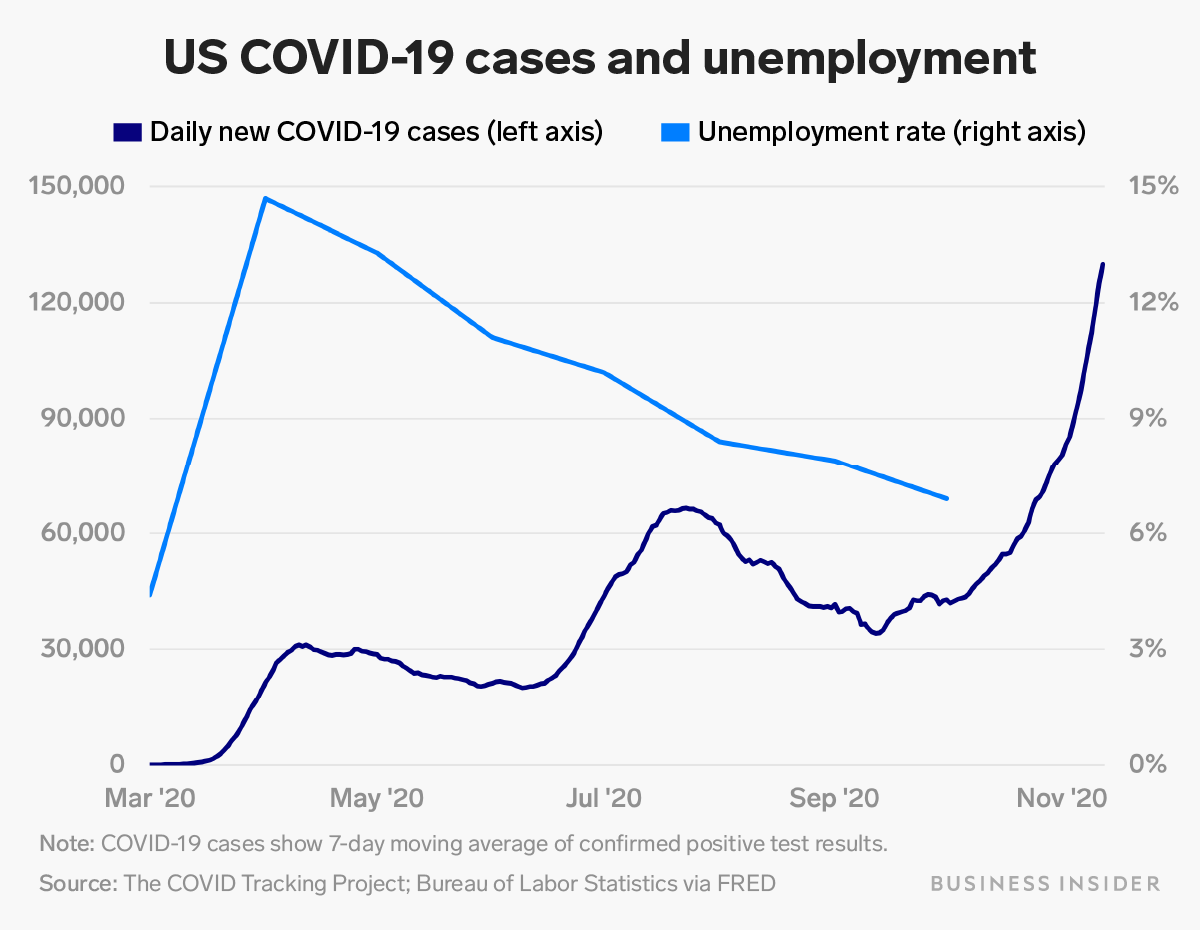

- Just as key fiscal relief policy expired, US virus cases were rising sharply.

- Congress’ $2.2 trillion CARES Act was praised as a key driver of the US economy’s initial bounce-back.

- But components such as expanded unemployment benefits expired in July, just as US virus cases surged and the pace of economic recovery slowed.

- Visit Business Insider’s homepage for more stories.

Congress’ critical support for unemployed Americans expired just as US coronavirus cases surged in a second wave.

The $2.2 trillion CARES Act was widely praised as buoying small businesses, households, and struggling sectors through the first months of the pandemic. The package also included critical aid for jobless Americans in direct relief payments and a $600-per-week expansion to unemployment benefits.

The unprecedented amount of fiscal support fueled a sharp initial rebound in economic activity, hiring, and consumer spending. Yet enhanced unemployment benefits ended in July, leaving jobless Americans with considerably less financial aid. Businesses were also forced to reopen as emergency relief loans dried up.

And just as the stimulus programs expired, a second wave of coronavirus cases emerged in the US. Economic reopening brought quarantined Americans back outside, and continued hiring pulled the unemployment rate lower through the summer.

Congress remains stuck in negotiations over a new stimulus bill, but chances of fresh support arriving in 2020 are slim. With daily infections hitting record highs day after day, the nation’s recovery faces its biggest threat yet.