- This post originally appeared in the Insider Today newsletter.

- You can sign up for Business Insider's daily newsletter here.

Hi! We've got a new photo of a supermassive black hole that also provides some clues about one of the most mysterious parts of our galaxy.

In today's big story, disgraced crypto executive Sam Bankman-Fried finds out how long he's going to prison.

What's on deck:

-

Markets: Robinhood's shiny, new credit card.

-

Tech: AI workers are the hottest asset in tech these days.

-

Business: Inside Amazon's plan to save $1.3 billion by reducing office vacancies.

But first, how long is it going to be?

If this was forwarded to you, sign up here.

The big story

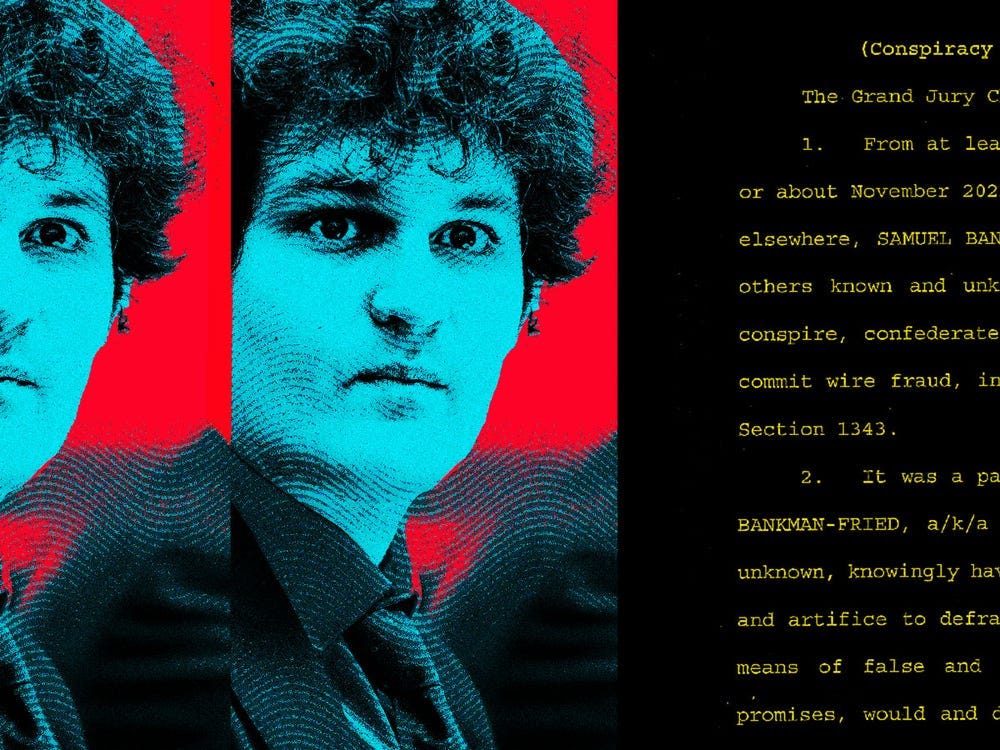

Sam's sentencing

Bitcoin is booming, but a piece of its darker past is back in the spotlight.

Sam Bankman-Fried, the ex-CEO of FTX and former face of crypto, will be sentenced in a Manhattan courtroom today.

Bankman-Fried, more commonly known as SBF, was found guilty of seven counts of fraud and conspiracy last November. Those charges could bring up to 110 years in prison, but SBF's sentence, which is expected to be announced by this afternoon, will likely be much shorter than that.

Prosecutors are pushing for 50 years, while SBF's attorneys are asking for 6 1/2. The decision will ultimately fall to US District Judge Lewis Kaplan, who also oversaw cases between writer E. Jean Carroll and former US President Donald Trump.

But Kaplan's decision comes with an interesting wrinkle, writes Business Insider's Jacob Shamsian. Customers who lost billions with the downfall of FTX might get all their money back.

An FTX debtor lawyer told the bankruptcy court that FTX customers and creditors "will eventually be paid in full."

But according to some, FTX customers getting their money back is despite SBF, not because of him.

John J. Ray III, who is leading FTX through bankruptcy court, wrote to the judge that SBF left the exchange "a metaphorical dumpster fire."

And while victims might recoup their money, it comes with a big catch. What's paid out is based on the value of assets when FTX declared bankruptcy in November 2022 instead of where things currently stand.

That's a tough pill to swallow, as bitcoin's price has increased by more than 300% since FTX's bankruptcy.

In the meantime, life after SBF seems to be just fine for crypto. The long-awaited bitcoin ETF approval came just a few months after Bankman-Fried was convicted. Not long after that, the cryptocurrency hit an all-time high. And a halving event is around the corner that could push prices even higher.

It's a shocking turnaround for an industry deemed all but dead a few years ago. Critics pointed to FTX and SBF's downfall as an example of how crypto was only full of bad actors. Now, those betting against the market are losing big, and bitcoin seems like it's here to stay.

3 things in markets

-

Robinhood's golden pitch on getting a credit card. The trading app unveiled its first credit card, which offers 3% cashback rewards. It also announced the first 5,000 users to refer 10 people to its monthly service plan will receive a solid-gold version of the credit card worth more than $1,000.

-

Commercial real estate's behind-the-scenes dealmaking to avoid a crisis. Borrowers and lenders are renegotiating debts to buy time ahead of a potential market rebound. The process often includes mortgages being trimmed or lengthened by the lender while borrowers agree to invest more into the building.

-

Tesla's 2024 will go from bad to worse, Bernstein says. The investment firm cut its price target for the EV maker to $120 a share, implying a 33% drop from current levels. Tesla is trading too expensive relative to its automaker peers and has minimal upside catalysts, a team of analysts led by Toni Sacconaghi wrote in a research note.

3 things in tech

-

The fight for AI talent is reaching a fever pitch. Big Tech is upping the ante for recruiting from the limited pool of AI workers with massive compensation packages. Companies' high-profile executives are even reportedly being used to hold onto talent.

-

Gen Z <3 ChatGPT. A new Pew survey shows 43% of Americans 18-29 say they've used the chatbot compared to 23% of all adults. And it's not just to mess around. Almost a third of young people reported using ChatGPT "for tasks at work."

-

Microsoft's Copilot is struggling to live up to the standards set by ChatGPT. Microsoft employees told BI that customers are complaining that the tech giant's AI tool isn't performing as well as OpenAI's model. "Every time a customer starts using it, they start comparing it to ChatGPT and saying, 'Aren't you guys using the same technology?'" one of the people said.

3 things in business

-

Amazon aims to save $1.3 billion by radically reducing office vacancies. The tech giant's office reduction is part of a larger cost-cutting strategy that includes shuttered projects and layoffs. But it's another blow to the commercial real estate market, which is already reeling from the remote-work boom.

-

Mark Zuckerberg seems like a terrifying boss. Newly unsealed documents from a lawsuit against Meta reveal that in an email Zuckerberg directed execs to track user analytics from competitors. While that alone is alarming, Business Insider's Katie Notopoulous explains why receiving that kind of message from your boss is bone-chilling.

-

How to fit in if you ever find yourself dining with a billionaire. The ultrawealthy follow a specific set of rules when attending events — for example, no ludicrously capacious bags. It's best to make sure your behavior goes "unnoticed" in such places, etiquette coach Jamila Musayeva told BI.

In other news

-

A new generative AI model could compete with rivals like OpenAI. Say hello to Databricks' DBRX.

-

Nvidia is about to face its first major threat as rivals target its special sauce.

-

What yachting industry insiders have to say about Jeff Bezos' superyacht.

What's happening today

-

Major League Baseball's opening day is today.

-

Former FTX CEO Sam Bankman-Fried will be sentenced.

The Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York. Hallam Bullock, editor, in London. George Glover, reporter, in London. Grace Lett, associate editor, in Chicago.