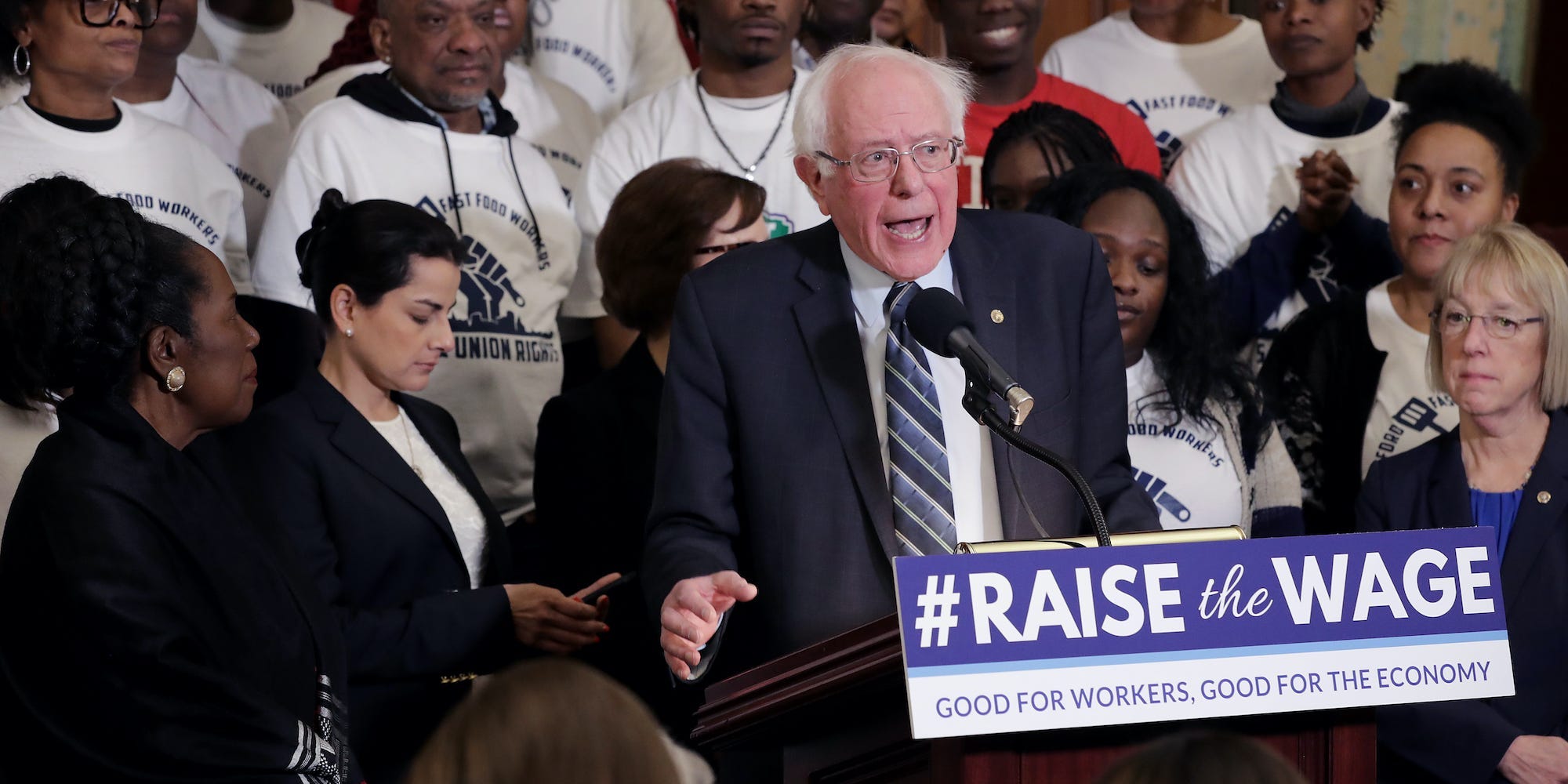

Photo by Chip Somodevilla/Getty Images

- The Congressional Budget Office projects that raising the minimum wage to $15 an hour will increase the budget deficit by $54 billion.

- 900,000 fewer people would live below the poverty line with the wage increase, while employment would be reduced by 1.4 million workers.

- Under the Raise the Wage Act, cumulative pay from 2021-2031 would increase, on net, by $333 billion.

- Visit the Business section of Insider for more stories.

Raising the federal minimum wage to $15 an hour by 2025 will lift 900,000 people out of poverty, while increasing the country’s budget deficit by $54 billion over the 2021-2031 time period, according to a report from the Congressional Budget Office.

Introduced by Sen. Bernie Sanders of Vermont and other top Democrats on Jan. 26, the Raise the Wage Act of 2021 proposed a gradual increase of the federal minimum wage to $15 an hour by 2025. The legislation would gradually phase out sub-minimum wages for tipped workers and would tie the value of the minimum wage to inflation and increases in the median wages over time.

—Bernie Sanders (@BernieSanders) February 5, 2021

According to the CBO report analyzing the effects raising minimum wage, it found that the move would add $54 billion to the cumulative budget deficit resulting from higher prices for goods and services, along with increased spending for programs like unemployment compensation and reduced spending for nutrition programs.

Here are the main findings from the CBO report:

Reduced employment

Since higher wages would increase employers' costs to produce goods and services, consumers will buy less of the more expensive products, and in turn, less goods will be made and employment will decrease. The CBO projected that when minimum wage would reach $15 an hour by 2025, employment would be reduced by 1.4 million workers, or 0.9%.

"In 2021, most workers who would not have a job because of the higher minimum wage would still be looking for work and hence be categorized as unemployed; by 2025, however, half of the 1.4 million people who would be jobless because of the bill would have dropped out of the labor force, CBO estimates," the report said. "Young, less educated people would account for a disproportionate share of those reductions in employment."

Unemployment compensation spending would increase as a result of reduced employment.

Increased spending for health care programs

Medicaid and Medicare spending will increase as minimum wage rises because with more people projected to be unemployed, more people will be enrolling in Medicaid. Medicare will increase because payment rates for health care providers will be higher.

Spending for the Children's Health Insurance Program would also increase because some families would become ineligible for Medicaid as their incomes increased under a higher minimum wage, and CHIP has higher income thresholds for eligibility.

Increased Wages

From 2021 to 2031, the CBO estimated that cumulative pay for the 17 million directly affected workers, and the 10 million potentially affected workers, would increase, on net, by $333 billion with a minimum wage increase. A directly affected worker is one who had a wage below the amount proposed by the bill, and a potentially affected worker is one who had a wage only slightly higher than the proposed amounts.

Reduced nutrition spending

Spending for the Supplemental Nutrition Assistance Program and child nutrition programs would decline because increases in income for low-income households would reduce their average benefit amounts.

Reduced poverty

The report found that 0.9 million fewer people would have an income below the federal poverty line under the Raise the Wage Act. For families with workers earning at or near the federal minimum, real income would increase. In contrast, real income would fall for families that lost employment due to the minimum wage increase, along with families that saw a decline in business income.

All of the estimates in the report are based on the CBO's economic forecast for 2021 - 2031 that came out in the beginning of February.