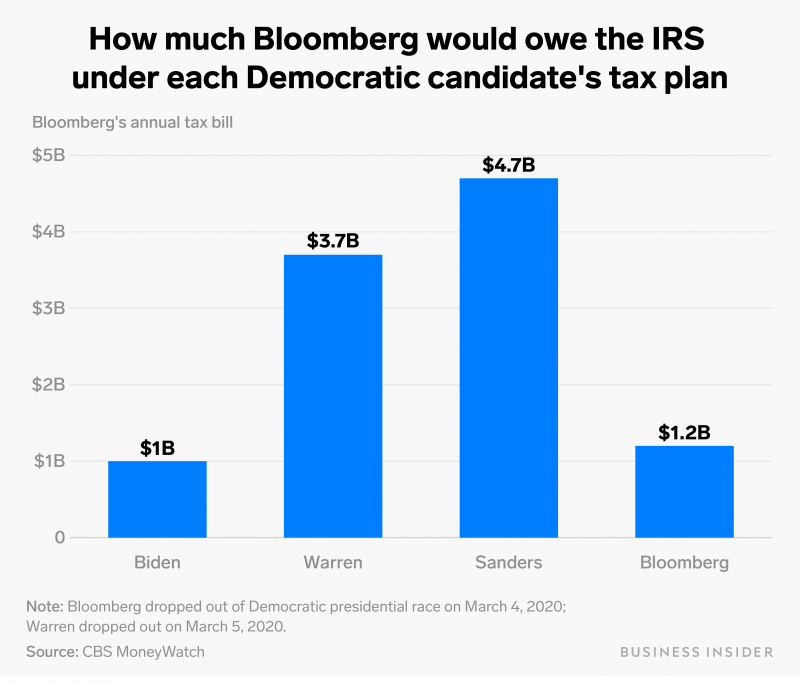

- Mike Bloomberg’s tax bill would be nearly $4 billion cheaper under the tax plan of his chosen candidate, Joe Biden, than under Bernie Sanders.

- Even after spending more than $500 million on his own campaign, Bloomberg is still one of the richest people in the country with a net worth of $58.4 billion.

- Bloomberg released his own plan to raise taxes on the wealthy before dropping out of the race on Wednesday, but it was in the form of an income tax instead of a wealth tax like the one Sanders proposed.

- Visit Business Insider’s homepage for more stories.

Mike Bloomberg blitzed the country with ads promising to raise taxes on the rich during his short-lived but expensive presidential campaign.

But when he dropped out of the race after getting trounced on Super Tuesday, the former New York City mayor endorsed the candidate that wants to raise taxes on billionaires like Bloomberg the least – namely, Joe Biden. Under Biden’s tax plan, Bloomberg’s annual tax bill would be $3.7 billion cheaper than it would be under Bernie Sanders, according to an analysis by CBS MoneyWatch.

Sanders’ “Tax on Extreme Wealth” is the most aggressive tax proposal in the race, applying to individuals with net worths above $32 million. Elizabeth Warren proposed taxing those with net worths over $50 million in her “Ultra-Millionaire Tax.” The senator from Massachusetts withdrew her own bid for the Democratic nomination on Thursday.

Before his own withdrawal, Bloomberg proposed an income-based tax on ultra-wealthy Americans. The former New York City mayor's tax plan included raising the tax rate for the highest-earning Americans from 37% to 39.6%, according to his campaign website. That was the tax rate before Trump's unpopular Tax Cuts and Jobs Act took effect in 2018. Bloomberg also proposed adding an additional 5% "surtax" on incomes of more than $5 million a year, according to his campaign website.

Biden, however, released a proposal that did not include a wealth tax. While Biden's plan does call for raising taxes, corporate rates would still be below what they were before Trump's tax bill took effect, according to The Washington Post.

A majority of the American public, a group of ultra-wealthy Americans, and a handful of presidential candidates all hold the opposite view, believing that a wealth tax would help close the growing wealth gap in the United States.

Any true wealth tax proposal would face substantial headwinds before becoming law, Business Insider reported. The constitutionality of such a tax would likely end up debated in front of the Supreme Court, according to former Department of Justice tax attorney James Mann, who is now a tax partner at law firm Greenspoon Marder. The revenue raised by a potential wealth tax would also likely be much lower than its advocates expect because of tax evasion tactics the ultra-wealthy would probably undertake to avoid paying more, Mann told Business Insider.