Welcome to Insider Finance. If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

On the agenda today:

- PE firms are stuck in a power struggle with their investors – and lawyers are bringing in cash no matter what.

- KKR is building out its sales team and marketing efforts to reach more wealthy clients.

- "Do-gooder" companies are using ESG missions to amp up their public debuts.

Let's get started.

PE firms are stuck in a power struggle with their investors

Private-equity firms are quarrelling with investors: fund managers say big clients have untenable demands, while investors say they're being forced to sign away rights - and lawyers are raking in cash no matter what.

KKR is angling to reach more wealthy clients

Private-equity giant KKR is building out its sales team and boosting its marketing tactics in an effort to win over more private wealth clients. Here's what else the firm is doing to expand its client base.

Tricolor used this pitch deck to win over BlackRock investors

Tricolor, an alternative auto lender that serves thin- and no-credit Hispanic borrowers, used a 25-page deck to raise $90 million from BlackRock investors. See the pitch deck Tricolor used to raise the funds.

How "do-gooder" companies are ramping up their IPOs

So-called "do-gooder" companies, like eyewear brand Warby Parker and yogurt company Chobani, are increasingly touting sustainability and ESG missions to boost their public offerings. But experts say their IPOs steer clear of specific metrics for fear of liability or investor backlash. Here's why.

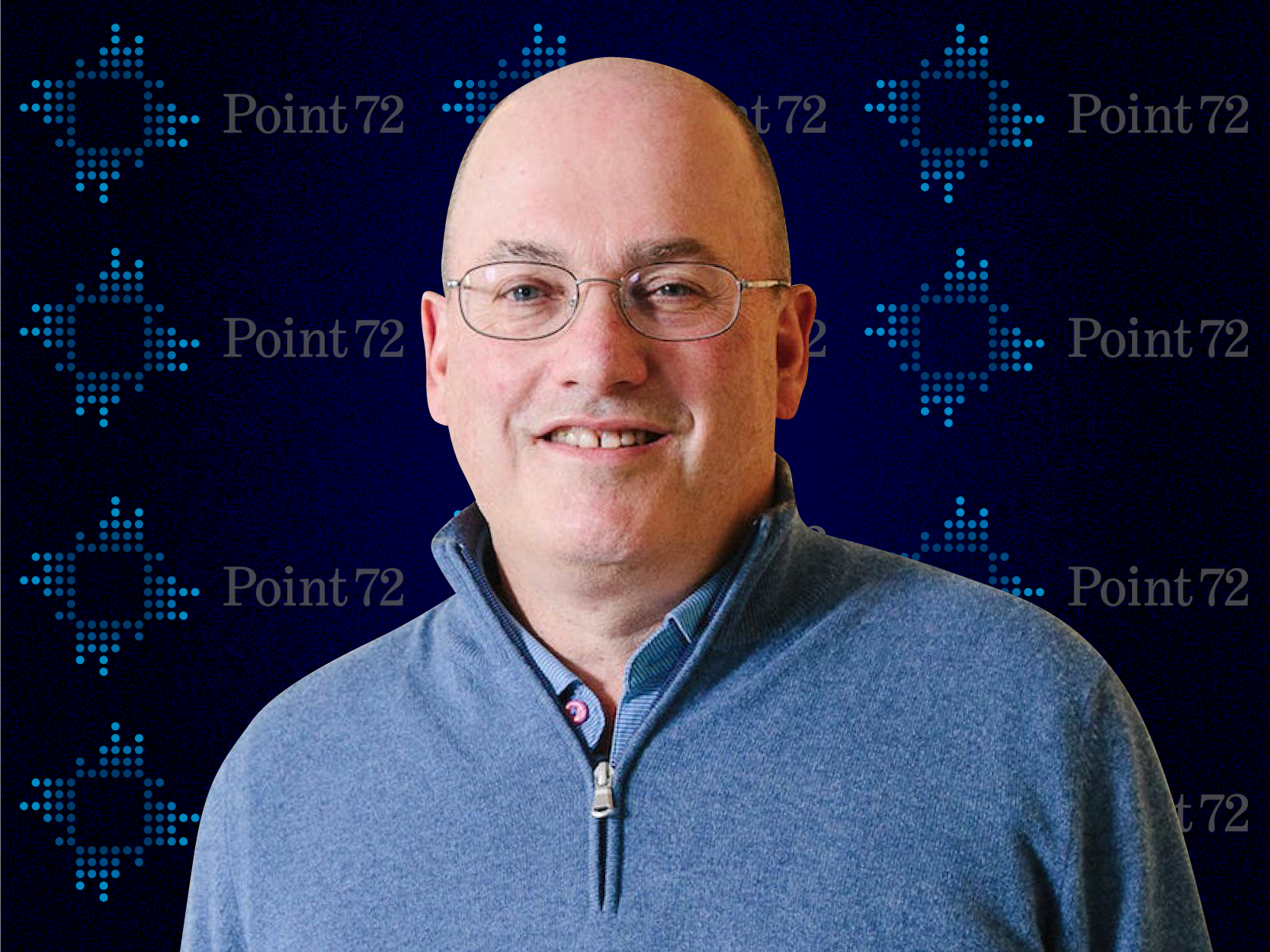

Steve Cohen, Ilana Weinstein dish on hedge-fund talent

In a panel with Dmitry Balyasny and Mike Rockefeller, Cohen and Weinstein talked about recruiting and retaining top talent, and the most important parts of launching a fund. Read the biggest takeaways from their conversation.

Asset management M&A is heating up

Invesco is in talks to merge with State Street Global Advisors, according to the Wall Street Journal. Analysts don't expect consolidation in the asset management industry to slow down anytime soon - so we're tracking some of the industry's likeliest buyers and sellers.

On our radar:

- Last year, only 93 Black women raised $1 million or more in venture capital funding. We outlined 11 business owners trying to break that record in 2021.

- The hottest new gig in finance? "Finfluencers." Bloomberg reports that Wall Street influencers are making $500,000 - even beating out some bankers.

- JPMorgan will launch its digital bank in the UK this week, according to CNBC. More on the hotly anticipated debut.