- Oilfield contractors and firms are likely to cut more than one million jobs this year, a new Rystad Energy analysis reveals.

- The cuts are in response to an unprecedented one-two punch to the sector, which has seen the price of oil collapse and projects slowed to protect against the spread of coronavirus.

- The shale industry will see the deepest cuts, Rystad said. It could shrink by more than 30%.

- Visit Business Insider’s homepage for more stories.

More than one million oilfield service jobs are likely to be cut this year in the wake of the spreading coronavirus and historic oil price crash, according to an analysis published today by the research firm Rystad Energy.

That represents a 21% reduction in the global oilfield service (OFS) industry, Rystad says.

Employing more than 5 million people, the OFS industry is responsible for everything from finding new oil to constructing wells.

Service firms in the shale industry will be hit the hardest, Rystad says, perhaps seeing cuts of up to 32%, as the price shock threatens new drilling activity.

We need your help: Have you or an acquaintance been laid off by an oil company? Please contact us at [email protected] or through the secure message app Signal at (646) 768-1657.

The unprecedented one-two punch to the oil industry

The oil industry is no stranger to a boom-and-bust cycle, yet the recent price shock remains unprecedented, David Doherty, an oil analyst at the research firm BloombergNEF, said.

"Normally you get a supply shock or a demand shock," he said. "You don't get both of them all at once."

In the past month, the spreading coronavirus has all but evaporated demand for oil as airlines ground planes and consumers seek shelter at home.

Meanwhile, failed international negotiations to limit supply have caused Saudi Arabia and Russia to flood the market.

The price of oil collapsed in a matter of weeks. It's down about 60% since the beginning of the year, and it has reached lows of close to $20 - which it hasn't seen since 2002.

Rystad Energy says about 13% of the projected job cuts are tied to the oil price collapse, while 8% ares linked more directly to the novel coronavirus.

The virus will force contractors to "slow down project developments fearing the spread of Covid-19 on their worksites," the Rystad report said.

Exploration and production: The epicenter of job loss

When the price of oil crashes, exploration and production firms - E&Ps - are typically dealt the heaviest blows, analysts told Business Insider earlier this week.

The logic is simple: Companies are less likely to invest in searching for and pumping oil when they can barely eke a profit out of each barrel.

"The breakeven oil price for the average oil company's free cash flow is now $25, disregarding debt," Per Magnus Nysveen, the head of analysis at Rystad Energy, said in an email.

For the past week, the US benchmark price, WTI, hovered at or below $25.

Within the E&P sector, oilfield service (OFS) workers and firms are often hit first by layoffs, according to Marshall Watson, a professor of petroleum engineering at Texas Tech University.

The firms are involved in everything from finding new sources of oil to building wells. And typically, the people they employ are contractors, who have limited job security.

"You're going to have a decimated industry," Watson said.

The last price war, which collapsed oil prices in 2015 and 2016, shrunk the oilfield service workforce by close to 30%, Rystad says, relative to 2014.

"The industry now has to face the additional effect of a big decline in demand, caused largely by the Covid-19 outbreak around the world," Rystad said in a press release.

Layoffs, furloughs, and cuts have already begun

A growing number of companies - mostly in the exploration and production sector - have already started laying off or furloughing their employees including Apache and Halliburton.

Last week, Apache said it would cut 85 people from its Midland, Texas, office, according to Reuters. Halliburton said it would furlough 3,500 employees in Houston, per the Houston Chronicle.

"We are lowering our Permian rig count to zero and focusing capital elsewhere in our portfolio and, as a result, have made the difficult decision to further reduce staff," Apache said in a statement. "We are working to support affected employees."

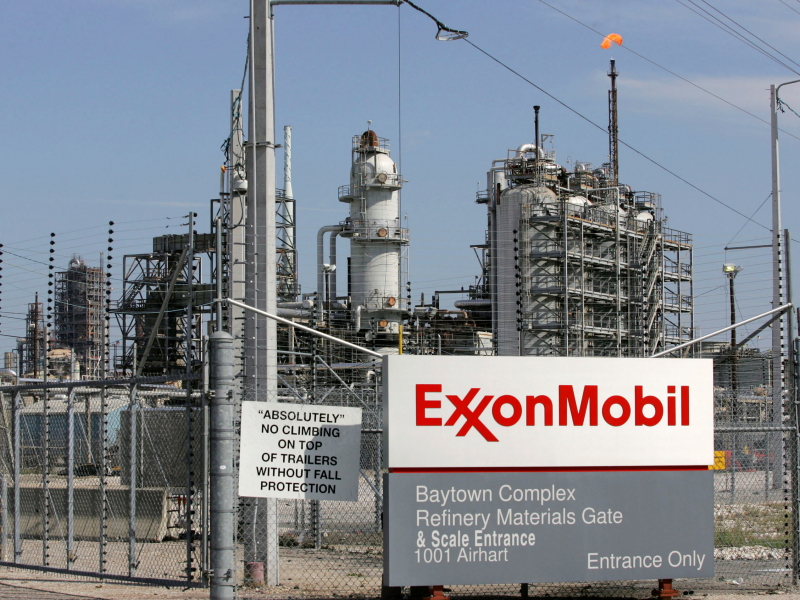

Some oil majors are also planning cuts. Exxon, for example, has already alerted vendors and contractors of near-term cuts, according to Reuters.

"Based on this unprecedented environment, we are evaluating all appropriate steps to significantly reduce capital and operating expenses in the near term," Exxon CEO Darren Woods said in a recent statement.