Photo by Montinique Monroe/Getty Images

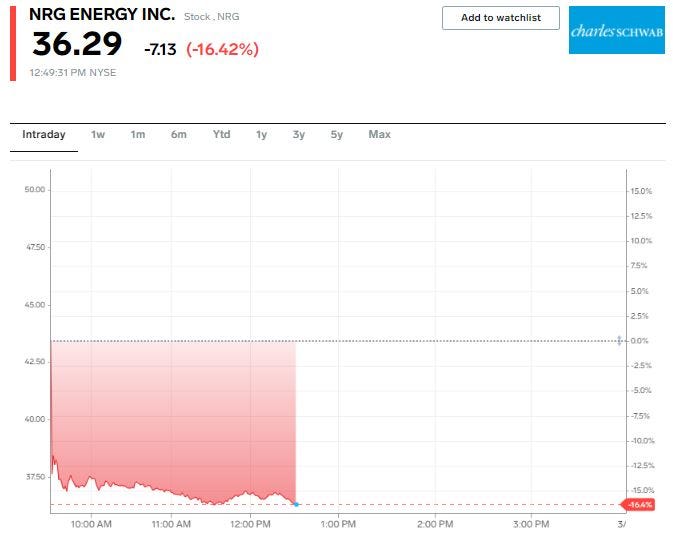

- NRG Energy plunged as much as 17% on Wednesday after it said the February Texas snowstorm wreaked havoc on its financials.

- NRG Energy withdrew its previously issued 2021 guidance and now expects to record a $750 million loss.

- The utility company said pending legislative actions and resulting impacts "remain uncertain."

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

NRG Energy led the S&P 500 lower on Wednesday, falling as much as 17% after the utility company said last month's Texas snowstorm wreaked havoc on its financials.

NRG said it expects to record a $750 million loss related to the storm, and it withdrew its 2021 guidance as it sees additional uncertainties related to pending legislation and its potential impact on the company.

In February, a week long snowstorm brought freezing temperatures and snow to Texas, which was ultimately hit with rolling blackouts as the state's electric grid became overwhelmed by the demand for energy. Wholesale electric prices soared, resulting in some Texas residents being hit with multi-thousand dollar utility bills.

NRG Energy CEO Mauricio Gutierrez said the company's loss estimates could widen as it has received resettlement data for 80% of its commercial and industrial customers compared to 99% for residential customers.

Defaults on the Texas power grid surged to $3.1 billion, up from a previous assumption of $1.3 billion. Those defaults are passed on by the grid operator to market participants, of which NRG is responsible for just "shy of $200 million," Gutierrez said in a conference call on Wednesday.

Texas lawmakers are considering new legislation to mitigate the impact of February's crisis, which presents "significant uncertainty," for NRG Energy, Gutierrez said.

But the utility company still remains committed to retaining its investment grade credit rating, and said as of March 15 it has $3.3 billion of liquidity available to continue to support its operations, though it may extend its debt reduction program into 2022.

Other utility companies with exposure to the Texas snowstorm include Vistra and Exelon, which both traded lower on Wednesday.

Dit artikel is oorspronkelijk verschenen op z24.nl