REUTERS/Leah Millis/Karl Mondon/Digital First

- The husband of House Speaker Nancy Pelosi purchased up to $11 million in mega-cap tech stocks in May and June.

- A disclosure form shows Paul Pelosi exercised options to purchase $4.8 million worth of Alphabet.

- Pelosi also bought option contracts in Apple, Amazon, and Alphabet, according to the disclosure.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Paul Pelosi, investment manager and the husband of House Speaker Nancy Pelosi, purchased up to $11 million worth of mega-cap tech stocks in May and June, according to a financial disclosure form filed last week.

Pelosi's biggest purchase was $4.8 million worth of Alphabet shares on June 18, according to the disclosure. Pelosi exercised 40 call options to buy 4,000 shares at a strike price of $1,200. With shares of Alphabet currently trading at $2,524, that stock position is now worth more than $10 million, representing an unrealized gain of more than $5 million.

On May 21, Pelosi purchased up to $1 million worth of call options in Amazon, along with up to $250,000 in call options on Apple. According to the disclosure form, Pelosi purchased 20 Amazon call options with a strike price of $3,000 and an expiration date of June 17, 2022, along with 50 Apple call options with a strike price of $100 and an expiration date of June 17, 2022.

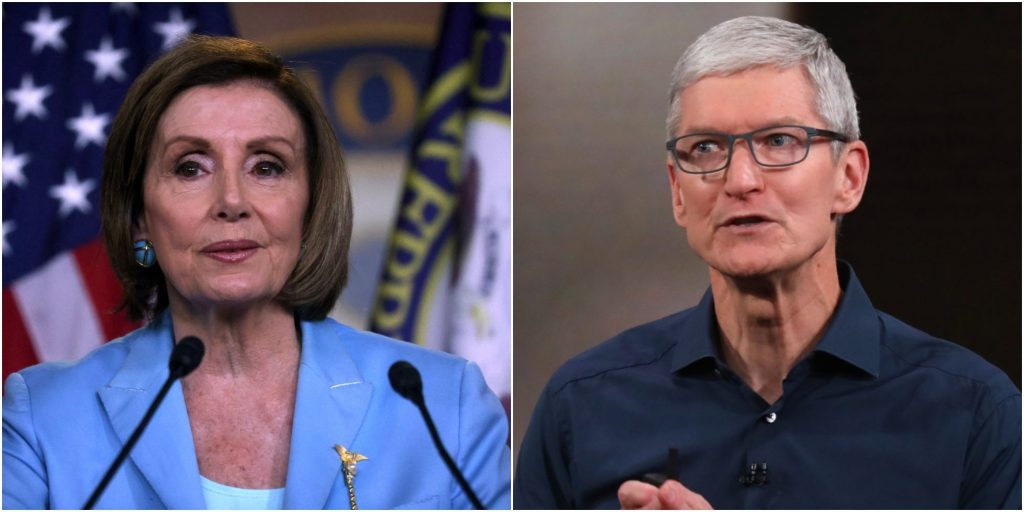

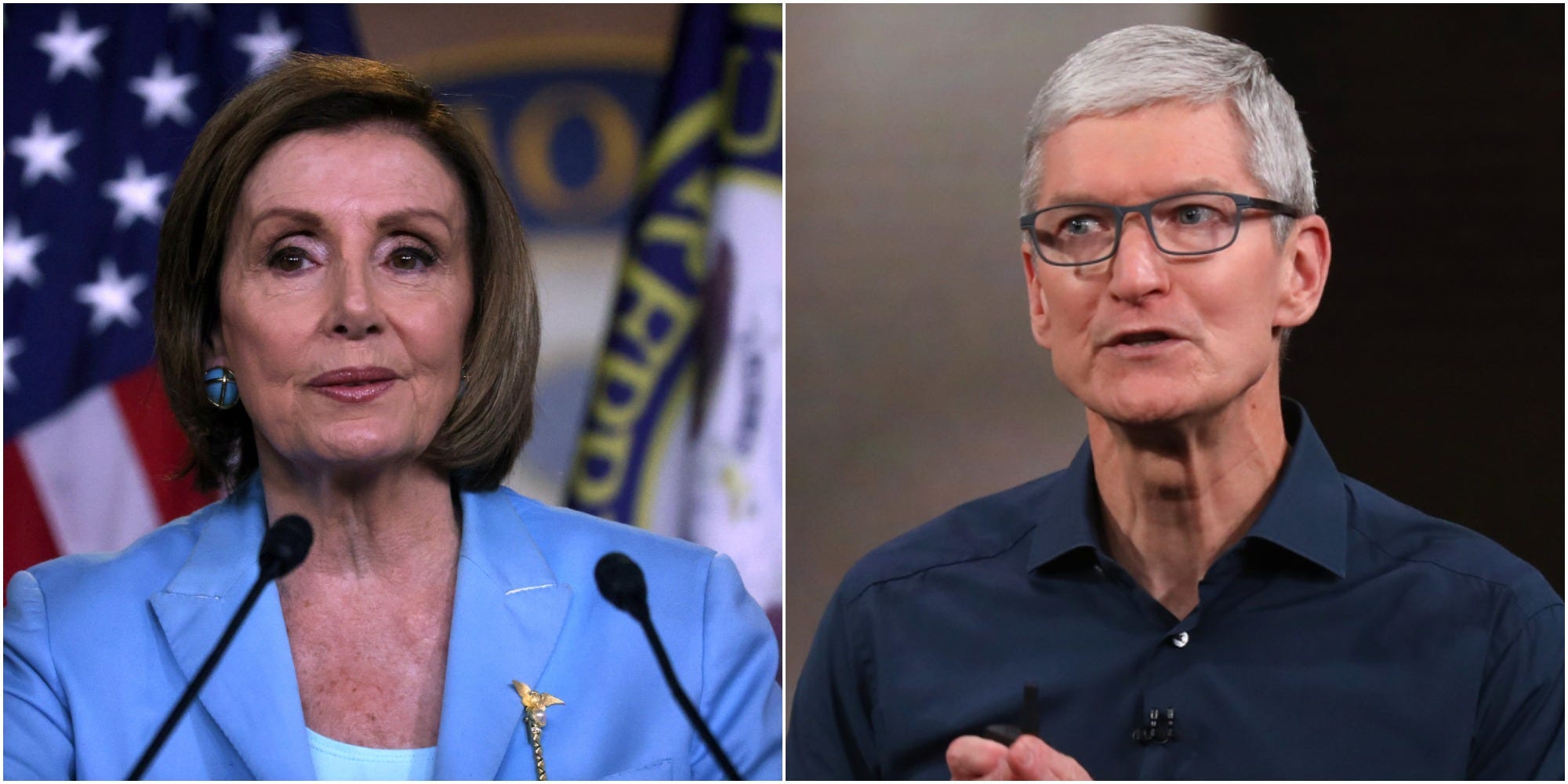

The stock purchases come as Pelosi's wife and the House of Representatives work on anti-trust legislation designed to better regulate the massive multi-trillion dollar tech companies. Apple CEO Tim Cook recently called House Speaker Pelosi to voice his opposition to the pending legislation.

Finally, Pelosi purchased up to $5 million worth of Nvidia call options on June 3. According to the disclosure form, Pelosi purchased 50 Nvidia call options with a strike price of $400 and an expiration date of June 17, 2022.

The long-dated in-the-money call options give Pelosi leverage to the potential upside moves in mega-cap tech stocks. The trades could be a bet on a continued regime of low interest rates, muted inflation, and slowing economic growth in a post-pandemic recovery, or on the business outlook of the companies themselves.

This isn't the first time the investment decisions of Pelosi's husband came into focus. Earlier this year, Paul Pelosi purchased up to $1 million of long-dated Tesla call options.