Nurphoto / Getty Images

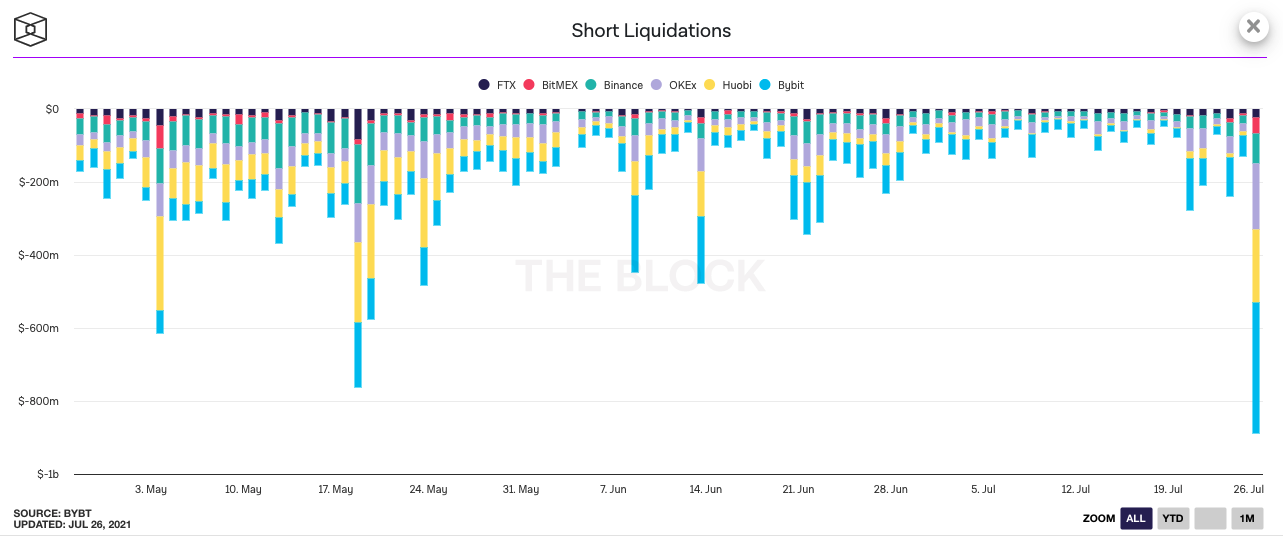

- $883 million worth of crypto short positions were liquidated in a 24-hour span amid bitcoin's rally towards $40,000.

- Short positions on bitcoin accounted for 81% of the squeeze, the Block said.

- A researcher from The Block said this liquidation event resulted in one of the largest total magnitudes of losses in dollar terms for traders who were positioned short bitcoin with margin and futures products.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

$883 million worth of crypto short positions were liquidated in a 24-hour span amid bitcoin's rally towards $40,000.

Data from Bybt.com compiled by The Block notes that short positions on bitcoin accounted for 81% of the squeeze, with $720 million liquidated.

Most of the crypto short liquidations happened late Sunday night as bitcoin's price spiked 10% to break the $39,000 level for the first time in six weeks.

Ryan Todd, research analyst at The Block, told Insider that given bitcoin's historically high price relative to past cycles, this liquidation event posted one of the largest total magnitudes of losses in dollar terms for traders who were positioned short bitcoin with margin and futures products.

"We've seen this in the past when bitcoin has entered a choppy trading range for several weeks, with traders positioning towards a bearish bias," Todd said. He cited a $1 billion liquidation late in December when bitcoin broke past $20,000, and a January $800 million liquidation when bitcoin passed $30,000.

He added that he's not surprised by the magnitude of the liquidations given the nature of the bitcoin market.

"This is business as usual for crypto - a market that is known to be highly volatile and exposed to high levels of product leverage on these exchanges. A perfect recipe for liquidations that can cut both ways depending on sharp spot movements to the up or downside," said Todd.

As of Monday afternoon, bitcoin has jumped 18% to a 24 hour high of $40,499, according to Coinmarketcap.