- Bed Bath and Beyond spiked 90% after-hours Tuesday, and rose more than 50% in premarket, likely driven by a short-squeeze.

- The Reddit favorite revealed a tie-up with Kroger and accelerated its share buyback program.

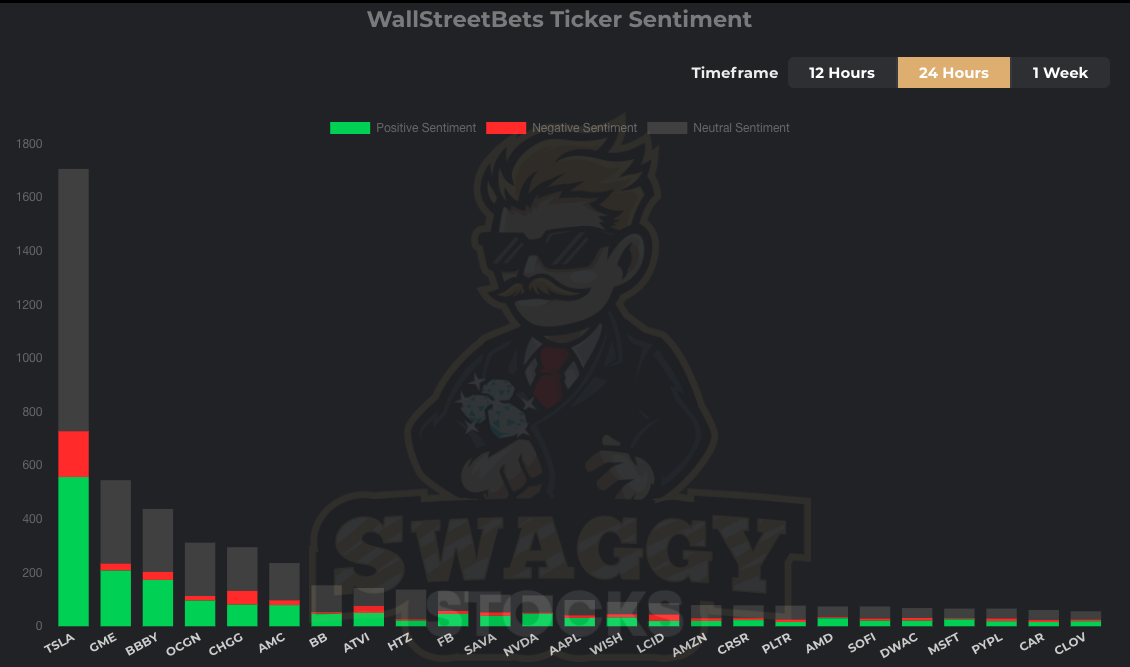

- Data showed BBBY was the third-most mentioned stock on Reddit's Wall Street Bets on Tuesday.

Bed Bath & Beyond's stock surged as much as 90% in Tuesday's after-hours session after the homewares retailer revealed a partnership with grocery chain Kroger and an earlier end to its $1 billion stock buyback program.

The Kroger tie-up will let the company sell a range of its home and baby products at the grocery chain's online outlet and some physical stores, starting in 2022. At the same time, Bed Bath & Beyond said it plans to launch its own digital marketplace in the same product areas that will include third-party brands.

The retail chain's shares rose 91% to $32 per share at one point in extended trading after the news releases Tuesday. But they were more subdued in Wednesday's premarket session, last trading 53% higher at $25.61 per share.

Despite the flurry of news releases, Bed Bath & Beyond's rise seems likely to be driven by a short-squeeze – when a shorted stock's price goes up instead of down, forcing short sellers to cover their positions.

The meme-stock momentum trade from earlier this year began with amateur investors who gathered to pinpoint highly-shorted stocks they could buy en masse, with the hope of racking up fast profits.

Bed Bath & Beyond is among the most popular meme stocks in that crowd. It was the third-most positively mentioned stock on Reddit's Wall Street Bets on Tuesday, according to data from sentiment aggregator Swaggy Stocks.

Alongside the online retail operation updates, Bed Bath & Beyond said Tuesday it will complete its $1 billion stock buyback program by the end of February, two years ahead of schedule. After already completing $600 million in share repurchases, there are $400 million of buybacks remaining.

Bed Bath & Beyond also revealed more details of its efforts to remake its business.

"To further enable the company's transformation through these growth partnerships and expanded capabilities, Bed Bath & Beyond is realigning its organizational infrastructure and refreshing its leadership team to support its stronger business model," the retailer said in a statement.

Under new leadership appointments, Anu Gupta was named chief growth officer and Rafeh Masood has been designated as chief customer officer.