Welcome to Insider Finance. If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

On the agenda today:

- Private equity investors are pouring money into showbiz.

- Lazard is raising pay for junior investment bankers.

- Top money managers are in bidding wars for diverse talent.

Let's get started.

Private equity investors are betting on Hollywood

A Blackstone-backed firm led by two ex-Disney execs poured $500 million into Reese Witherspoon's Hello Sunshine, in a move that reflects investors' push into showbiz. As the industry recovers from the pandemic, more private equity players are pouring money into entertainment. Here are 13 firms betting on Hollywood's comeback.

Lazard is increasing junior investment bankers' base comp

Wall Street's pay raise frenzy isn't slowing down. Following Goldman Sachs' decision to raise base pay for some junior investment bankers, Lazard announced it will raise first-year analyst salary to $100,000, second-year salary to $110,000, and third-year salary to $110,000. Here's what we know about the raises so far.

Top money managers are in bidding wars over diverse talent

The competition for diverse talent on Wall Street is getting fierce - and in some cases, firms are making counteroffers that are 15% to 20% higher than initial offers to woo candidates. Everything you need to know about the battle for talent.

Credit Suisse is rebuilding after a senior staff exodus

Nearly 70 bankers, traders, and other employees have departed Credit Suisse in recent months. Now, the bank is starting to replenish its leadership and investment-banking teams. We have a rundown of who's recently joined the bank.

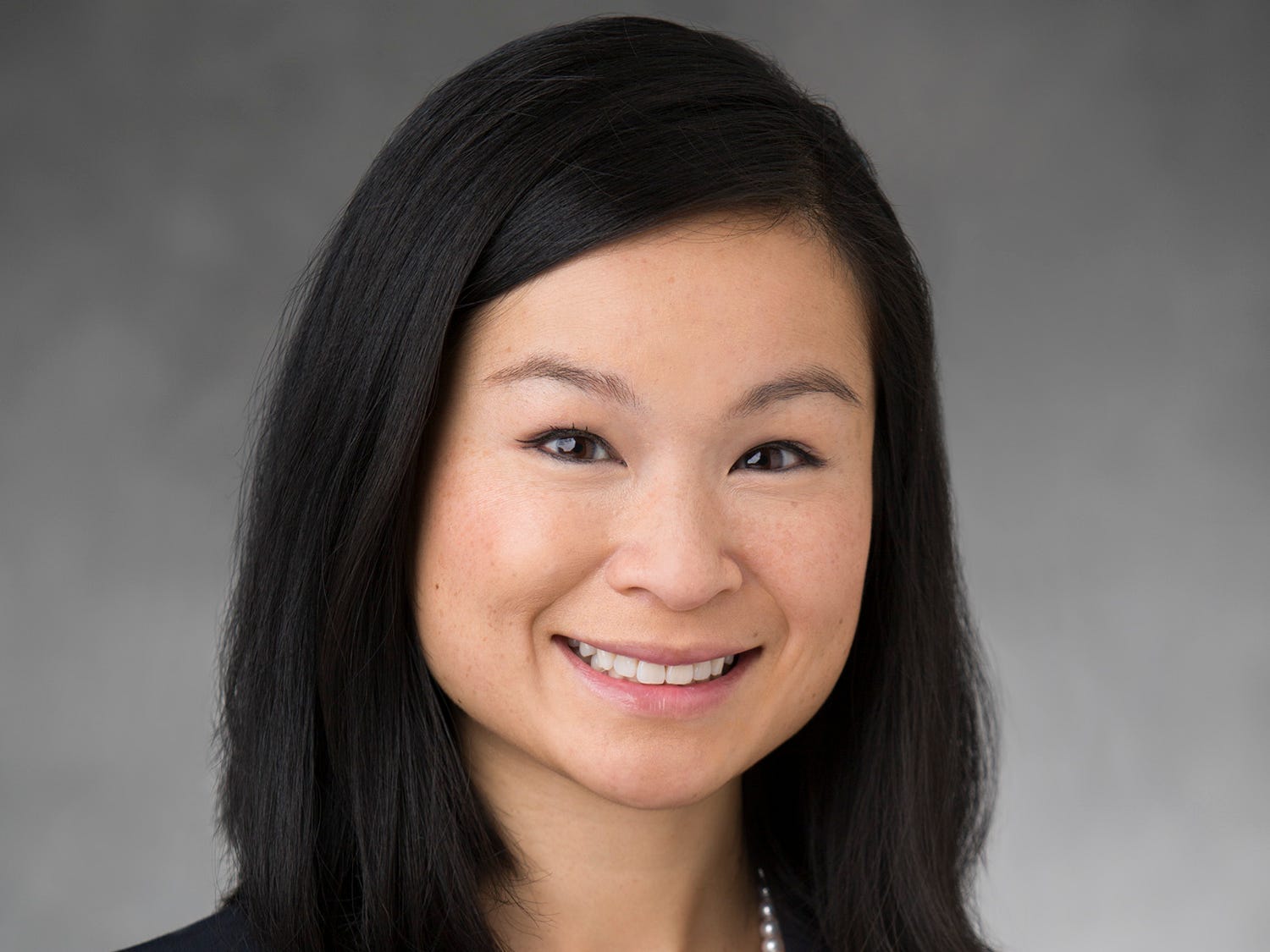

Morgan Stanley just promoted a star in its credit division

Rachel Russell, a Morgan Stanley lifer, was promoted to lead the firm's collateralized loan obligation business - a red-hot corner of Wall Street that's poised to set records in 2021. What we learned from the internal memo announcing her promotion.

General Atlantic's wager on Duolingo is paying off after its big IPO

Duolingo's IPO raised $521 million last week. Now, General Atlantic's key tech dealmaker wants to "press its advantage" in the booming edtech sector. Why he thinks edtech is here to stay.

Fintech M&A is going into overdrive with Square's $29 billion Afterpay deal

The fintech space has exploded in recent years, keeping Wall Street bankers busy. Here, a dozen heads of fintech investment banking gave us an inside look at dealmaking in the red-hot sector.

Chief marketing officer may be the most influential job in wealth management

Wealth management, now generally commoditized, is boiling down to a marketing business, with branding becoming one of the few ways firms can stand out. Here's how marketing became crucial to wealth management.

Nominate someone for Insider's 2021 class of Wall Street rising stars

We're putting together a power list of the young talent on Wall Street. If you know a standout in investment banking, investing, or sales and trading, you can nominate them here.

On our radar:

- Credit Suisse will join Wall Street in raising junior pay to $100,000, according to Financial News. More on the pay raises amid the war for banker talent.

- New York City will require proof of vaccination for indoor activities including going to restaurants, gyms, and performances. Here's what you need to know.

- A software engineer left a bad Glassdoor review of his company. Now it's suing him for $1 million.

- We asked baristas what annoys them the most - here are their eight rules of coffee-shop etiquette.

- A LaGuardia traveler posted a photo of a restaurant selling $28 Sam Adams beer, prompting a price audit of the entire menu.

- Spies, stake-outs and the gig economy: Meet the Jefferies analyst unmasking dark delivery.