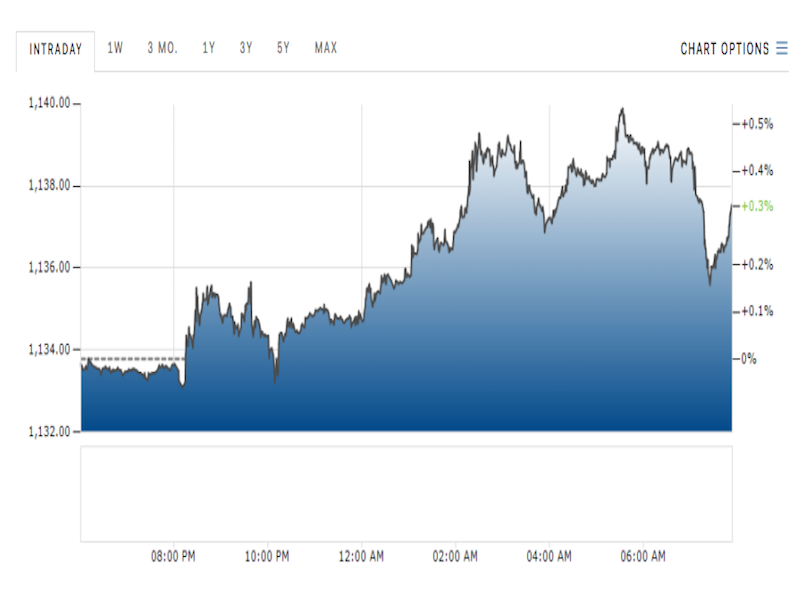

The Korean won fell as South Koreans headed to the polls.

The won closed down by 0.7% at 1139.24 on Tuesday.

Polls in South Korea closed at 7 a.m. ET, although the final results won’t be known until later. Liberal Moon Jae-in is expected to beat his conservative opponent, former prosecutor Hong Joon-pyo.

Tuesday’s election result is “unlikely” to have a huge effect on the Korean economy, Gareth Leather and Krystal Tan, economists at Capital Economics, said.

“Moon’s Democratic Party (DPK) not only lacks a majority in parliament but his policy proposals are nowhere near bold enough to address the challenges facing the economy,” they argued in a note.

However, if Moon wins, that would bring an end to about a decade of conservative leadership in Korea, and could lead to shifts in South Korea's relationships with North Korea and China.

He's in favor of dialogue with North Korea in order to mollify the rising regional tensions. There is also the possibility that a Moon presidency could lead to improved relations between China, according to Bloomberg.

"A softer stance toward China is particularly important, in our view," Jan Dehn, head of research at Ashmore Group, said in a note. He explained in greater detail:

"With the US withdrawal from TPP and China's stated pro-globalization stance South Korea's longer-term interest may be shifting towards China and away from the US, especially if the US becomes more protectionist. Philippines has already become more ambiguous towards the US, so if South Korea follows suit Japan will find itself increasingly isolated in the Pacific Rim."

As for the rest of the world, here's the scoreboard as of 7:51 a.m. ET:

- TheUS dollar indexis up by 0.4% at 99.49. "The dollar continues to recover against the Japanese yen," Marc Chandler, global head of currency strategy, wrote.The euro is down by 0.3% at 1.0888 against the dollar. German industrial production fell by 0.4% month-over-month in March, below expectations of an increase of 0.6%.The British pound is down by 0.2% at 1.2916 against the dollar after data released by the Retail Sales Monitor from the British Retail Consortium on Tuesday showed that retail sales in April surged 5.6% versus a year ago after slipping 1% in March.The Japanese yen is down by 0.6% at 113.92 per dollar.