Jim Watson/AFP via Getty Images.

- Bank of America says about half of Biden's infrastructure plan is traditional, or physical, infrastructure.

- This contrasts with the GOP argument that less than 6% of Biden's plan goes to roads and bridges.

- The bank added that nontraditional infrastructure will take longer to prompt economic growth.

- See more stories on Insider's business page.

The leaders of the Republican party have argued that President Joe Biden's $2.3 trillion infrastructure plan funds too many things that aren't physical, or traditional, infrastructure, saying that less than 6% of its spending goes to rebuilding roads and bridges.

Senate Minority Leader Mitch McConnell slammed the plan the same day Biden unveiled it, calling it a "liberal wish-list," and House Minority Leader Kevin McCarthy released a statement to similar effect. Both floated the 6% statistic, and House Minority Whip Steve Scalise recently said that "over 90% of the bill they're proposing has nothing to do with roads and bridges," calling it "Soviet-style infrastructure."

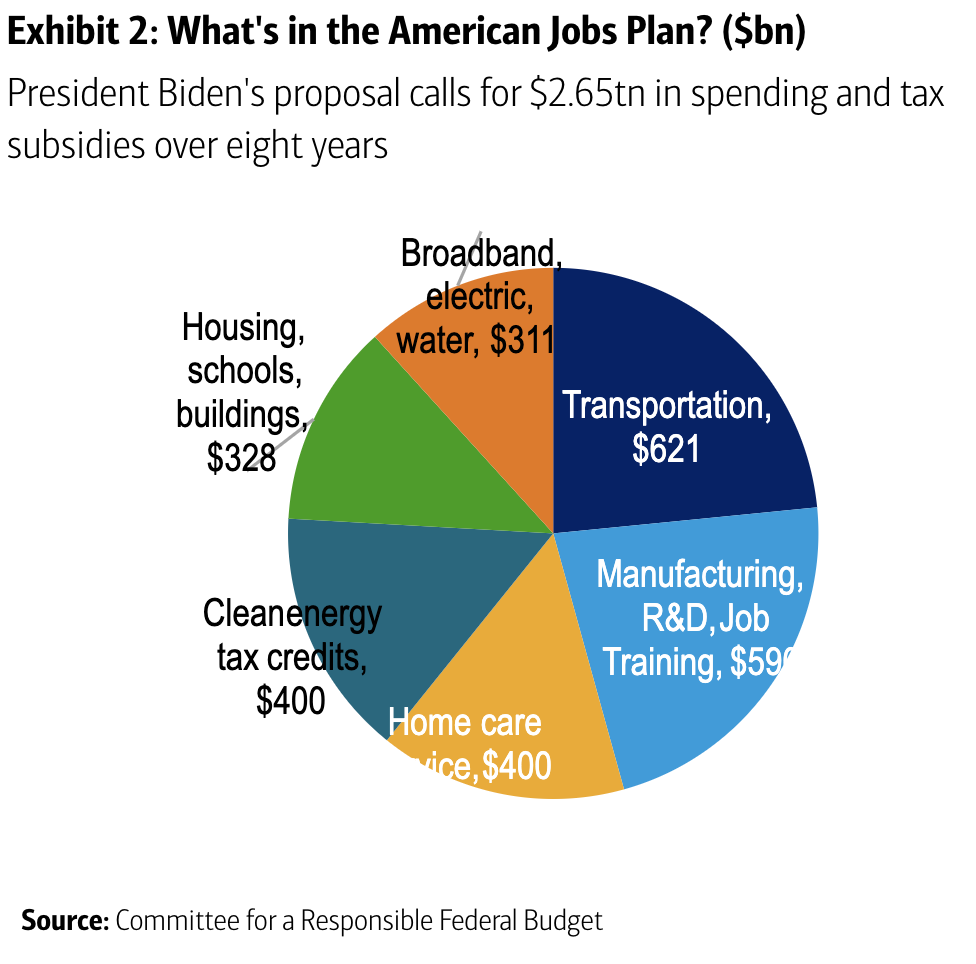

Bank of America has done its own calculations and a team led by Joseph Song found that "about half of the $2.2 trillion in spending should be considered traditional 'infrastructure' spending." The bank said that investments in broadband and the electric grid qualify as traditional infrastructure – things that Republican lawmakers don't include in their definition.

Ultimately, the bank said it expects Biden's plan to boost growth and lead to better productivity, offsetting the higher taxes Biden proposes and the potential "crowding out effect" of higher public spending potentially displacing investment by the private sector.

According to the bank's report, traditional infrastructure – transportation, buildings, water, broadband, and more – should impact economic growth quickly in the US, while nontraditional infrastructure, like education, training, and research and development, will take more time to boost the economy.

Committee for a Responsible Federal Budget

Bank of America separately wrote in its Friday municipal report, by a team led by Ian Rogow, that it believes an infrastructure package this large will help boost GDP, while noting that Moody's largely agrees.

While Rogow's team sees Biden's proposed corporate tax hike to 28% as a potential "drag on growth," it said the proposed $400 billion in clean energy tax credits should help reduce the tax burden for some companies.

McConnell also opposed Biden's 28% corporate tax hikes, calling the plan a "Trojan horse for the largest set of tax hikes in a generation," and Insider reported on Thursday that a group of Republican senators are drafting their own infrastructure plan - one that would cost between $600 billion and $800 billion, to be funded without any corporate tax hikes.

However, JPMorgan said on Thursday that the US corporate tax rate should be increased to catch back up to other world economies, and Biden has remained firm on increasing the corporate tax rate, saying in a speech last week that the tax hike would level the playing field for large companies and average Americans.

He said: "I'm not trying to punish anybody, but damn it, maybe it's because I come from a middle-class neighborhood, I'm sick and tired of ordinary people being fleeced."