- Shares of Nautilus Biotechnology soared as much as 65% on Thursday after Amazon revealed a $14.7 million stake in the biotechnology company.

- Nautilus is a small-cap company that is developing a platform technology to measure and identify proteins.

- The investment from Amazon represents its continued focus on the health care space.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

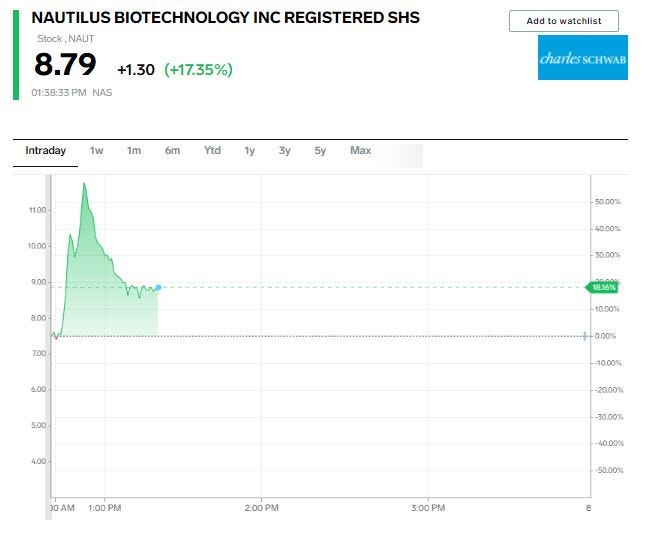

Nautilus Biotechnology soared as much as 65% on Thursday after Amazon revealed in a SEC filing last week that it owned a $14.7 million stake in the small-cap company as of June 30.

The Amazon disclosure was first reported by CNBC on Thursday, leading to a surge in the share price of Nautilus.

Nautilus is developing a platform technology that works to measure and identify the complexities of proteins, which could ultimately lead to potential drug discoveries and aid diagnostic testing. The sub-$1 billion company does not yet generate any revenue.

The biotechnology company went public earlier this year via a SPAC merger. While there is no indication of Amazon directly working with Nautilus, this isn't the first time the e-commerce giant set its eyes on the health care space. In 2018, Amazon purchased PillPack, an online pharmacy, for $753 million.

In addition to Amazon's investment in Nautilus, Jeff Bezos' venture capital firm Bezos Expeditions invested in the company, according to CNBC.

Nautilus co-founder Sujal Patel told CNBC, "I don't have further comments in terms of their [Amazon's] motivations in the future," Patel said.

Despite Thursday's surge, shares of Nautilus are still more than 50% below the high reached in February when the SPAC deal was announced. Shares of Nautilus pared their gains following their initial pop and were up 17% at time of publication.