- Bitcoin is a volatile, speculative asset facing regulatory and industry upheaval, James Gorman says.

- Morgan Stanley’s chairman says there wasn’t a banking crisis last year, but three lenders messed up.

- The bank’s ex-CEO expects the Fed to cut interest rates twice and skirt a recession this year.

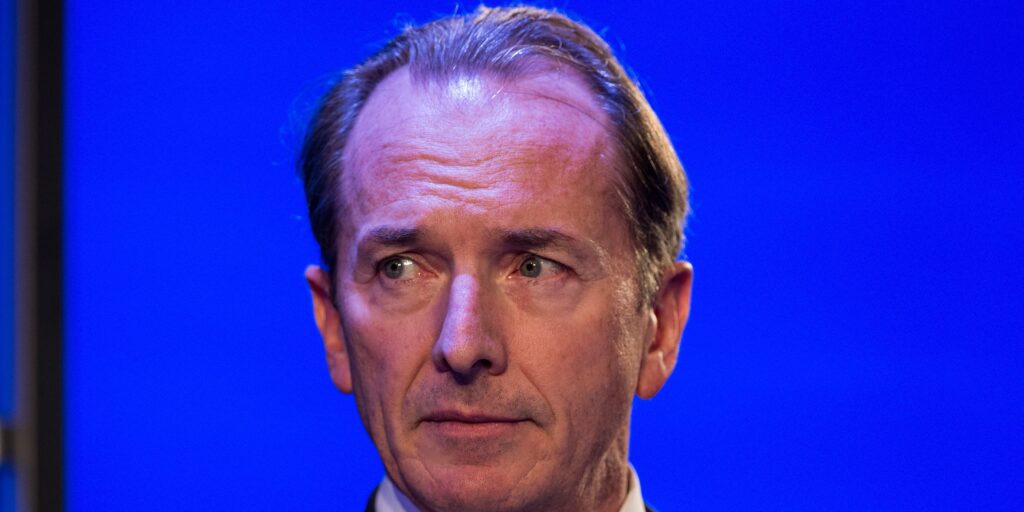

Buying bitcoin is rank speculation, the bank failures last spring weren’t a big deal, and there probably won’t be a recession, according to Morgan Stanley’s executive chairman.

“I’ve never really understood the value of bitcoin as a form of stored value,” James Gorman, who stepped down on New Year’s Day as the investment bank’s CEO after 14 years in charge, told Bloomberg this week.

"I joked once, I wish I bought it at $60 and I'm glad I didn't buy it at $60,000," Gorman continued. "It should play for wealthy people a very small role in their financial fabric because it's so speculative, it's so volatile, and again it's going through enormous regulatory change and industry disruption — we've seen some classic failures of late."

Bitcoin's price soared by roughly 12-fold between March 2020 and November 2021, from about $5,000 to more than $60,000. The most popular cryptocurrency then crashed below $17,000 by the end of 2022, but has since rallied to north of $40,000.

The crypto space has been roiled by regulatory crackdowns and multiple scandals in recent years, including the dramatic downfall of FTX and Sam Bankman-Fried.

"Listen, bitcoin's not going away, it's not a fad," Gorman said. "I just don't think it's a core investment. I think it's a speculative asset of which there are plenty of choices."

Separately, the Wall Street veteran blamed the collapse of Silicon Valley Bank, Signature Bank, and Silvergate Capital in March on bad management decisions, and dismissed fears of an industry-wide disaster at the time as overblown.

"People kept telling me we're having a banking crisis — no we're not, we had a crisis among three banks," he said. "It's not a crisis for the market."

Gorman issued a sunny outlook for the US economy as well, citing the rapid decline in inflation, resilient growth in output, and historically low unemployment.

"It's unlikely we'll have a recession, very unlikely we'll have a hard landing," he said, adding that he expects the Federal Reserve will cut interest rates a couple of times in the second half of this year, boosting economic growth.