Igor Golovniov/SOPA Images/LightRocket via Getty Images

- Meme stocks are losing steam after a three-week rally that mirrored the frenzy of activity seen earlier this year.

- Some of the most popular stocks have dropped 17% in the past week, Vanda Research said.

- "Retail investors will rush to the exit unless there's an immediate rally," the analysts said.

- See more stories on Insider's business page.

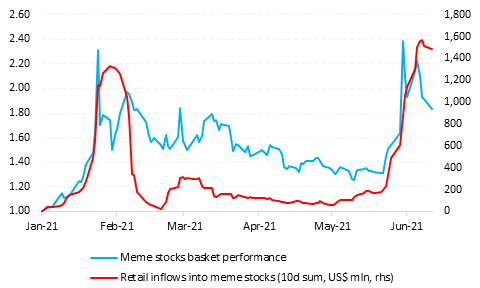

Meme-stock momentum is fading after a three-week rally that mirrored the GameStop frenzy earlier this year.

The latest meme-stock bubble has lasted for three weeks, said Vanda Research senior strategist Ben Onatibia and analyst Giacomo Pierantoniwhich, which is about the same timeframe as earlier this year when an army of Reddit day traders poured into GameStop to push a short squeeze and drove other favorites higher as well.

Now, momentum for the basket of companies is "deteriorating," as a basket of the most popular stocks has fallen 17% in the past week, the analysts said. On top of that, open interest for meme-stock call options has dropped in the past couple days as traders cash in before the expiration. And that's likely to continue.

"Given the amount of risk embedded in these investments, we think retail investors will rush to the exit unless there's an immediate rally," the analysts said in the Wednesday note.

Vanda Research

AMC Entertainment led the latest round of meme-stock madness. After the company's once-largest shareholder dumped almost all of its remaining shares, retail traders poured into the stock for weeks, driving it to all-time highs. Shares of the movie-theater chain are now trading around $60.

Other retail-trader favorites, like BlackBerry, GameStop, Clover Health, and Nokia, followed AMC's footsteps amid the rally. Meanwhile, new names like Beyond Meat, Wendy's, WorkHorse, ContextLogic, and Clean Energy Fuels, also joined the basket.

The trend of meme stocks began earlier this year with retail traders wanting to squeeze short-sellers on nostalgic stocks like GameStop and AMC Entertainment. But now, Vanda said, "squeezing highly shorted stocks is quickly falling out of fashion."

The fizzling out of the meme-stock craze has coincided with a rally in cryptocurrencies. Matt Maley, chief market strategist for Miller Tabak + Co., told Insider previously that meme stocks in the past have taken off when cryptocurrencies have corrected, and vice versa. He said as the Federal Reserve considers pulling back on quantitative easing, there will be less liquidity in the markets.

Meme stocks and other "high-flying liquidity-fueled assets are going to have a tougher time rallying to the same degree that they once did," he said.