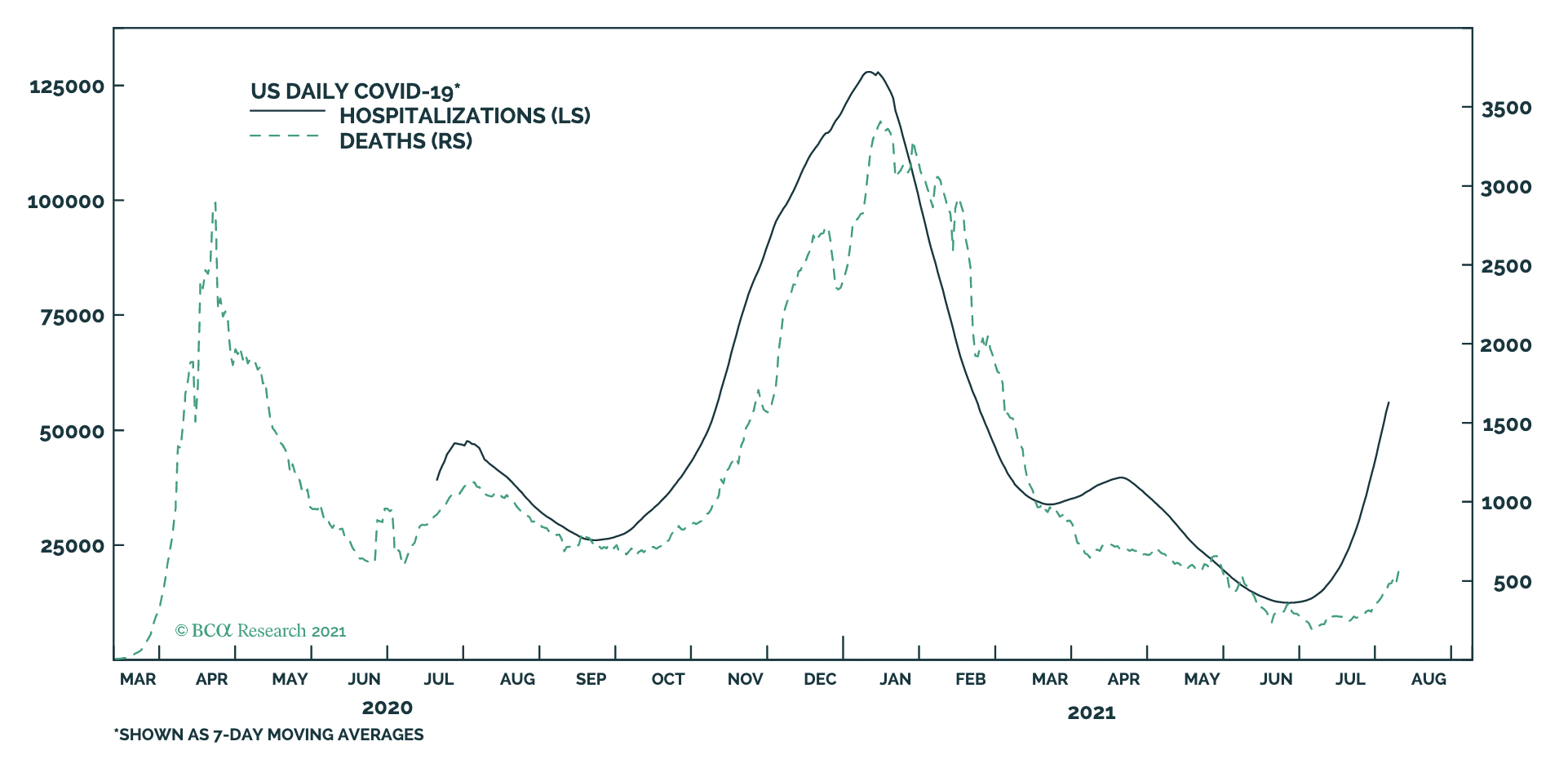

The highly contagious Delta variant of COVID-19 has given the virus new life, Peta said, adding that it poses a "diminishing threat" to the economy and markets because fatality rates are way down despite recent spikes in cases and hospitalizations. Vaccination rates have improved but are slowing, Peta continued, meaning the virus will likely stick around but become less of an issue.

"Provided that no new variant capable of evading the existing vaccines emerges, our waning-threat base case will remain valid," Peta said.

Conversely, inflation should be investors' biggest concern if the economy starts to overheat, Peta said, adding that there are higher readings to come, but it's most likely a near-term issue.

The Federal Reserve has long argued that price spikes are "transitory," or temporary, and are largely tied to shortages caused by transient supply-chain issues or demand increases. That narrative has held up "reasonably well" so far, Peta said, noting that high inflation has been most stark in prices of hotels and airplane tickets as well as new, used, and rental cars.

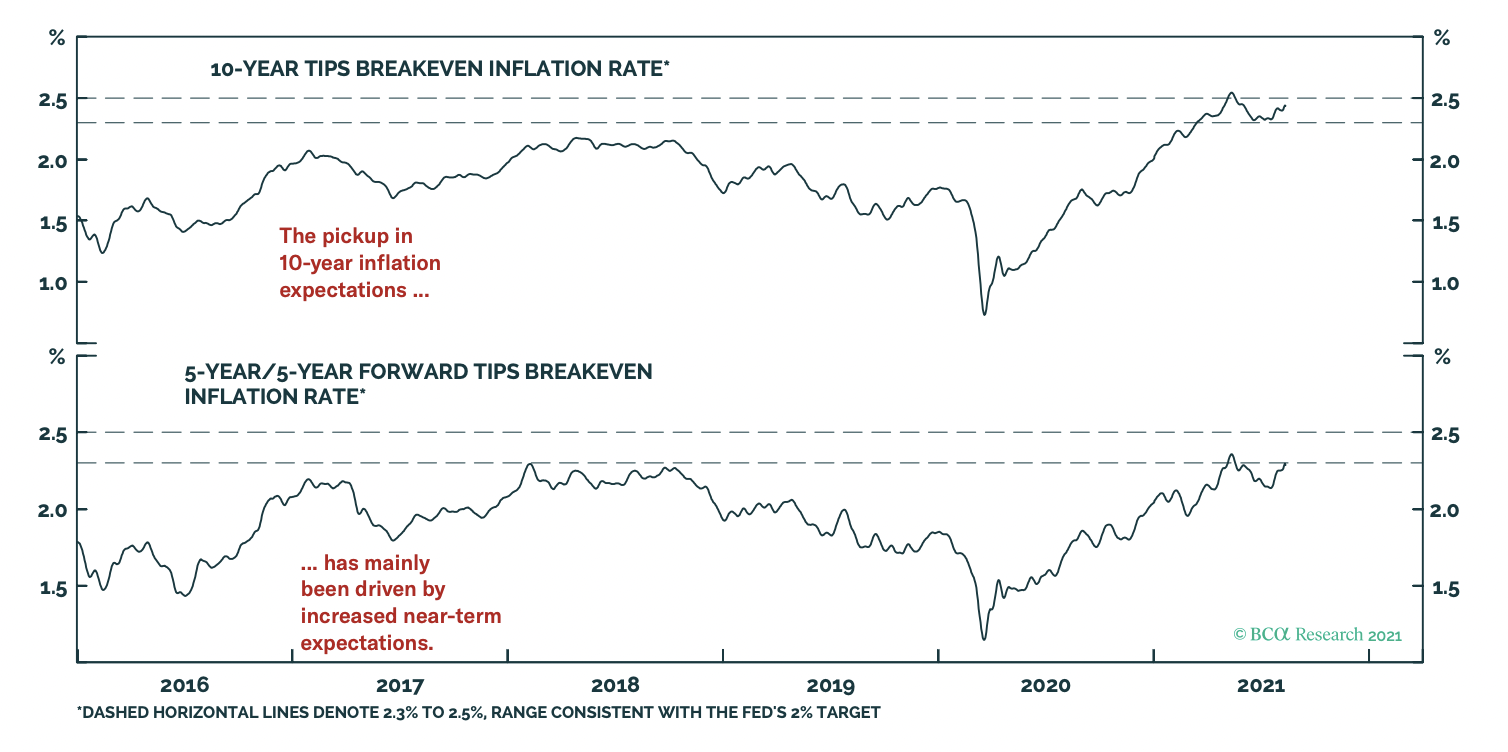

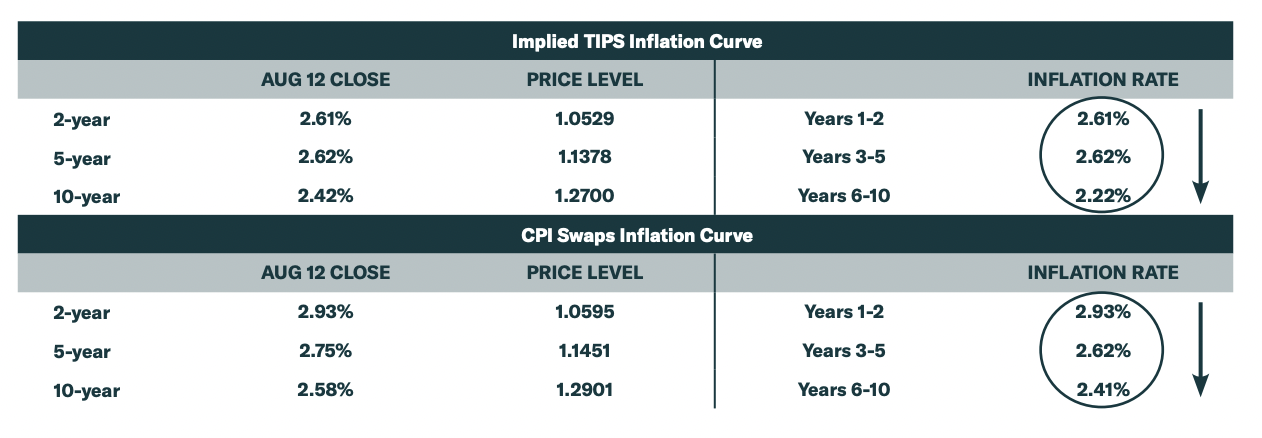

The market is right in pegging inflation as a short-term risk, Peta said, given that aggregate demand will exceed capacity in the next few years, in part because of the excess fiscal stimulus released to the public. But current expectations for Treasury Inflation-Protected Securities (TIPS) reflect that inflation expectations are front-loaded and won't persist past five years.

These inverted inflation expectations mean it's not a long-term threat, Peta said, adding that an upward price spiral won't happen if consumers and businesses don't change their buying behavior out of a belief that the price increases are temporary.

Concerns about hot inflation and an overheating economy seemingly evaporated this summer as investors made a 180-degree reversal and sought safety in bonds - a safe-haven asset that's less appealing when inflation rises. The move caught many market experts off guard.

Fears of slowing global growth were reflected in a sudden and sharp decline in bond yields, which move inversely to prices, from mid-May through late July.

But the bond-buying craze that sent US 10-year Treasury Note yields plummeting is more of a technical correction than an economic warning, Peta said, adding that BCA Research's bond strategy team projects 10-year yields to "grind higher" and hit 1.75% by year's end and 2.25% by the end of 2022. Bond purchase tapering will commence in December or January, Peta said.

Investors should target stocks in the Financials sector as yields creep higher in the next year and improve banks' profitability, Peta said. But he added that stock-pickers should watch out for high-flying stocks in the Technology sector that will likely suffer as interest rates rise.

In addition, BCA Research's strategy team has an overweight rating on the following three sectors: Consumer Discretionary, Health Care, and Industrials. The firm sees rising rates as bullish for small-cap stocks and value names.

By contrast, BCA Research is pessimistic about prospects for stocks in the Materials sector and stuck to its underweight rating for the group in a recent note.