- Russia has been launching waves of drone and missile attacks against Ukrainian infrastructure.

- To replenish its stocks of missiles and other weapons, Russia has scrambled to find more microchips.

- The hunt for those vital components is a sign of what may await the US and China in a protracted war.

In October, after weeks of successful Ukrainian counterattacks, Russia changed its strategy and began a campaign of long-range airstrikes.

Using waves of exploding drones and salvos of ballistic and cruise missiles, Russia has sought to destroy Ukraine's power grid, overwhelm its military, and terrorize its population.

To date, the Russian military has launched thousands of missiles and drones against Ukrainian critical infrastructure and urban centers, killing and wounding hundreds of civilians.

But those strikes have depleted Russia's missile stocks, and Western sanctions are making it harder for Moscow to buy or make a small but critical component: microchips.

Russia's scramble to find microchips for its weapons hints at struggles the US and China could face in a future war.

Russian strikes and microchips

Western-made microchips and processors power many of Russia's weapon systems, even its most advanced missiles and aircraft. For example, the Orlan-10, one of the Russian military's most widely used drones, is able to gather battlefield intelligence thanks to Western-made parts.

While Russia's supply of modern precision weapons is dwindling, it is still making missiles. Ukrainian military intelligence said late last year that Russian factories had produced 40 new missiles a month on average since the war started. That may allow for continued attacks, but it is likely too low to meaningfully support any large-scale Russian offensives.

Extensive sanctions imposed by Western countries since the war started have hamstrung Russia's weapons production. The situation has gotten so bad that Moscow has begun cannibalizing older weapons and even scavenging non-military hardware, such as fridges and dishwashers, for microchips that could go into missiles and other weapons.

That means that as the war drags on the Russian military will have fewer advanced weapons to fight a Ukrainian military that is receiving more advanced hardware from the West.

Russia's struggle to find microchips is also a warning in militaries around the world, especially the US and China.

Microchips, major tensions

All advanced military hardware uses microchips, often in many ways, from communications to navigation to targeting and fire control. Despite the worldwide dependence on microchips, the market is extremely small, especially for the chips needed advanced precision weaponry.

To understand how exclusive the microchip market is, one has just to look at a relatively obscure Dutch company: Advanced Semiconductor Materials Lithography.

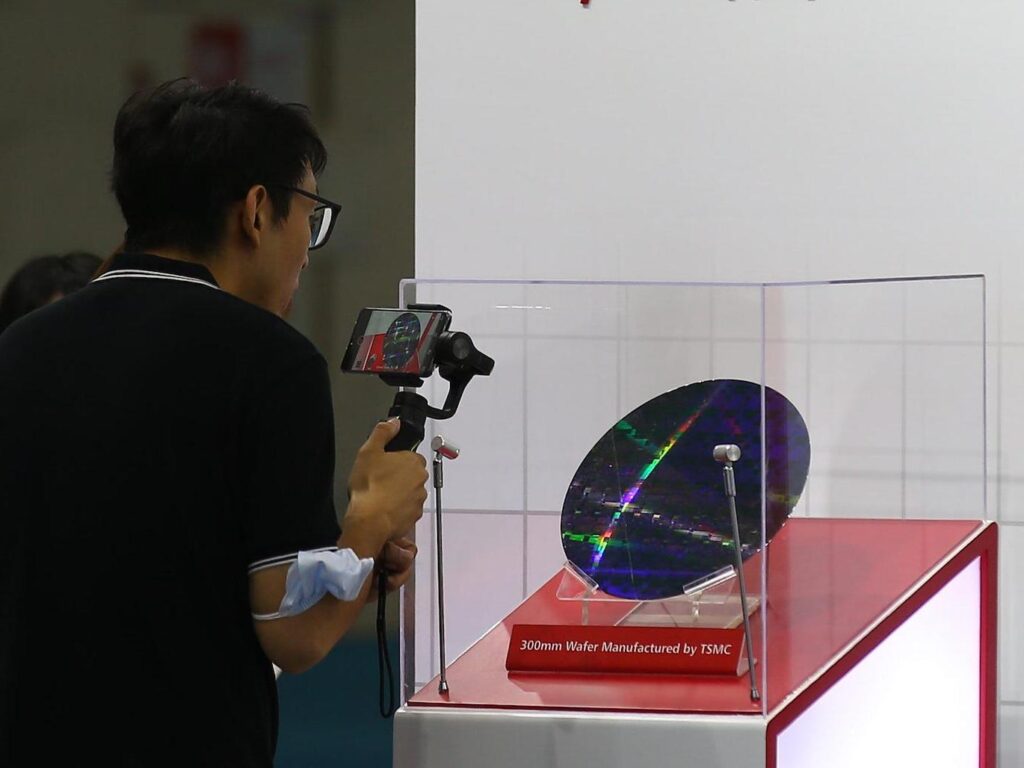

ASML is the only firm that produces extreme ultraviolet, or EUV, lithography machines, which are needed to make advanced microchips. The machines cost as much as $200 million, and only a few firms can afford to buy them and produce highly advanced semiconductors, including Samsung in South Korea, Intel in the US, and TSMC in Taiwan.

TSMC is the world's largest semiconductor foundry, producing about 90% of the most advanced semiconductors and one-third of the new computing power produced each year, according to Chris Miller, a professor at Tufts University and author of "Chip War."

A US-Chinese clash over Taiwan, or some other disruption, like a Chinese blockade, that halts exports of advanced semiconductors would affect numerous other industries. A protracted war between the US and China over Taiwan would worsen that impact, and both sides would likely face challenges in replacing their cutting-edge weapon systems and munitions as the available supply of microchips shrunk.

"In terms of a war or a blockade between China and Taiwan, the impact on not just the tech sector but all of manufacturing would be close to catastrophic," Miller said in a recent interview with The Verge.

"It certainly would be catastrophic to Apple or to AMD if we were to lose access to TSMC's facilities, but it's also dishwashers, microwaves, and autos that would face tremendous disruptions," Miller added, describing a manufacturing crisis that would feel like the 1929 stock market crash "in terms of its shock."

The US and its allies have sought to curtail China's ability to manufacture advanced semiconductors in order to restrict Beijing's artificial intelligence and defense ambitions.

The US, Japan, and the Netherlands agreed earlier this year to further limit export of chip manufacturing equipment to China and are seeking further restrictions. The US has also pledged to spend billions to encourage increased domestic production of microchips.

For its part, China has moved to bolster its own domestic chip industry and continue its technological development.

While tiny in size, microchips have become a major focus for advanced economies, which want to ensure their supplies so their industries can keep working and their militaries can keep fighting.

Stavros Atlamazoglou is a defense journalist specializing in special operations, a Hellenic Army veteran (national service with the 575th Marine Battalion and Army HQ), and a Johns Hopkins University graduate. He is working toward a master's degree in strategy and cybersecurity at Johns Hopkins' School of Advanced International Studies.