Bruce Bennett/Getty Images

- The labor shortage is uneven, leaving some industries more likely to raise wages than others.

- The hotel, restaurants, and leisure sector is most likely to raise pay, Morgan Stanley said Monday.

- Independent power and renewable electricity businesses are the least likely to hike wages, the bank added.

- See more stories on Insider's business page.

Like many aspects of the US recovery, the labor shortage is uneven.

Where some industries were able to quickly shift to telework and retain most employees through the pandemic, others are struggling to rehire. Job openings sit at a record-high 9.3 million, but hiring lagged economist forecasts for two months straight while quits reached all-time highs.

Several businesses have already raised wages in a bid to attract more workers than the competition. Yet certain sectors are still likely to see additional pay hikes as the shortage lingers, Morgan Stanley economists led by Ellen Zentner said in a Monday note.

"Wage pressures to-date have been relatively narrow, but our leading indicators point to labor market tightness in an increasing number of industries, raising the prospect of further wage increases and broadening out of wage pressures," the team said.

Morgan Stanley

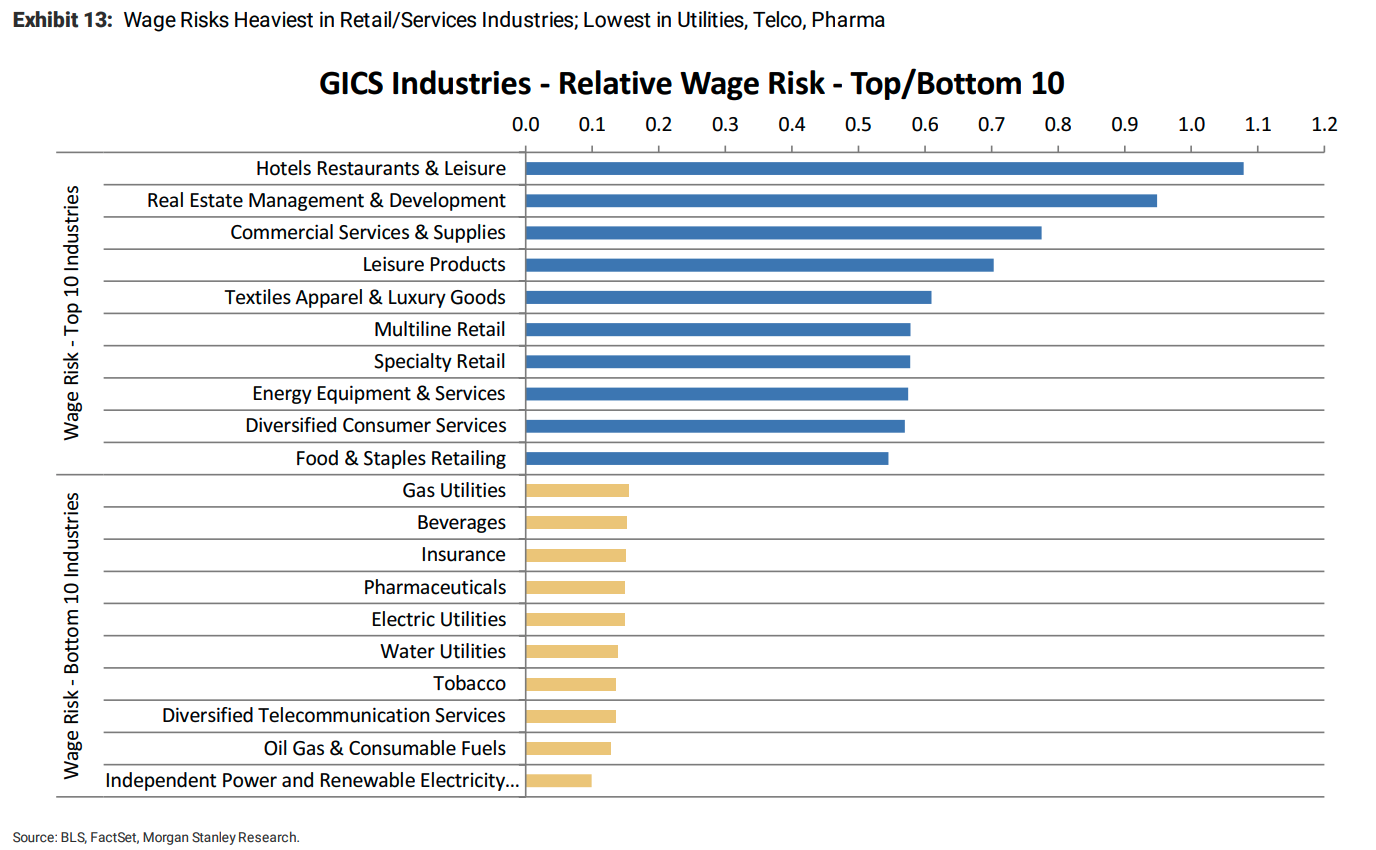

Hotels, restaurants, and leisure businesses came out on top, with real estate management and development following close behind. Commercial services and supplies businesses touted the third-highest wage-risk score. Morgan Stanley homed in on which sectors are most likely to raise wages first by analyzing companies' earnings-per-employee, estimated margins, and historic wage growth.

The sectors at the greatest risk of wage hikes shared a handful of characteristics. Many were among those hit hardest by the pandemic and related lockdowns. The top 10 sectors mostly consisted of service jobs, likely due to the mass layoffs seen in 2020. Retail businesses also face higher wage risk as consumer demand booms and businesses struggle with supply bottlenecks.

On the other end of the spectrum, producers make up most of the sectors with the softest wage risk. Independent power and renewable electricity businesses sit at the bottom of the list, followed by the oil gas and consumable fuel sector. Water utilities, tobacco, and telecom services businesses were all nearly tied for having the third-lowest wage risk.

Morgan Stanley also expects a larger share of sectors to drive wages higher. While 64% of industries saw above-trend pay growth since March, that share grew to 93% in April and reached 79% in May. A deeper look at industry-specific data shows wage pressures growing in middle- and high-wage industries, marking a departure from trends seen just before the pandemic, the team said.

Still, the elevated rate of wage growth might not be felt in the near term. Most industries' pay hikes have been dwarfed by stronger inflation through spring. Only 21% of sectors saw pay climb faster than the Consumer Price Index in the three months through May, Morgan Stanley said. For workers to actually benefit from the faster-than-average pay growth, businesses will need to keep raising wages after the anticipated cooling of inflation.