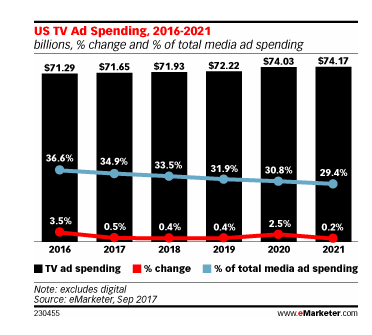

- People are abandoning cable TV faster than previously thought, and that’s having a negative effect on TV ad spending. According to eMarketer’s latest figures, TV ad spending in 2017 will total $71.65 billion, a year-over-year increase but down from the $72.72 billion predicted earlier.

People are also spending less time in front of the TV, with the average time among US adults dropping to three hours, 58 minutes a day this year, the first time it has dropped below four hours.

TV ad spending will be lower than anticipated this year, according to eMarketer, because people are cord-cutting at a faster clip than previously expected.

According to the market-research company, TV ad spending in 2017 will expand just 0.5% to $71.65 billion, down from the $72.72 billion predicted in its first-quarter forecast for 2017. Further, it said, TV’s share of total media ad spending in the US will drop to 34.9% and is expected to fall below 30% by 2021.

“eMarketer expected a slowdown this year in TV ad sales, after 2016 benefited from both the Olympics and US presidential election,” said Monica Peart, eMarketer’s senior forecasting director. “However, traditional TV advertising is slowing even more than expected, as viewers switch their time and attention to the growing list of live streaming and over-the-top [OTT] platforms.”

Cord-cutters, or consumers who are opting for getting their TV via the internet rather than traditional pay TV services, are a major factor behind tempered TV ad spending. As the phenomenon gains momentum, traditional pay TV operators like Dish Network are developing their own streaming platforms such as Sling TV, networks such as HBO and ESPN are launching or planning their own standalone digital subscription services, and digital players like Hulu and YouTube are delivering live TV channels over the web at lower prices.

In fact, cord-cutting has become so prevalent that even telecommunication companies like AT&T and T-Mobile have jumped in on the action in recent weeks, offering customers bundle deals with access to streaming services like Netflix and HBO.

eMarketer has also increased its estimates for the growth in cord-cutters substantially for 2017 through 2021, saying that by 2021 the number of cord-cutters will nearly equal the number of people who have never had traditional pay TV, or "cord-nevers."

The company forecasts that there will be 22.2 million cord-cutters over the age of 18 this year, more than the 15.4 million the company had previously predicted. This figure is up 33.2% over 2016. The number of US adult cord-nevers is expected to grow 5.8% this year to 34.4 million.

"Younger audiences continue to switch to either exclusively watching OTT video or watching them in combination with free TV options," said Chris Bendtsen, the senior forecasting analyst at eMarketer. "Last year, even the Olympics and presidential elections could not prevent younger audiences from abandoning pay TV."

While eMarketer predicts that 196.3 million US adults will still watch traditional pay TV, including cable, satellite, or telco, this year, that number would be down 2.4% from 2016. By 2021, the company thinks, that total will have fallen nearly 10% compared with 2016.

US adults who watch TV are spending less time in front of the screen as well. The average time spent watching TV among US adults this year will drop 3.1% to three hours, 58 minutes a day this year, according to eMarketer, the first time it has dropped below four hours.

In contrast, digital video consumption continues to rise. US adults will consume one hour, 17 minutes of digital video this year, the company said, up 9.3% over 2016.