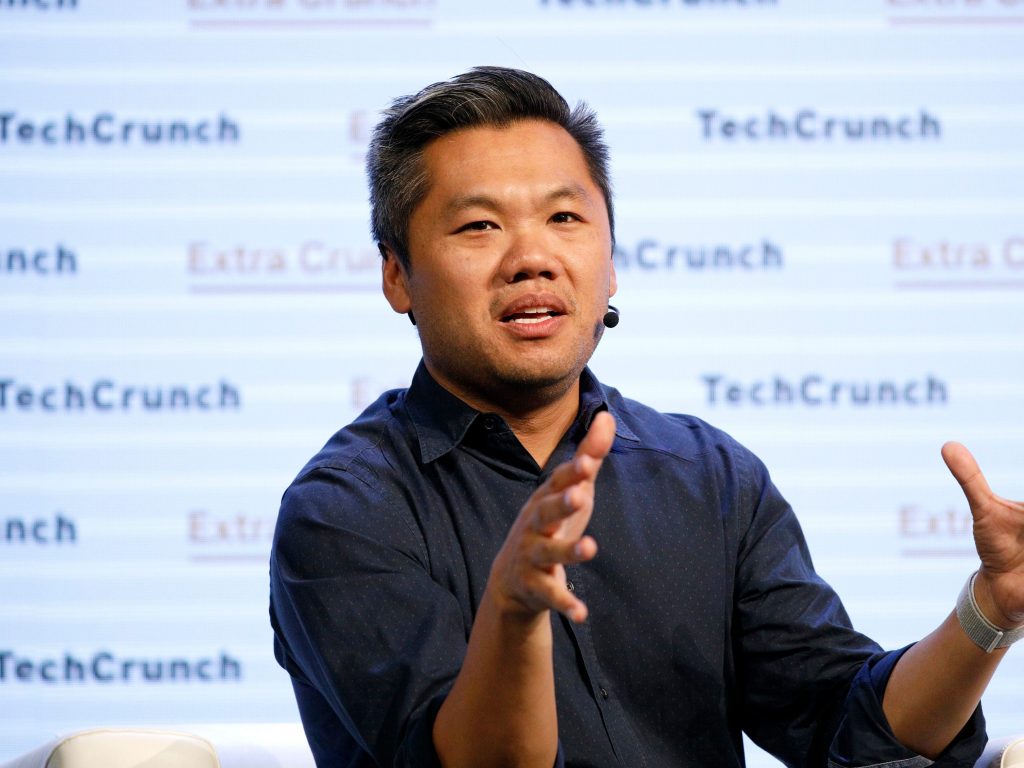

- In a new book, startup exec and investor Andrew Chen digs into what it takes to turn a startup into a massive brand.

- He draws on his own experiences and on interviews with the CEOs and founding teams of companies like LinkedIn, Twitch, Zoom, and Airbnb.

- It's a practical handbook for entrepreneurs struggling with the tricky concept of "network effects" — but it falls short.

- This is an opinion column. The thoughts expressed are those of the author.

A new book by Andrew Chen, a partner at one of the most successful modern venture capital firms, explores one of the key secrets of successful Silicon Valley startups: how to establish and harness network effects.

Although Chen falls far short of his articulated goal "to write the definitive book on network effects," he has produced a practical handbook for entrepreneurs struggling with how to effectively apply what can be a devilishly tricky concept.

'Network effects' describes what happens when products get more valuable as more people use them

These have been around for a long time, and Chen tells the story of Bank America establishing the first credit card in the 1950s to demonstrate the power of the concept. Adding more merchants made the cards more valuable to customers, and adding more cardholders attracted more merchants. The internet established a vast network of networks and vastly expanded the number of potential business models in which network effects are observed, from all manner of online marketplaces to global social networks.

The result is that network effects have taken on a kind of mystical status among tech investors. Chen notes that they have become a standard explanation for the success of every unicorn and are claimed by every startup. One venture firm asserts it has identified 13 different kinds of network effects and claims to have demonstrated that they're responsible for 70% of the value created by tech companies since the internet became a thing.

Yet for all the hype, network effects remain poorly understood

Contrary to popular belief, they're not a competitive advantage in themselves; the core advantage remains relative size — known as economies of scale.

In the analog world, economies of scale typically manifest themselves through the benefit of spreading fixed costs across a larger customer base. In the digital realm, however, economies of scale also increasingly manifest as network effects. This provides additional protection for an established market leader, but accordingly ensures that a new entrant or smaller industry participant is likely to suffer from a significant competitive disadvantage. And some network effects businesses — like many online marketplaces for products as diverse as used cars and sneakers — operate in crowded sectors where no player particularly distinguishes itself by size or performance.

Where "The Cold Start Problem" is at its most useful is in breaking down the key decision points in the life cycle of a network effects business. Chen begins by defining an "atomic network" as the smallest network needed with enough density and stability to stand on its own, and uses this concept to show what's needed to successfully launch a business — solving the cold start problem of the book's title.

In doing so, Chen demonstrates why even when trying to establish a huge business — he describes $1 billion in valuation over 10 years as "a pretty standard minimum bar" to attract venture capital — it's far better to start with a manageable niche than go for a big-bang launch.

Market structure matters

While "The Cold Start Problem" is a helpful guide on the key product-related decisions that must be made as a company grows its initial atomic network past the tipping point into a thriving defensible franchise, it is has much less to say on a topic that is essential to understanding the potential strength of network effects in any given context: industry structure.

The question of what market characteristics lend themselves to resilient network effects has been the subject of extensive discussion by both academics and practitioners. Indeed, some of the most thoughtful work on this topic by practitioners has come out of the very firm, Andreesen Horowitz, where Chen now works. Incorporating these structural insights would have significantly improved "The Cold Start Problem." Also disappointing is Chen's assertion that a number of traditional retail business models — notably grocery stores and streaming subscription services like Netflix — are primarily network effects businesses, which they clearly are not.

Chen interviewed over 100 founders for the book, but his own experience working at Uber, which frames both the introduction and conclusion, plays an outsized role in the narrative. This is not for the better. Chen displays a tin ear in appearing to wholeheartedly embrace the culture of the Travis Kalanick era, despite disturbing evidence in articles, videos, books, and court filings. Also, the business itself displays some structural attributes associated with the weakest network effects businesses: the effects don't extend beyond local markets (hence the expensive retreat from Asia); the commodity nature of the product ensures that the value of incremental supply quickly taps out (more drivers don't help once you have enough cars to provide a ride in three minutes); and there is little loyalty displayed by either riders or drivers (as reflected in Chen's description of Uber's relentless need to incentivize drivers with expensive bonus programs).

Network effects have indeed come to play an outsized role in both the business imagination and the business models of the modern era. "The Cold Start Problem" provides a valuable service in identifying the key product decisions that drive the potential of network effects at each step of a company's journey, from birth to maturity. It provides modest assistance, however, in understanding which network effects businesses can be expected to actually yield consistently superior results.

Jonathan A. Knee is professor of professional practice at Columbia Business School and a senior advisor at Evercore. His most recent book is "The Platform Delusion: Who Wins and Who Loses in the Age of Tech Titans."

Dit artikel is oorspronkelijk verschenen op z24.nl