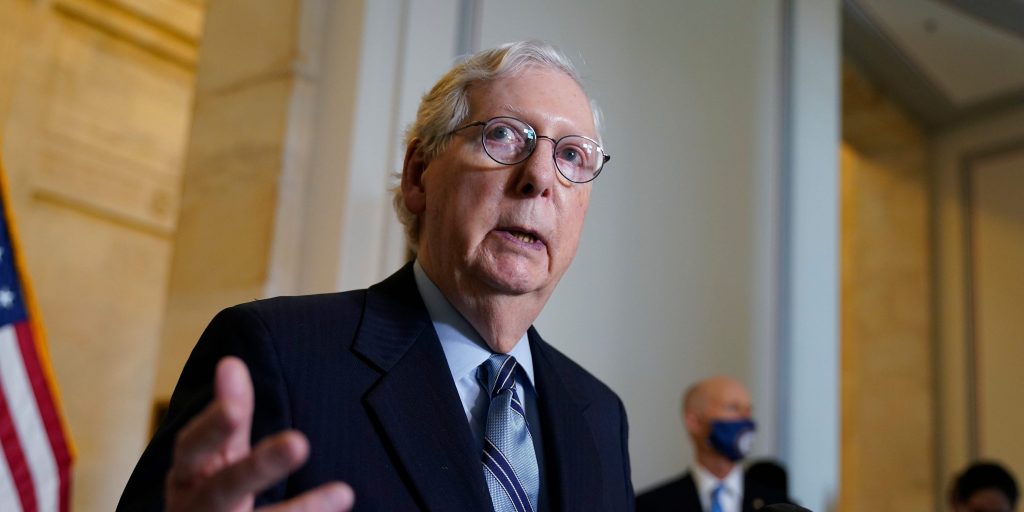

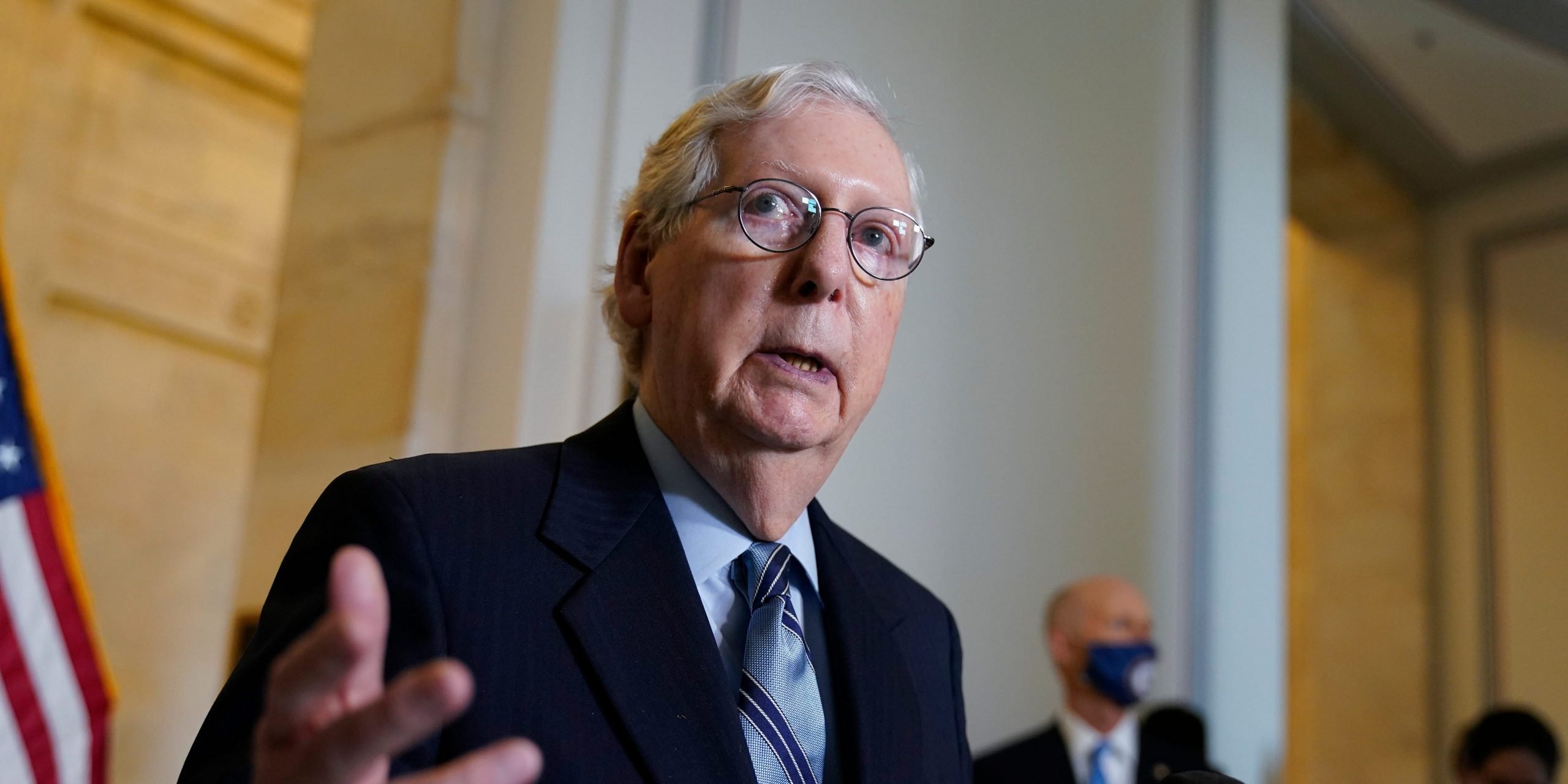

AP Photo/J. Scott Applewhite, File

- McConnell gave former Treasury Sec. Larry Summers "kudos" on Monday for his comments about inflation.

- Summers, who served in the Clinton and Obama administrations, has repeatedly slammed Biden's spending.

- Summers continues to forecast dangerously high inflation, but signs point to price growth cooling in June.

- See more stories on Insider's business page.

Senate Minority Leader Mitch McConnell is siding with an unlikely ally as he rails against President Joe Biden's spending plans: former Treasury Secretary Larry Summers.

The senator from Kentucky gave Summers "kudos" on Monday for "predicting" the now-elevated rate of inflation. Price growth accelerated in May to its fastest one-year pace since 2008 as massive demand butts heads with supply-chain issues and widespread shortages. Republicans recently doubled down on their worries around rising inflation and blamed the Biden administration for fueling such risk.

McConnell echoed such sentiments during a Monday press conference and invoked Summers as a harbinger of the price surge.

"He predicted we would have raging inflation, and that is, in fact, what we are grappling with today," the Minority Leader said.

Summers, who served as President Bill Clinton's Treasury Secretary and as director of the National Economic Council for President Barack Obama, has spent much of 2021 railing against the Biden administration and the Federal Reserve for their policy stances. He criticized Democrats and Republicans in March for passing the "least responsible" fiscal policy of the last 40 years, adding both parties were creating "enormous" risks.

Just last week, the former Treasury Secretary warned the US could see inflation "pretty close" to 5% by the end of the year.

Other Republican lawmakers have seized on Summers' words, using them as ammo with which to slam Biden's economic agenda. Mentions of rising prices have become commonplace at GOP press conferences, and a late May memo urged party members to refer to inflation as "Democrats' hidden tax on the Middle Class."

Yet Republicans have frequently cited products' year-over-year price gains as proof of overwhelming inflation, an inherently skewed comparison as it refers back to price declines seen at the start of the pandemic. The early 2020 readings now make for a lower bar to clear and boost year-over-year readings.

Summers' remarks also directly conflict with the outlook held by the Biden administration and the Fed. The "overwhelming consensus" is that inflation will "pop up a little bit" before fading to healthy levels, Biden said Thursday. Fed Chair Jerome Powell on June 16 repeated his expectation that inflation will prove to be "transitory" as bottlenecks were addressed.

Early signs suggest Powell's forecast is correct. Prices of used cars, industrial metals, and lumber all cooled through early June, signaling broad inflation could soon slow to less concerning rates.

The deficit-spending debate rages on

McConnell also knocked Democrats' proposals to spend trillions of dollars more on infrastructure and family support programs. Passing a "portion" of Biden's original infrastructure plan makes sense, but approving both of his follow-up plans would be "wildly out of proportion to what the country needs," McConnell said.

"The pandemic is, essentially, in the rearview mirror. To continue to borrow and spend at this level is completely unacceptable for the future of this country," he added.

The push for fiscal austerity contrasts with May comments from Treasury Secretary Janet Yellen. With the Fed set to hold rates near zero well into the future, the government should spend on support programs before debt becomes a bigger burden, she said.

"We're in a good fiscal position. Interest rates are historically low... and it's likely they'll stay that way into the future," Yellen said. "I believe that we should pay for these historic investments. There will be a big return."