- Julian Robertson has seeded dozens of hedge funds, many of which have had their own spin-offs.

- Funds related to Robertson include Tiger Global, Lone Pine, Coatue, Viking Global, and D1 Capital.

- We've mapped out these connections with a searchable graphic.

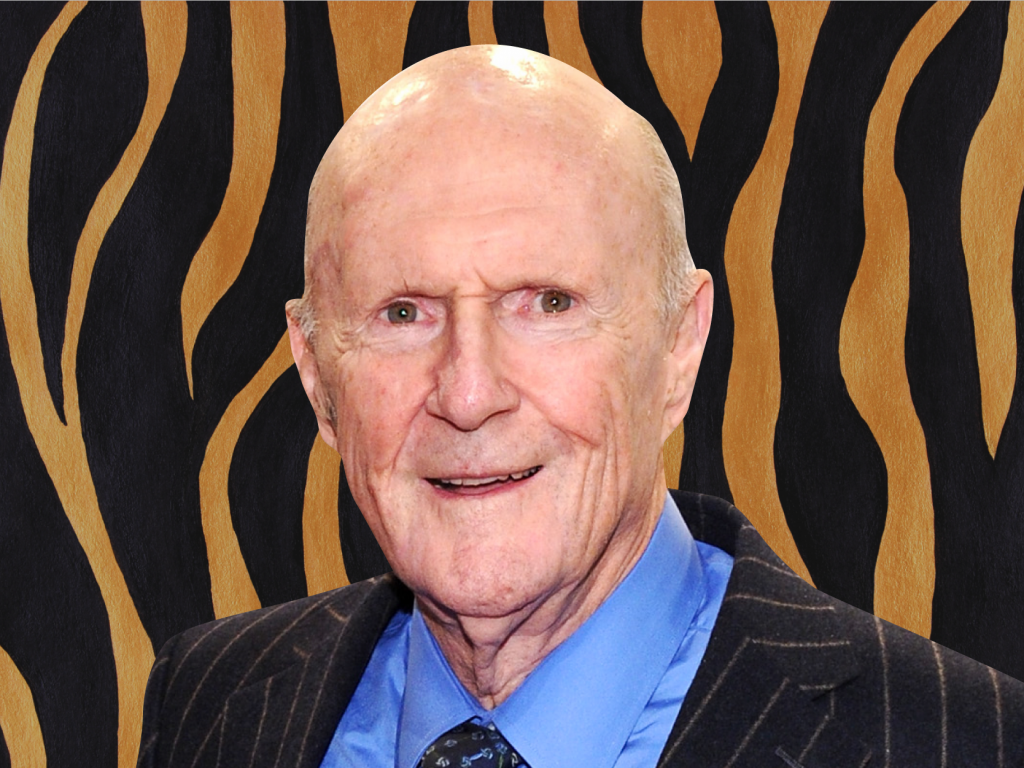

Two decades after Julian Robertson closed Tiger Management to outside investors, his name is still closely linked to some of the buzziest names in the hedge fund industry he helped pioneer.

The legendary investor's sprawling network of spinoffs and seeded startups is overwhelming and has spawned fellow billionaires like Chase Coleman, O. Andreas Halvorsen, Philippe Laffont, and many more.

Recently, headlines around Robertson's so-called Tiger Cubs have focused on losses as their big growth stock bets plummet. Hedge funds with a focus on tech stocks (as many of the funds with roots back to Robertson do) have been hard hit. The tech benchmark Nasdaq Composite Index has fallen 24% this year.

For many years Tiger Cubs piled into tech names like JD.com, Meta Platforms, and Netflix. They also pushed into venture capital, getting in on pre-IPO companies like Instacart and Stripe that are now seeing their valuations slashed.

Coleman's Tiger Global is down 52% for the year, Bloomberg reported earlier this month. Insider reported that Laffont's Coatue is down 17% for the year even though it liquidated many of its positions. Lone Pine, and Grand cub D1 Capital have also suffered. Viking Global was the rare Tiger Cub with single-digit losses through April.

Tiger Legatus, a Tiger Grand Cub run by former Viking Global portfolio manager Jesse Ro, announced it was shuttering after nearly 13 years of trading, the Financial Times reported Wednesday.

In late 2019, Insider mapped out these connections to show the influence Robertson has had on the industry. The list is massive, with hundreds of names and nearly 200 different firms.