Getty Images

- Investors worried about stagflation should buy the dip, Goldman Sachs strategists said.

- "Despite near-term uncertainty, we expect the equity market will continue to rally," they added.

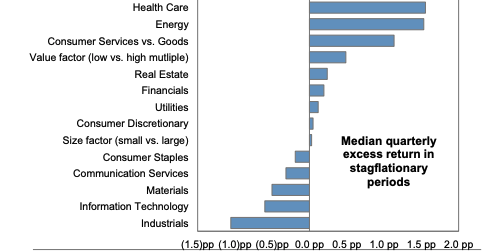

- During stagflationary periods, health care and energy generally outperformed.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Stock market investors worried about stagflation should buy the dip because the trend of rising prices will be short-lived, Goldman Sachs said in a recent note.

"Investor anxiety has catalyzed a long-anticipated S&P 500 pullback, but we believe this dip will prove a good buying opportunity, as 5% pullbacks usually have in the past," the bank's strategists led by David J. Kostin said in a note dated Friday and released Monday.

During stagflationary periods, health care and energy generally outperformed, while the more vulnerable industrial and information technology sectors lagged, Goldman said.

"Thematically, stagflation has been associated with shifts in consumer spending behavior and the outperformance of services companies relative to firms selling goods," the strategists said.

Kenneth R. French, Goldman Sachs Global Investment Research

And they expect the market to continue its uptrend in the coming months to help lift the S&P 500 to 4,700 by year-end, representing a 7% gain from current levels.

That's despite Goldman economists expecting core inflation, as measured by the personal consumption expenditures index, to peak at 4.25% by the end of the year. Commodity strategists forecast a spike in the price of oil as well.

"Despite near-term uncertainty, we expect the equity market will continue to rally as investors gain confidence that the current pace of inflation is transitory," they said.

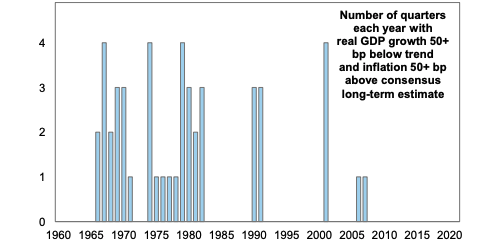

Stagflationary periods are defined by the strategists as two or more consecutive quarters in which core consumer price inflation ran at least 50 basis points above the consensus long-term expectation while real US GDP growth registered 50 basis points or more below trend.

American investors, the strategists said, have had little experience with stagflation in recent decades, hence the jitters.

For instance, they pointed out that since 1960, only 41 quarters were stagflationary, mostly between the late 1960s and early 1980s.

This is why, "stagflation," the strategists said, was the most common word in client conversations last week.

Goldman Sachs Global Investment Research