Welcome to Insider Finance. If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

On the agenda today:

- Private-equity recruiting is in full swing – and some funds have already extended offers.

- Merrill Lynch is coming up with new ways to keep advisors from jumping ship.

- Goldman Sachs just appointed a new CFO.

Let's get started.

Private-equity recruiting is in full swing

PE recruiting ramped up on Monday, with Thoma Bravo kicking off recruitment of 2022 buy-side investment-associate roles. Mega-funds like Apollo, TPG, and Carlyle have followed suit and also begun extending offers. Here's where the different funds stand so far.

Goldman Sachs appoints new CFO

Goldman Sachs has appointed Denis Coleman as its new CFO. Coleman will replace Stephen Scherr, who's departing the bank at the end of the year following a 30-year career. More on Goldman's new finance chief.

Merrill Lynch is scrambling to keep advisors from jumping ship

In a leaked memo, we learned Merrill Lynch will be making changes to boost morale - and to keep financial advisors from leaving for competitors. To do so, the wealth manager plans to ramp up its alternative investments platform and mortgage offerings. Get the latest on the campaign, code-named "Project Thunder."

Marc Lasry says the Fed "screwed" big distressed investors

Marc Lasry's $11.7 billion Avenue Capital is too big for most opportunities, the billionaire and Milwaukee Bucks' co-owner said. Lasry and other distressed investors said small-cap and mid-cap companies - ideally between $500 million and $4 billion - have the best opportunities to create value in the current market. More on Lasry's beef with the Fed.

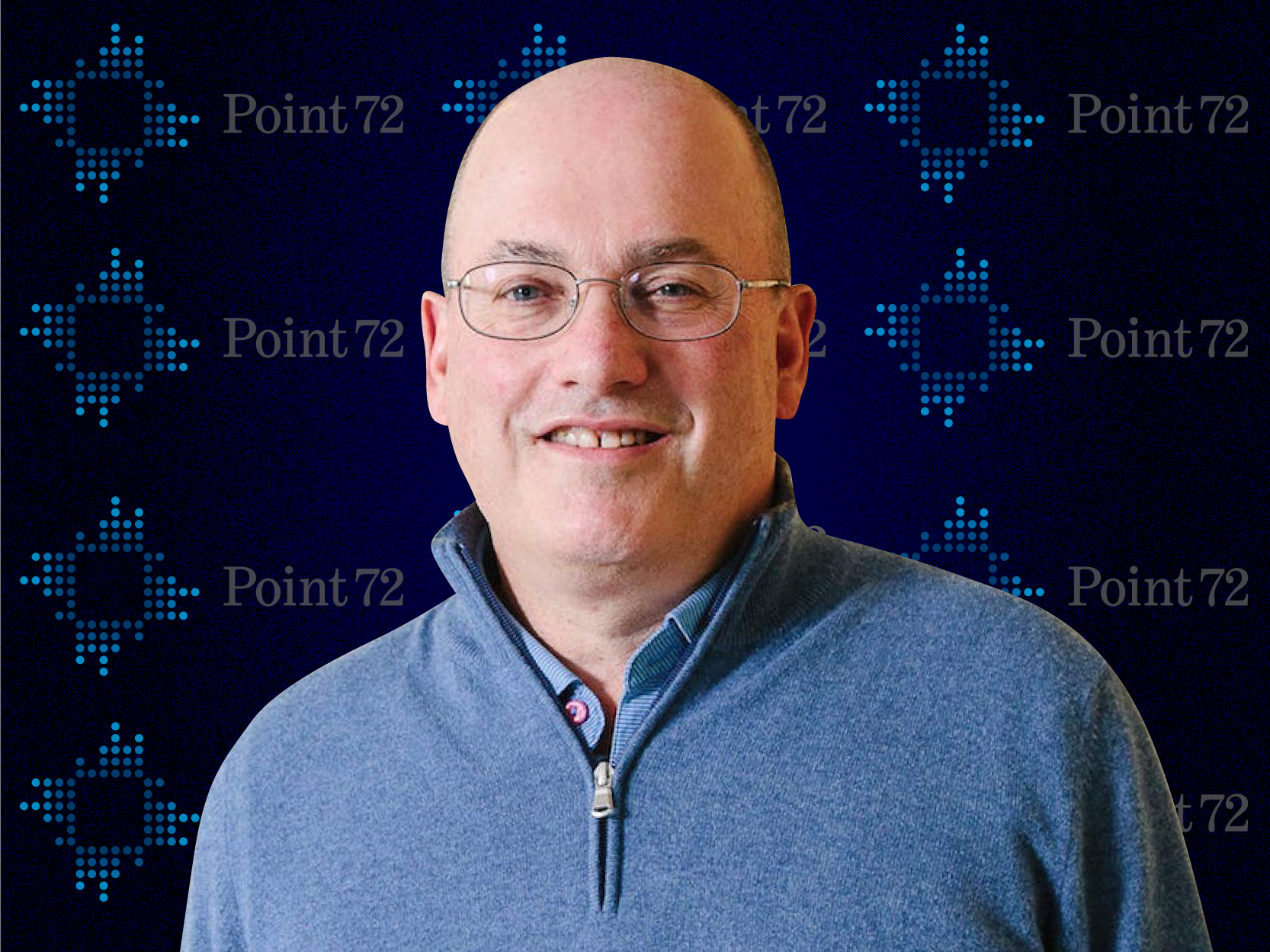

Steve Cohen is backing a new crypto trading firm

Billionaire Point 72 founder Steve Cohen has agreed to personally back a new cryptocurrency-trading platform, according to the Wall Street Journal. He'll invest in Radkl, the quant-trading firm, personally, rather than through his hedge fund. Everything we know so far.

Litecoin's creator: "We really screwed up"

Charlie Lee said litecoin "really screwed up" when an employee retweeted a false press release that said Walmart was partnering with the coin. Before the statement was debunked, litecoin spiked as much as 25%, then tumbled again. Here's what else Lee said about litecoin's rollercoaster of a day.

JPMorgan is considering adding buy now, pay later features, said Marianne Lake, its consumer banking co-CEO. As the payment feature becomes a top priority for big banks, JPMorgan believes it can use its size to take on leading industry players like Affirm and Klarna. Get the rundown on the bank's BNPL ambitions.

Snowflake is bringing a finance-focused cloud to Wall Street

Data-warehousing company Snowflake launched its Financial Services Data Cloud on Tuesday, which will cater to financial institutions like banks, hedge funds, and asset managers. The cloud has already nabbed BlackRock, Capital One, and Refinitiv as customers - here's what else we know.

On our radar:

- Financial News reports that investment banks are seeing a surge in applications this year - exemplified by the 50,000 applicants for JPMorgan's investment banking division.

- Legal-tech M&A deals spiked this year, signaling a wave of growth in the space. These are the seven most significant deals so far.

- CEOs are asking a lot of questions about Biden's vaccine mandate. Here are answers to their 11 biggest questions.

- JPMorgan is hiring two new executives to help reinvigorate its online investing products, according to WSJ. More on the new hires.