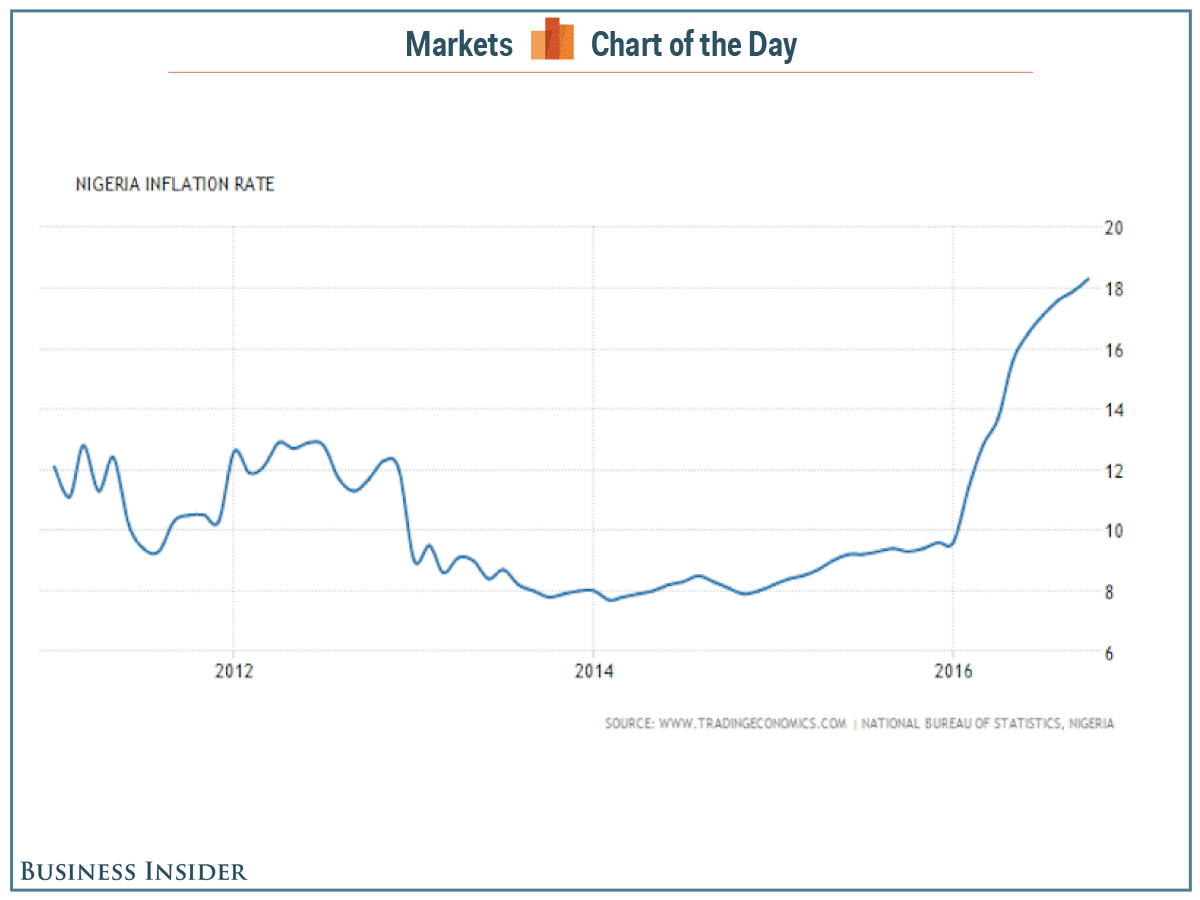

Nigeria’s inflation surged to an 11-year high.

Consumer prices rose by 18.3% year-over-year in October, according to data from the central bank, accelerating from the previous month’s rate of 17.9%.

This was the highest rate since October 2005, and the 12th consecutive month it accelerated. The rate was in line with the median Bloomberg estimate.

“Persistent above-target inflation will prompt the Central Bank of Nigeria to tighten monetary policy,” argued John Ashbourne, Africa economist at Capital Economics, in a note.

“Erratic policy-making does, admittedly, make it difficult to pin down the timing of the move,” he continued. But “we expect that the bank will hike its key policy rate from 14.00% to 16.00% at its meeting next week,” he added.

Nigeria has been struggling to rein in inflation amid a shortage of dollars and lower oil prices. Notably, inflation has risen by more in urban areas (19.9% year-over-year) than in rural areas (16.9% year-over-year), which Ashbourne attributes to the fact that those who live in cities have a "greater propensity to buy imported goods."

The country's economy shrank by about 2% year-over-year in the second quarter, following a drop of 0.36% in the first - marking its first recession in 20 years. Third quarter data will be released later this month.

And back in June, Nigeria devalued its currency, the naira. Officially, it's about 37% weaker against the US dollar compared to a year ago, but it's down by about 50% against the dollar on the black market.