- As the stock market continues to hit record highs, fewer stocks are participating in the upside.

- Declining stock market breadth amid record highs often serves as a warning signal to investors.

- "We see the loss of breadth as indicative of a period of consolidation, but it is not significant enough to dictate concern," Fairlead Strategies founder Katie Stockton said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Even as the stock market continues to hit record highs, underlying market internals are beginning to flash warning signs that have often preceded prior sell-offs.

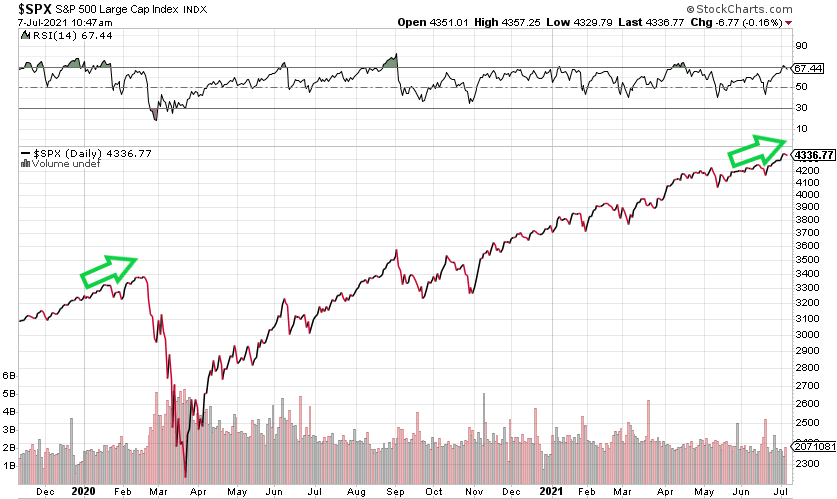

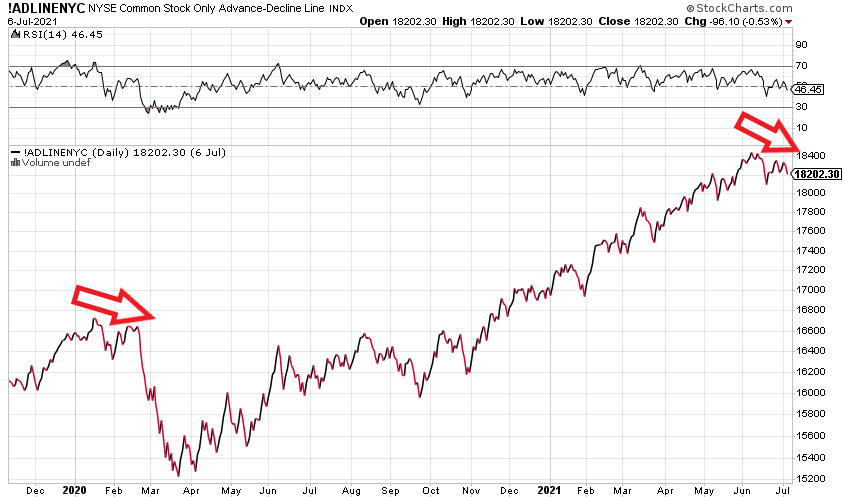

Market breadth, or the participation of individual stocks in broader market moves, has been declining even as mega-cap tech juggernauts like Amazon and Apple power higher. Instead of the bull market rally broadening out, it's beginning to narrow, setting up the same negative divergences that flashed just prior to the COVID-19 induced market sell-off in March 2020.

Technical analysts often search for positive divergences in certain indicators and indexes to confirm broad movements in the stock market. Meanwhile, a negative divergence, when an indicator and index move in opposite directions, tends to serve as an early warning sign that volatility is imminent.

But so far, the declining market participation is something to be aware of rather than an outright sell-signal, according to Fairlead Strategies founder Katie Stockton.

"We see the loss of breadth as indicative of a period of consolidation, but it is not significant enough to dictate concern," Stockton said in a note on Wednesday.

As the S&P 500 continues to establish a series of higher highs, the NYSE Common Stock Only Advance/Decline Line is making a series of lower highs. The Advance/Decline line measures the difference between advancing stocks and declining stocks on any given day.

While the S&P 500 was hitting new highs in February of 2020, the breadth indicator was not confirming the move higher after it peaked in January of 2020. Just two months later, the stock market experienced the fastest bear market in history, with the S&P 500 dropping about 35% in less than a month.

Now, a similar setup is brewing. But not every negative divergence between breadth indicators and the overall market has led to a sharp sell-off in stocks, and the recent breakout in mega-cap tech stocks following a year of sideways consolidation could have staying power and continue to lift the market higher.

In an interview with CNBC on Tuesday, Stockton said the recent rotation into tech stocks "is real and here to stay."

Dit artikel is oorspronkelijk verschenen op z24.nl