Donald Trump’s election night victory has sent shockwaves through bond markets around the world.

Selling in the US, brought on by the presumption that Trump’s protectionist trade policies and plans for massive infrastructure spending will bring back inflation, caused yields to surge by more than 80 basis points. That selling ran the 10-year yield up to the important level of 2.50% on Monday.

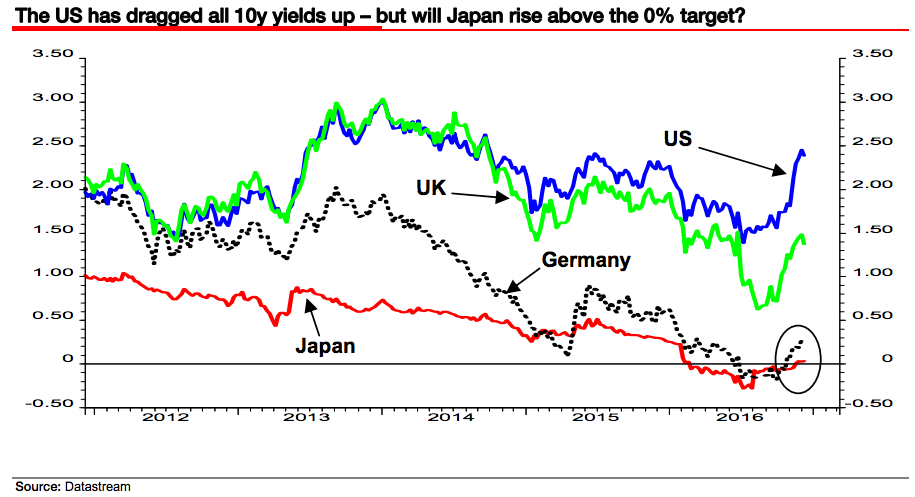

As a result, bond yields around the world have been pulled higher. The UK 10-year tacked on another 30 bps to its post-Brexit move, and has found itself testing the 1.50% level. Additionally, yields in the eurozone have also been on the elevator up. Germany’s 10-year yield reached almost 40 basis points after bottoming out near -20 bps over the summer.

But there’s one place that hasn’t seen the same outcome. Japan, where the 10-year yield remains trapped near zero.

According to Albert Edwards, strategist at Societe Generale, this is due to the Bank of Japan, which he refers to as "the dog that doesn't bark." Back in September, the BOJ promised to target zero yields on the 10-year government bond through its purchases of Japanese government bonds as it tries anything and everything to generate 2% inflation.

"As economics 101 tells us that no-one can control both price and quantity, this means the BoJ is prepared to print any quantity of money to meet its 0% target," Edwards wrote in a note to clients out on Monday.

The way Edwards sees it, the US 10-year yield could rise as high as 3.25%, testing the upper bound of the 40-year bull market in Treasurys. As US yields rise, that will cause European yields to follow suit and spreads versus Japan to widen. Therefore, the BOJ will have to ratchet up its printing press even more to keep the 10-year JGB near zero.

As a result, Edwards believes the yen could tumble to 125 per dollar.

And Deutsche Bank Strategist Taisuke Tanaka seems to have a similar line of thinking. In his note to clients sent out on Tuesday, Tanaka wrote now that the yen has already sunk to the firm's 2017 forecast of 115 per dollar as a result of the spike in US yields.

Going forward, Tanaka also expects a rise in US yields to cause the BOJ to print more money and buy more JGBs. He says look for the US 10-year yield to reach a high of 3.60% by June of 2017 and the yen to also dive to 125 per dollar.

"From a technical perspective, our 115 forecast assumed the largest rally (61.8%) we would expect during a USD/JPY down-cycle in 2016," Tanaka wrote. "However, our economists' latest US growth forecasts (3.0% in 2017, 3.3% in 2018) suggest that the USD/JPY up-cycle is still in play and will last a while longer. Our new forecast of 125 sees the USD/JPY rebounding to roughly the same high (125.86) it hit in June 2015."