Reuters

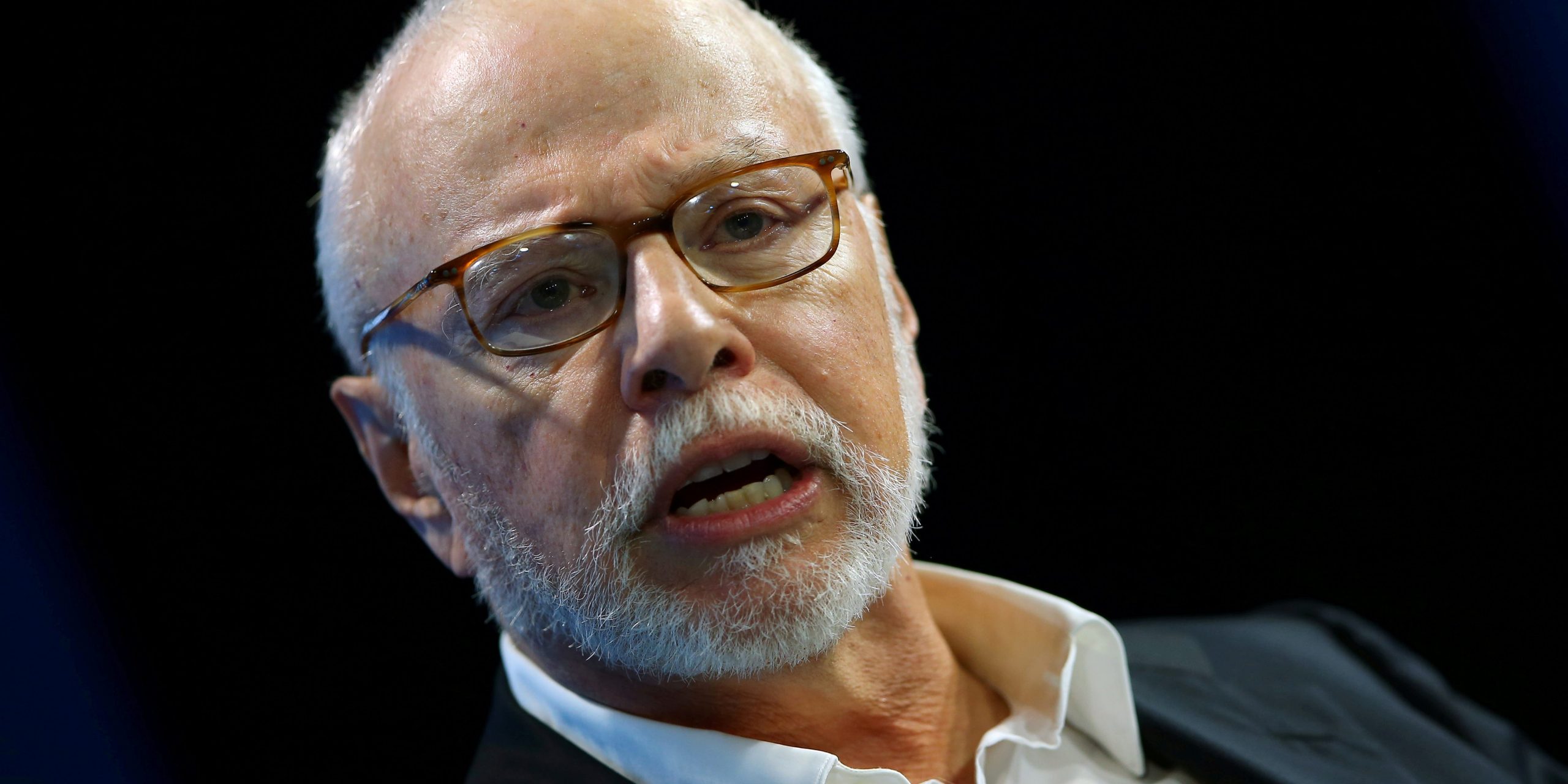

- Rocket Internet surged on Tuesday after it was revealed that activist investor Elliott Management, led by Paul Singer, took a 15.1% stake in the German-based tech startup incubator.

- The recent position by Elliott could complicate Rocket Internet’s previously announced plans to delist from the exchange and go private after struggling to recreate some of its earlier successes.

- Shares of Rocket Internet jumped 6% in Frankfurt, and its OTC share class surged 13%.

- Visit Business Insider’s homepage for more stories.

Rocket Internet traded higher on Tuesday after the company revealed that Elliott Management, led by Paul Singer, took a 15.1% stake in the German-based tech startup incubator.

Shares of Rocket Internet jumped as much as 6% in Frankfurt, and its OTC share class surged as much as 13% on Tuesday.

Rocket Internet has struggled over the years to replicate its wildly successful early stage investments in companies like Lazada, a consumer electronics company, and Zalando, a fashion retailer. That struggle led company founders to announce a plan in September that would entail Rocket Internet delisting from the exchanges and going private.

Elliott’s 15% stake in Rocket Internet could complicate those plans, as the activist investor is not shy in advocating management to make certain strategic decisions to help enhance shareholder value.

According to the shareholder structure posted on Rocket Internet's website, Elliott could make change happen as its founders own just under half of the company, rather than a majority.

Those changes may be welcomed by existing shareholders, as the company's valuation has fallen from more than $10 billion when it launched its IPO in 2014, to about $3.6 billion today, according to Bloomberg.