- The odds of a stock market melt-up are rising as institutional investors raise $297 billion in cash, Fundstrat's Tom Lee said in a Monday note.

- "Institutional investors have been steady sellers of risk assets even as equities managed to post gains," Lee said.

- The strategist remains positive on equities, especially cyclical stocks, and is seeing signs of capitulation.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Odds of a potential "melt-up" in the stock market are rising as institutional investors raise near record levels of cash, Fundstrat's Tom Lee said in a note on Tuesday.

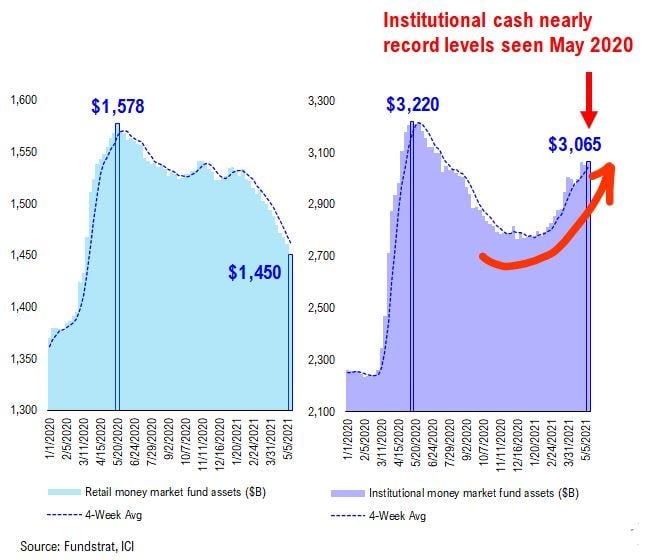

Since the start of 2021, money market balances of institutional investors have surged by $297 billion to more than $3 trillion, nearly matching the peak levels seen during the height of the COVID-19 pandemic in May of 2020.

The near-record cash raise by professional investors comes even as the stock market managed to move higher so far this year, with the S&P 500 up 11%, and as data continues to show improving momentum for the US economy.

"Institutional investors have been steady sellers of risk assets even as equities managed to post gains," Lee said.

While professional investors have been raising cash, the money market balances of retail investors has fallen by $76 billion in 2021 to about $1.5 trillion, according to the note. Assuming that $76 billion in retail money flowed into the stock market, it has been more than offset by the cash raise of institutions.

To Lee, the current dynamic is a sign of capitulation among institutional investors, which could potentially lead to a "melt-up" in the stock market as they look to deploy the cash raised back into the stock market.

The cash raised by institutions coincides with survey data from the National Association of Active Investment Managers that showed positioning in the S&P 500 is the most cautious since April 2020.

"Anytime investors are this cautious, it is a strong 'contrarian' buy signal. Thus, we see high odds of a market melt-up," Lee said.

Lee recommended investors take advantage of this dislocation by buying cyclical stocks poised to benefit from a full reopening of the US economy, including stocks in the energy, materials, and financials sectors, according to the note. Lee is cautious on technology stocks and said investors should use any strength to reduce exposure to the sector.