Happy hump day, readers. Phil Rosen here, your faithful host reporting from New York.

Today's rundown is as packed as it is pressing. Europe is facing serious economic headwinds as a recession looks all but inevitable and energy restraints continue to mount.

A Wall Street firm published a bleak forecast for the continent yesterday, and it matches consensus with word on the Street.

But an economist told me there's two avenues that could lead to Europe avoiding a recession (at least in the near term).

Let's dive in.

If this was forwarded to you, sign up here. Download Insider's app here.

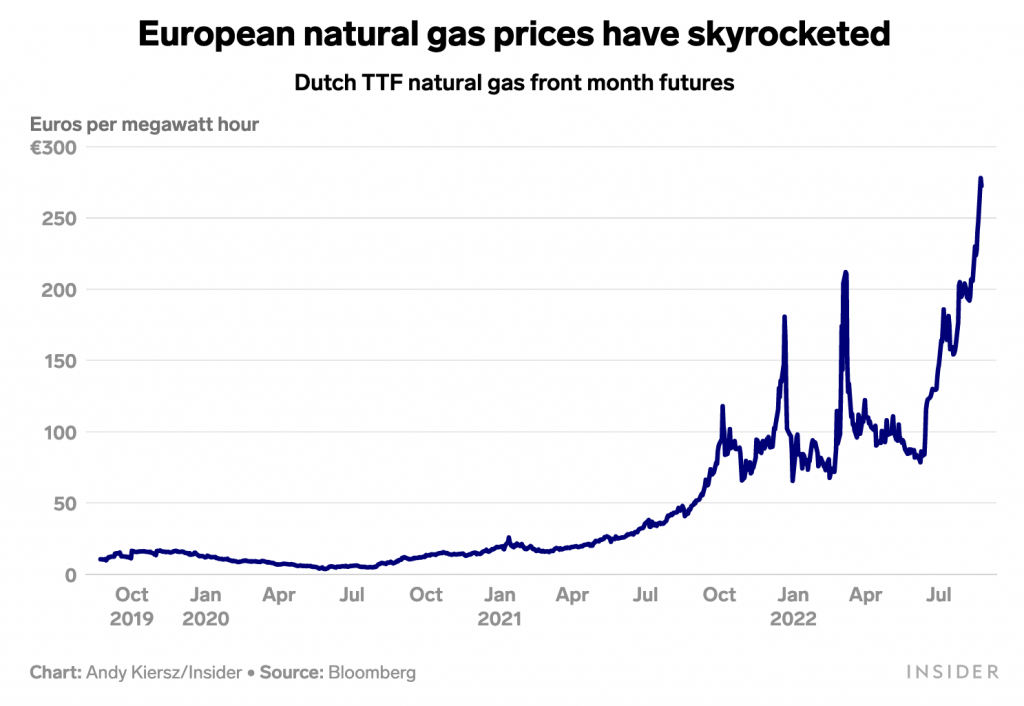

1. JPMorgan is anticipating a severe recession for Europe by the end of this year as rising natural gas prices and higher interest rates spell trouble for the bloc.

Nations are running out of even more gas than initially thought thanks to Russia slashing flows to the continent.

The bank said Europe's energy import costs have quadrupled in recent months, and as Insider's Matthew Fox writes, those high prices only exacerbate the challenge for the European Central Bank.

After I read my colleague's report, I called up Boston College economist Aleksandar Tomic to see whether Europe had any shot of avoiding a downturn.

"The big question is whether Europe wants inflation or recession," he told me. "If you pick not a recession, you really just pick delaying a recession because inflation will rise so much."

It's likely impossible for the ECB to orchestrate a soft-landing at this point, he said, so policymakers may just let prices continue to rise.

A key variable, too, is whether Europe commits to its looming sanctions on Russian energy.

Enforcing sanctions will almost guarantee a recession, Tomic explained, as record energy prices would climb even higher because EU nations have yet to secure enough alternative supplies.

But going easy on a warring Moscow raises political questions.

Still, the economist maintained Europe may have no choice but to continue importing Russian energy supplies well into the future.

Should Russia stop its war on Ukraine, the Eurozone outlook could improve, but Tomic isn't anticipating a ceasefire anytime soon, which means it'll come down to policymakers.

"Avoiding a recession will come at a cost for Europe," he said. "I don't see an easy path forward."

So what comes next for the European economy? Do you see any chance to avoid a recession? Email me at [email protected] or tweet @philrosenn.

In other news:

2. US stock futures edge lower early Wednesday, as investors mull the latest hawkish comments from Minneapolis Fed President Neel Kashkari. Meanwhile, Norway has overtaken Russia as Europe's largest natural gas supplier. Here are the latest market moves.

3. Earnings on deck: NVIDIA Corp., Salesforce, and more, all reporting. Plus, look out for the advance report on durable goods, expected from the US Census Bureau later this morning.

4. BlackRock's Rick Rieder said his $2.4 trillion portfolio is facing "maximum uncertainty." Insider's Will Edwards sat down with the executive to hear where he thinks the US economy and Fed policy is headed. Rieder also broke down three places to put your money right now.

5. The 10-year Treasury yield moved back above 3% on Tuesday and that could mean more pain for stocks. The S&P 500 twice this year dropped for weeks after the bond yield hit that mark. "It's getting to the point where you can set your clock to it," Bespoke Investment Group said in a note. "When the yield on the 10-year US Treasury hits 3%, sell stocks."

6. AMC Entertainment could see a massive drop as it's likely to resort to "APE" dilution to pay down its debt, Wedbush said. The investment research firm slashed its price target for the meme stock in half, to $2 a share, to account for the new preferred equity shares — which represents a downside of 81%.

7. China is burning 15% more coal compared to last August as the country sees its worst heatwave and drought in more than half a century. The key Yangtze River has dried up in some parts, impacting water supply for electricity generation in several provinces. What's more, China's increasingly turned to Russia for additional energy imports since the war in Ukraine began.

8. A 29-year-old former Morgan Stanley associate broke down why he started a $30 million crypto hedge fund to "almost solely" invest in Ethereum's Merge. Ahead of the key event, he's leaning into the firm's big bet on ether because he sees it as a high conviction investment. The exec shared why the ETH blockchain presents one of the "few networks that actually generates real revenue."

9. After paying off $300,000 of debt in three years, financial expert Bernadette Joy shared how she did it. She reached her money goals by living beneath her means and working side hustles. Now, she teaches others how to take command of their money — here are her top strategies.

10. Europe's energy resources are in a precarious state. The run-up this year has been driven by Russia's delivery cut-offs via the Nord Stream 1 pipeline, Insider's Harry Robertson writes. See the details behind this chart — and two others that paint a picture of just how extreme Europe's energy crisis is now.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. (Feedback or tips? Email [email protected] or tweet @philrosenn).

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.